Inflations effects on inventory management policies are likely far from top of the mind of Logistics Viewpoints readers in today’s challenging times. However, today’s elevated rate of inflation warrants a closer look at optimal inventory policies.

My colleagues and I published our 2022 Supply Chain Predictions earlier this month. One of the predictions I made in that article was that inflation will slow down supply chain resilience efforts. My logic was this: InflationCompanies might be discouraged by pressures from investing in higher cost initiatives such as putting up new warehouse locations to reduce disruption risk. They are more likely to have higher levels of inventory to reduce disruptions. I will discuss in this article how having higher inventories can be a cost-effective way to manage inventory and risk in an inflationary climate.

My colleagues and I published our 2022 Supply Chain Predictions earlier this month. One of the predictions I made in that article was that inflation will slow down supply chain resilience efforts. My logic was this: InflationCompanies might be discouraged by pressures from investing in higher cost initiatives such as putting up new warehouse locations to reduce disruption risk. They are more likely to have higher levels of inventory to reduce disruptions. I will discuss in this article how having higher inventories can be a cost-effective way to manage inventory and risk in an inflationary climate.

Inventory Risks and Costs

Let’s start by listing the different categories of inventory cost. There are costs directly related to physical inventory movement storage. There are also costs that are more abstract. Ordering and inventory purchase costs [think economic order quantities (EOQ)]They are the first to come to mind. Inventory can also lose value over time. This is especially true for perishable foods, cutting edge technology, and fashion products. There are also the financial costs. These are in the form interest, or cost capital, and taxation. Accounting for higher inventory costs can save companies taxes. This can result in smaller profit margins, and lower taxable income. There are also probability-based costs like lost sales. Here, risk management plays an important role in minimizing stock-outs and other ways that inventory can lead to lost sales opportunities.

Inflation Tips the Balance in Toward Larger Inventory Holdings

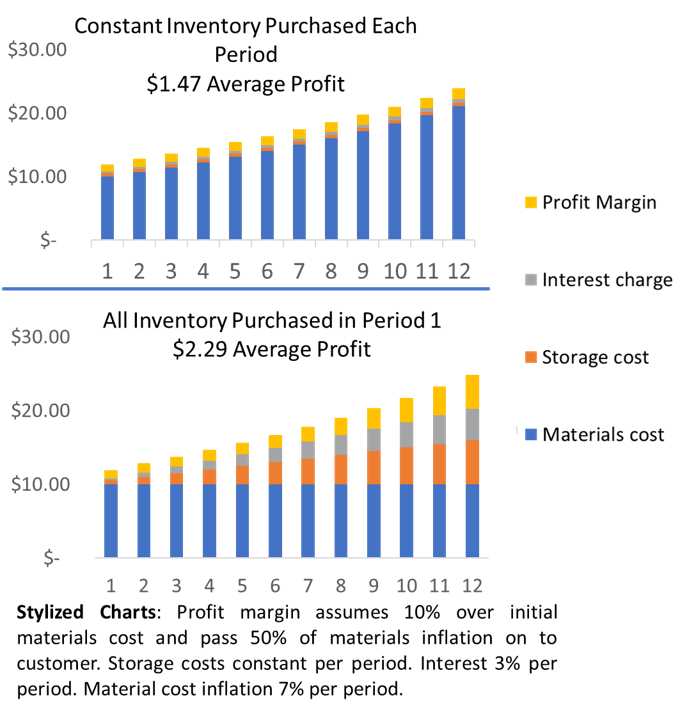

An article from Decision Sciencestitled Inventory decisions under inflationary circumstances [1]The relationship between cost categories and EOQ is described in detail. The relationship between inflation (excluding other factors), and the cost capital is that one would want as large an order quantity as possible when inflation exceeds the cost capital. This is because the benefits of owning an appreciating asset (the stock) will outweigh the cost of financing it. For many organizations, inflation is more common than the cost of capital. There are many other factors that can impact the decision to keep inventory. The most important factors for a particular situation are storage costs and the ability of a particular type of inventory hold value. High storage costs would clearly reduce the ideal inventory quantity. Inventory spoilage and obsolescence are also issues. Another important criterion is the ability of an organization to pass on inflation to customers. It is not possible to pass on 100% inflationary costs. The bottom line is that inflationary conditions subsidize inventory holding costs. This is advantageous when you want to keep inventory at levels that reduce stockouts or sales loss.

[1]Bierman, H., & Thomas, J. Inventory decisions under inflationary circumstances, Decision Sciences 8(1) (1977), 151-155