DOI: 10.26509/frbc-ec-202202

The trend decline of real interest rates in the US has made a significant impact on the economy over the last 20-years. This pushes policy rate close to the effective lower limit (ELB) and reduces inflation. This environment makes conventional monetary policies less effective at accommodating adverse shocks. The FOMC adopted an AIT framework to better fulfill the dual mandate of the Federal Reserves at the ELB. This CommentaryI argue that AIT is a better policy than a low-rate environment due to its ability to anchor inflation expectations. I also discuss possible implications of flexible implementation of AIT.

Review of the Federal Reserves Monetary Policy Framework

In early 2019, the Federal Reserve began a public review on its monetary policy framework. After a series Fed Listens events, which engaged a wide variety of participants, research conferences and internal discussions, Federal Reserve Chair Jerome Powell announced at the 2020 Jackson Hole symposium the adoption of a revised Monetary Policy Framework (Powell 2020).1The revised Statement on Longer Run Goals and Monetary Strategy (Board of Governors 2020) explains details of the framework.

The statement identifies two major changes that the Federal Open Market Committee will make to better fulfill its dual mandate of maximum unemployment and price stability. First, the FOMC has stressed that the goal is to achieve maximum employment. Future policy decisions will not be limited by deviations from the maximum level of employment. In other words: The new policy framework does not require policy responses when employment is higher or lower than its maximum level. The FOMC will also change its strategy regarding price stability. Instead of focusing on inflation targeting (IT), which seeks to stabilize inflation over a single period, it will now focus on an average inflation targeting approach (AIT), which aims to target the average inflation rate for longer periods.

This CommentaryI discuss the reasons behind the change in the monetary policies treatment of inflation. AIT is a more efficient policy framework than IT in current US economy. Additionally, I discuss selected economic theories that could be used to optimize flexible implementation of AIT.

Motivation for AIT – A Low-Rate Environment

Inflation targeting was adopted by the Federal Reserve and many other central banks around the globe in the early 2000s to achieve price stability. The FOMC declared a 2 percent numerical inflation goal in January 2012. This was measured by the annual change of the index of personal consumption expenditures (Board of Governors 2012).

The Federal Reserve employs a balanced approach to inflation targeting, which takes into account both maximum employment as well as the inflation target. Vice Chair Richard Clarida explained to me that when the inflation target is in conflict with the maximum unemployment goal, neither takes precedence (Clarida 2019, 2019). The goal is not to have inflation remain at 2 per cent every period. Rather, this commitment towards specific inflation targeting anchors public expectations of future inflation of 2 percent.

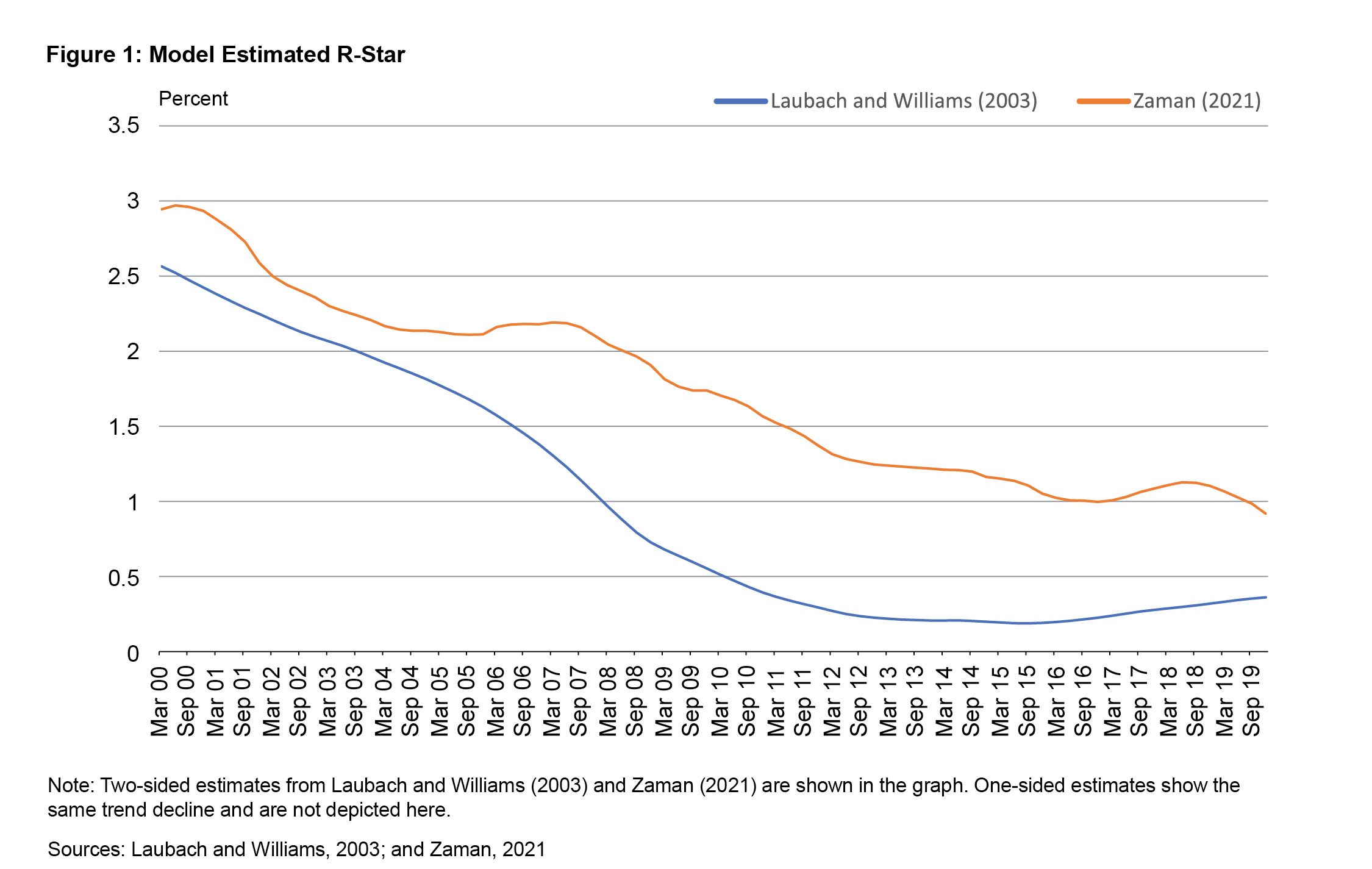

The Fed faces a challenge in the form of a decline in the natural rate of interest (often called rstar) over the past 20-years.2This is the real rate of interest that would prevail if the economy has maximum employment and inflation is stable. Monetary policy is neutral (neither restrictive nor accommodative). This rate is independent of monetary policy accommodation and reflects the main drivers of economic growth in the United States. According to a well-known model developed by Laubach & Williams (2003), the estimated rate of r-star has seen a significant decline from 2000, especially after the Great Recession. It is now below 0.5 per cent (Figure 1). Other estimates, such as one by an economist at Federal Reserve Bank of Cleveland (Zaman 2021), show a trend decrease in r-star. This is due to low productivity growth and an aging population as well as a desire for safer assets in the US economy.

The trend in real rates is responsible for the decline in the r-star. The Federal Reserve sets nominal rates of interest. These rates are determined by real rates as well as expected inflation. The nominal policy rate, which is set by the central banking, cannot drop below zero. This is commonly known as the zero lower bound or the effective lowest bound (ELB).3The central bank will reduce the nominal policy rate to encourage spending when an adverse shock to aggregate demand occurs. An r-star that is already close to zero makes it less likely that the central bank will reduce nominal policy rates. A falling r-star increases the likelihood that the nominal rate will be constrained by ELB. In this case conventional monetary policies are less capable of compensating adverse shocks and the economy enters recession with rising unemployment and falling inflation. Expectations of declining inflation in turn put downward pressure on actual inflation.

In this scenario, higher expected future inflation would be desirable. IT however makes it difficult for the central banks to increase expected future inflation. Future inflation above 2 percent is inconsistent with IT strategy which seeks stability at 2 percent.

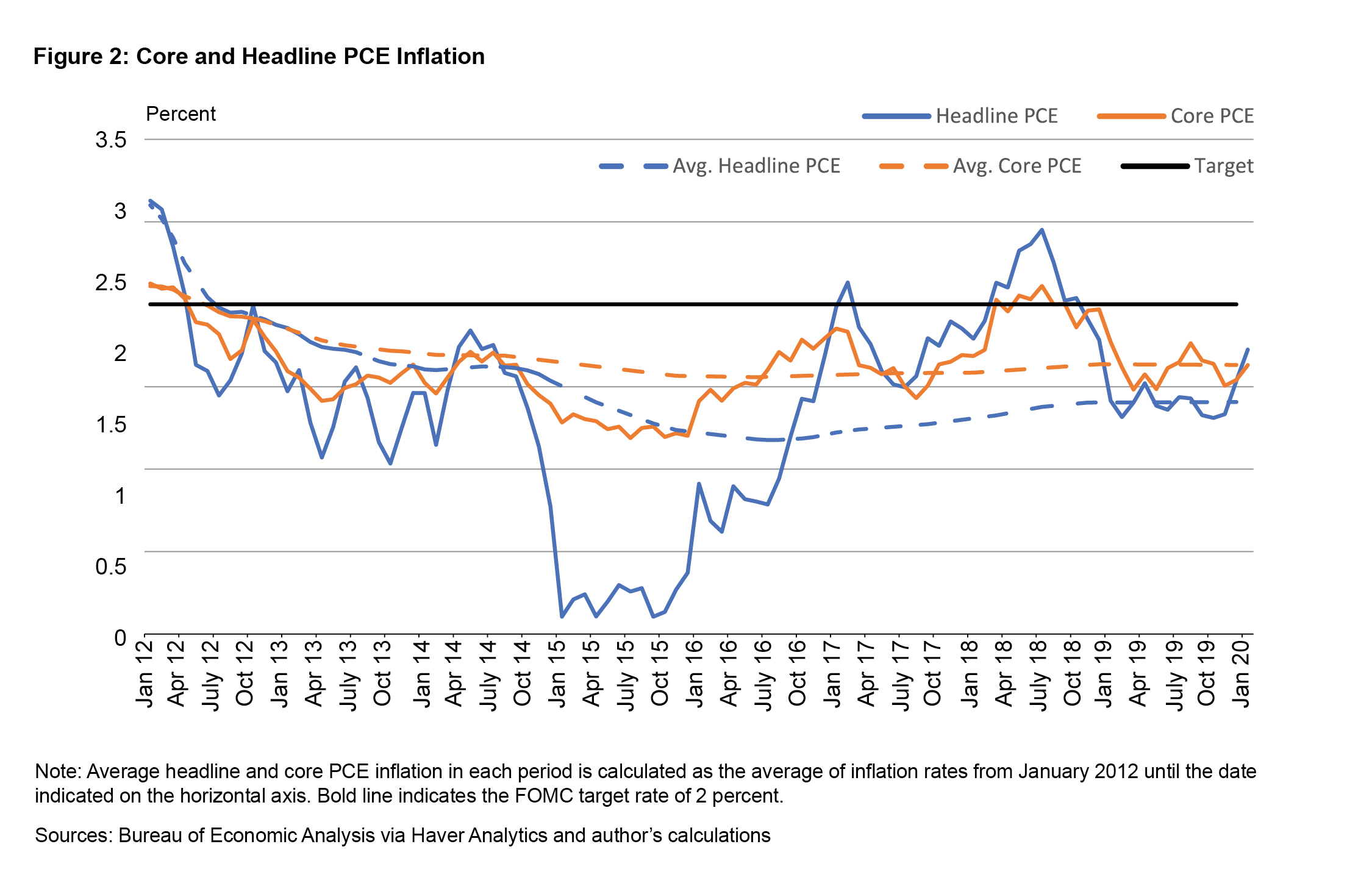

Between 2012 and 2019, the period that followed Great Recession and preceded SARS-CoV-2(COVID-19) pandemic (Figure 2), PCE inflation has generally stayed well below the FOMCs target of 2 percent (Figure 2). Even though the unemployment rate fell from above 8 to below 4 percent during the same period, this indicates a strong recovery in economic activity after the Great Recession.

Combining low inflation and a low rstar increases the likelihood that monetary policy’s ability to provide accommodation through lowering the federal funds rates will be limited by the ELB. Federal Reserves policy framework review was conducted to assess whether a new policy framework could be more effective in helping the FOMC achieve its goals of maximum employment and price stability within the current low-rate environment. This framework aims to achieve this goal by moving from flexible IT towards flexible AIT.

How can AIT help price stability within a low-rate environment?

The current policy interest rate is the main way the central bank influences inflation. Let us concentrate on inflation’s role in determining monetary policy. Assume that current inflation is below target. The New Keynesian standard model would see the central bank respond by lowering the current interest rate. This is a tactic that encourages household spending. In response, firms would increase their prices because they have to satisfy a higher demand. However, because the current interest rate is already at ELB, the central banks cannot lower the rate as much as if it were higher. This makes traditional policy tools less effective.

Inflation expectations are key to price stability in a low-interest rate environment. Inflation expectations play an important role in determining current inflation. If a consumer is planning to purchase a vehicle, and anticipates that inflation will rise in the next quarter then they would prefer to buy it now, rather than waiting a few months. This is because consumers are more likely to expect higher inflation in the future. Similar to the above, if a company updates its product’s price at the beginning and expects that inflation will go up in mid-year, it will increase its price at the beginning so that it matches the changes in aggregate price levels at the end. As implied by New Keynesian economic model, if current inflation is below the target, and the central bank wants this to increase, one way is to make the market aware. ExpectHigher inflation in the future This approach reduces the nominal interest rate and increases the expected future inflation rate.

AIT is better at generating changes in inflation expectations which help the central bank achieve price stabilization in a low-interest rate environment. AIT allows the central bank to adjust monetary policies to maintain an inflation rate of 2 percent over a longer period than when it uses IT. If inflation falls below 2% for a prolonged time, the central bank attempts to achieve an inflation rate of 2 percent. AIT acts as an automatic expectation stabilizer. In other words, if inflation is below the target, then the public should expect inflation rise to the target in the subsequent periods. This channel is particularly important when the current ELB monetary policy rate is at the ELB. The central bank cannot boost inflation through lowering the current rate. Instead, the central banks can adjust the real interest rate for the current period to increase the expected future inflation.

The Horizon of AIT

Additional information on the AIT policy of the FOMC can be found in the 2020 Statement on Longer Run Goals and Monetary Policy Strategy (Board of Governors of Federal Reserve System, 2020). In order to achieve inflation of 2 percentage points over time, when inflation has been consistently below 2 percentage, the FOMC will likely promote inflation moderately above 2 per cent for some time. This description suggests that 2 percent is not the target rate for inflation that the policy seeks in each period. The public should expect future inflation above 2 percent, even if past and current inflation has been below 2.5%. The FOMC has a balanced approach to achieving its goal by taking into account both unemployment shortfalls as well as inflation deviations.

However, the strategy statement does not include the AIT policy’s horizon. This is an important piece. To illustrate the extremes of the options, one might ask whether the target is to achieve a two-quarter average inflation level of 2 percent or a ten-year average inflation level 2 percent. The public’s expectations of inflation will be influenced by the average horizon. Imagine that AIT covers two quarters. The inflation rate in this quarter is 1.5%, which is lower then the target of 2 percentage points. In this case, the public would anticipate that the inflation rate for the next quarter will be 2.5%. Thus, the average inflation rate between the current quarter of the previous quarter and the next quarter would be 2 percent. However, if the AIT policy has a 10-year horizon, the public would expect inflation to be much lower that 2.5 percent in the following quarter. This is because the central bank will use 10 years to make up the 0.5% deviation in current period.

Another piece of information that the strategy statement does NOT explicitly provide is a weight on the goal for maximum employment relative to the weight on average inflation. This weight can also impact how inflation expectations should formed. As an example, let’s say that the inflation rate for the last quarter was 2.5 percent. AIT policies have an averaging period of two quarters (between current and last period). To offset the high inflation during the previous period, the central bank should follow AIT and tighten its monetary policy. What if the unemployment rate is high? If this is the case then tightening monetary policies would further dampen economic activity. This is contrary with the goal to achieve maximum employment. The central banks will make policy decisions based on the weights assigned to these goals.

The flexible nature of the FOMCs strategy reflects the fact that they have not specified the exact horizon nor the weight on average inflation targeting. Powell, 2020) – Chair Powell stated explicitly that the AIT approach is flexible, and that we aren’t tying ourselves down to any particular mathematical formula.

Why AIT Flexibility is Important

Jia and Wu (2021), created a macroeconomic model that explains how flexibility in AIT maximizes household well-being. Jia and Wu’s theoretical framework suggests that the public doesn’t know the exact policy horizon of AIT. Instead, they compare the accuracy of other forecasts to help them understand the policy horizon. Jia and Wu claim that the best AIT approach maximizes households’ well-being. First, the central banking should place more weight on the average inflation target (relatively the employment objective) when AIT has a longer horizon than AIT with a shorter horizon. The central bank should announce the longest possible horizon in the event of a supply shock to an economy.4The shortest possible horizon of AIT should be announced (two periods according to Jia & Wu (2021), when the shock has subsided and the economic conditions are approximately normal).

This is the intuition that flexibility regarding weighting has benefits. The central bank is more concerned about the average inflation over a longer time horizon. This means that it cares less about the deviations from the target in any given period, as long as they average over the AIT period. This policy is not optimal as the public views any deviation from the 2 per cent inflation target in any given time period as unacceptable. All things being equal, a longer AIT horizon means that the central bank places less emphasis on inflation stabilization than the goal of maximum employment for the current period. To correct this, AIT with a longer horizon should see the central bank increase the weight on its average inflation goal.

This is an example of the theoretical argument for adjusting AIT’s horizon depending on economic shocks. Imagine a positive supply shock today that drives inflation above the FOMCs target of 2 percent. To ensure price stability, the central banks should tighten monetary policies. This will reduce employment to below its maximum level. Jia and Wu (2021), a model that maximizes household well-being, suggests that the central banking should adjust its implementation for AIT and announce the longest possible horizon, while increasing the weight on stabilizing the average rate of inflation. Why? Because of its role in stabilizing expectations, AIT policy can reduce inflation due to the positive supply shock. The longest possible horizon for AIT policy has the greatest impact on inflation expectations. This is because the optimal AIT policy places the most weight on the inflation target with the longest possible horizon. In this case, the central bank is expected compensate for today’s high inflation strongest by lowering inflation in subsequent periods. The central bank immediately after the positive supply surprise raises its policy rate by a small amount, but it is committed further tightening monetary policies in future periods. This commitment leads to lower inflation today and lower inflation in the future.

After the supply shock is gone, the optimal AIT horizon in the model will revert to the shortest AIT period, which is two periods. After the supply shock is gone, the optimal AIT horizon in the model will revert to the shortest AIT period, which is two periods. In the absence of any additional shocks inflation in the next period will only depend on inflation in that period under a 2-period AIT. In this instance, past inflation doesn’t play a part in determining inflation expectations. Future inflation will depend on inflation that occurred later than the AIT horizon. Inflation expectations could change if past deviations from inflation targets are observed. This is contrary to the goal for anchoring inflation expectations. The optimal horizon for AIT in such cases is the shortest possible to minimize fluctuations in inflation anticipations.

The Jia and Wu (2021), model suggests that, absent any shocks, a central banking that takes an optimal approach to AIT would keep its inflation averaging range short to avoid fluctuations in future inflation anticipations. To achieve a desired balance, the central banks should adjust the inflation weight relative to employment to extend the inflation average horizon. This is especially true for shocks to the supply side.

Conclusion

The low-rate environment in America has pushed the nominal rate towards the ELB. This has created the need to create a new monetary policy framework that achieves the dual mandates by the Federal Reserve of maximum sustained employment and price stability. This CommentaryIt has been shown that price stability can be achieved in low-rate environments by switching from inflation targeting to average inflation targeting. AIT can anchor inflation expectations in a context where conventional policy tools are less effective at the ELB. A number of macroeconomic models suggest it is possible to implement AIT in a flexible fashion. This involves adjusting the AIT horizon and the weight on inflation deviations relative the weight on unemployment shortages based upon shocks to economy.

Footnotes

- See the following for a detailed description of the review process, including the sequence of papers submitted for review. https://www.federalreserve.gov/econres/notes/feds-notes/the-federal-reserves-review-of-its-monetary-policy-framework-a-roadmap-20200827.htm. Return

- This rate is also known by the long-run neutral interest rate or the long-run equity interest rate. Return

- The ZLB on nominal interest rate is what limits conventional monetary policies. In certain cases, however, a central banking institution can implement a negative interest rates policy that is slightly below the ZLB. In these cases, the ELB will be slightly below zero. Return

- A supply shock affects the cost of production. This can cause fluctuations in inflation but not directly impact demand for output. Wage markup shocks or oil price shocks are two examples. Return

Refer to

- Board of Governors of Federal Reserve System. 2012. Statement on Longer-Run Goals & Monetary Policy Strategy https://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals_201201.pdf.

- . 2020. 2020 Statement on Longer-Run Goals & Monetary Policy Strategy https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

- Clarida Richard H. The Federal Reserves Review of Its Macroeconomic Policy Strategy, Tools and Communication Practices: A speech at A Hot Economy: Sustainability, Trade-Offs, a Fed Listens event sponsored by the Federal Reserve Bank of San Francisco. San Francisco, California, September 26, 2019. Board of Governors of Federal Reserve System. https://www.fedinprint.org/item/fedgsq/22809.

- Jia, Chengcheng and Jing Cynthia Wu 2021. Targeting Average Inflation: Time Inconsistency and Intentional Ambiguity Working paper 21-19. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202119.

- Laubach, Thomas and John C. Williams. 2003. Measuring the natural rate of interest. Review of Economics and Statistics 85 (4): 106370. https://doi.org/10.1162/003465303772815934.

- Powell, Jerome H. 2020. New Economic Challenges, the Feds Monetary Policy Review, a Speech at Navigating a Decade Ahead, Implications for Monetary Policy. An Economic Policy Symposium sponsored Federal Reserve Bank of Kansas City Jackson Hole (Wyoming), August 27, 2020. Board of Governors of Federal Reserve System. https://ideas.repec.org/p/fip/fedgsq/88646.html.

- Zaman, Saeed. 2021. A Unified Framework to Estimate Macroeconomic Stars. Working paper 2123. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202123.