Ambitious targets to reduce plastic usage are being driven by the new policies and the historical pace of their enforcement. International agencies have been prioritizing the carbon footprint for years to address environmental impacts. This broad approach to emissions is now narrowing. Governments are now focusing on the production, use/reuse and disposal of plastics. They often use tax policy as their ammunition.

Businesses must not only track tax proposals but also understand the overarching goals to be able to see how likely disruptions to tax will occur.

Plastic taxes are a growing concern for finance and tax professionals. Many local governments and countries have adopted laws on plastic bags. These laws range from a single-use bag tax to complete bans. There is an opportunity for the corporate tax department to protect the company, guide it towards incentives, and align it to key consumer and investor trends.

Goal Setting

The world is facing a major plastic pollution problem, and governments are trying to curb it. The plastics tax is a key measure that is being implemented by different jurisdictions at different rates and in a variety of ways.

Despite international meetings and discussions such as the COP26 conference and other conferences, these taxes are not coordinated. Multinational tax functions may have to face challenges trying to keep up with their potential risk exposure. It is difficult for tax functions to comply with the growing number of laws. The U.K.’s plastic packaging tax is only the beginning. Although the effective dates of new taxes in Italy or Spain are still being delayed, they will likely become effective in 2023. Sweden and Poland announced they would also implement new legislation. These are just two examples of the changes that Europe is experiencing.

Each new rule has the potential to challenge traditional business operations. They are based on international goals set out by countries, international communities, and local jurisdictions. The European Commission Strategy for Plastics in the Circular EconomyFor example, the EU aims to make all plastic packaging recyclable or reusable by 2030. The EU will also require EU member states to produce PET drink bottles with at minimum 25% recycled plastic by 2025. This will increase to at minimum 30% by 2030.

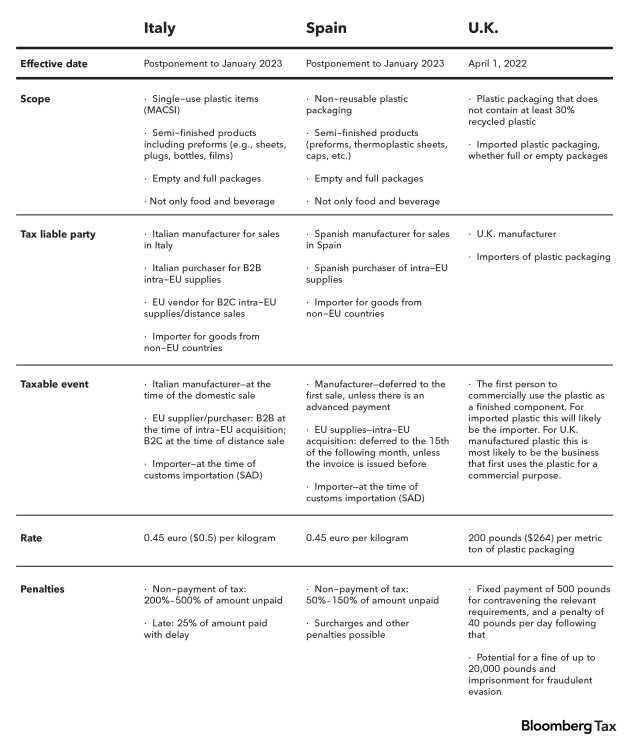

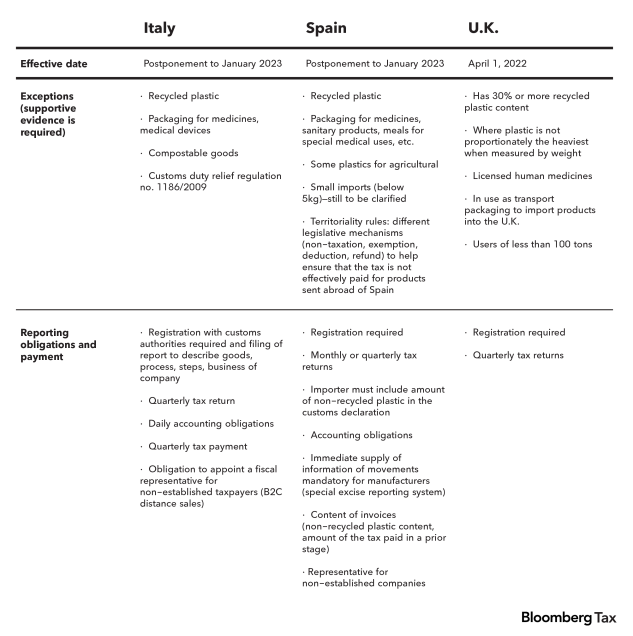

European plastic tax legislation in a glance

Updated from Summary of EY Plastics and Packaging Taxes webcast

The U.K. government is an example of one of the most progressive new tax systems. Plastic Packaging TaxThe, which encourages the use of recycled plastics in packaging, is intended to increase recycling and reduce plastic waste going to landfill or incineration. The U.K. has proposed six types of packaging with minimum recycling targets, including plastic. This will result in a recycling rate close to 75% by 2030. According to U.K. government reports the cost of single-use plastics in England has fallen by more than 95% over 2015,

Each new environmental policy could lead to increased costs and operational headaches for businesses. Consider any organizational implications with stakeholders before 2022 when many taxes are effective. However, governmental goals should be considered as a hint at future challenges.

Potential Opportunity

Corporations can respond by innovating and appealing to investors and consumers with a stronger environment, social, and governance (ESG), policy. They can work with industry partners to reduce the packaging’s plastic-heavy supply chain.

These new targets don’t just mean an increase in costs and operational headaches. The possibility of a more costly supply chain that is heavy in plastics is motivating businesses to work with industry partners to develop new manufacturing methods for packaging.

There are however some positives for businesses. Businesses have the opportunity to appeal to investors and consumers by taking a bold and determined approach to ESG policies. Governments offer a variety of economic incentives to help businesses adopt new production methods.

In 2018, the United Nations Environment Programme (UNEP) proposed economic incentives that included tax rebates. Roadmap for sustainabilityThis includes single-use plastics. Extended producer responsibility (EPR), policies that make producers responsible for financing and operating post-consumer waste collection systems and recycling systems, encourage better design for recycling.

This production innovation boosts recycled content for consumer packaging, industrial plastics, and consumer-facing plastics. In 1997, the United Kingdom implemented the first EPR system. This system is responsible for increasing recycling of packaging waste from 25% to 63.9% in 2017. The Department for Environment Food & Rural Affairs will update the EPR system for packaging in 2023.

The Way Forward

In the short-term, the pandemic forced businesses into rethinking their supply chains, operating model, risk exposure and risk management. As companies look ahead, their designs become more sustainable and can be used to protect their operations for long-term success.

Or, expiring incentives could lead to environmental reversals. Intangible assets such as innovation and brand are important to measure that benefit. Investors can look beyond the company’s initial investments and see beyond its book value.

Even before ESG trends, pre-pandemics, and even before ESG trends, there was an EY reportThe long-term value of a company was measured by its balance sheet. It was found that 80% of the market value could be read from the balance sheet in past. This percentage will drop to less than half by 2019.

Governments have made environmental sustainability goals a priority. There are taxes, incentives, and new laws that address everything from landfills to carbon emissions. Plastics and packaging taxes are the latest tool to drive behavioral changes while also replenishing government coffers.

Tax teams need to have a complete, current, and comprehensive picture of the plastic tax landscape in order to quantify the impact on their businesses and to embed this information into their systems to ensure that reporting and costing models are accurate. Only with the right technology and expertise can they navigate the complex world of plastics and inform other functions about the potential for organizational change.

It is a fast-moving landscape and tax teams are challenged to keep up. Those who can do so will have the opportunity to be a strategic partner in the business. They can help to avoid risk, take advantage of new incentives, and adapt to changing investor and consumer tastes.

These views are solely those of the authors. They do not necessarily reflect the views or opinions of Ernst & Young LLP, or any other members of the global EY organisation.

This article does not necessarily reflect The Bureau of National Affairs, Inc.’s opinion or that of its owners.

Kate Barton is EY Global vice chairTax