[ad_1]

In August, Maersk, the world’s largest shipping company, announcedIt would add eight new container vessels to its fleet. These ships would be unique among merchant vessels on the high seas. Instead of running on “bunker” fuel – the gunky, tar-like substance left behind after oil is refined – Maersk plans to power these ships on carbon-neutral methanol, a colorless liquid made from biomass such as agricultural waste or by combining renewably generated hydrogen with carbon dioxide.

Globally very little of this “green” methanol is produced today and compared with the oil industry waste product most ships run on, the cost is high. Maersk hasn’t yet announced a fuel supply for its new fleet but the company hopes that standing up the world’s first green methanol-powered fleet will spur the energy sector to significantly ramp up production of clean fuels.

“Rather than talking about how this can’t be done, let’s just get started and let’s start scaling,” said Morten Bo-Christiansen, the head of decarbonization at Maersk.

It’s a small step toward the enormous goal of decarbonizing shipping, an industry that accounts for roughly 3%The global greenhouse gas emissions and the is far off trackFrom achieving the Paris climate agreement goals.

Shipping companies, which operate in distant international waters, have been able to avoid any meaningful climate regulation until now. The industry is currently facing a reckoning. The US, EU, and other major economies are all beginning to make pledges draw up plansCop26, a group of countries including the UK & the US signed an agreement to green the shipping sector. declaration committing to “strengthen global efforts” to reach net zero by 2050.

Business leaders are beginning take notice. “Our crews see this as the number one thing on their boardroom agenda now,” said Guy Platten, the secretary general of the International Chamber of Shipping, a trade association that represents roughly 80% of the world’s merchant fleet.

This is a huge industry that has a huge impact on the climate.

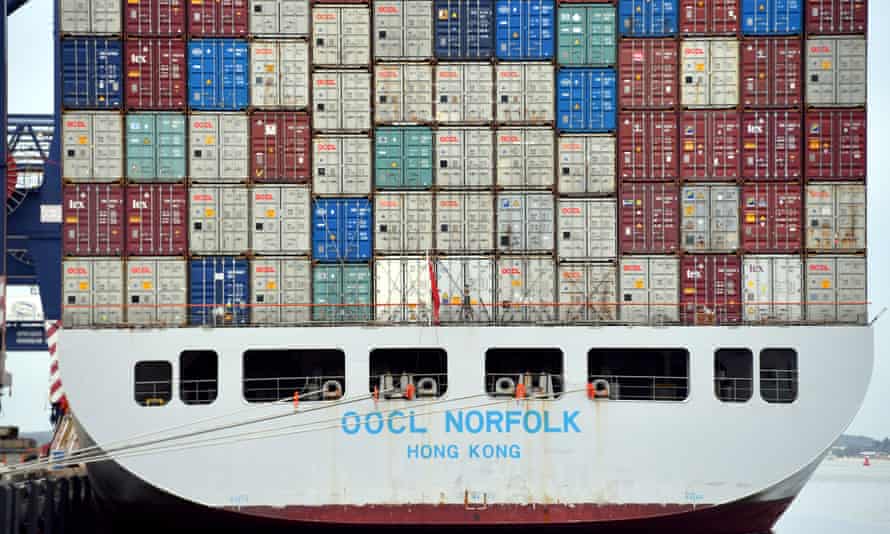

The shipping industry is a critical pillar of the global economy, with about 90% of all globally traded goods – from oil and steel to furniture and iPhones – ferried around the world by sea. Merchant ships are required to transport all these goods. 300m metric tonsEach year, the world emits roughly 6.6 million tonnes of dirty fossil fuels. 1bn metric tonsThe process produces carbon dioxide. This is about equivalent to the annual carbon emission of Japan.

These carbon emissions must be eliminated by shipping industries by 2050 in order to stay in line with the Paris climate agreement’s 1.5C global heating target. However, its emissions increased by 10% between 2012 and 2018. The International Maritime Organization (IMO), an UN body that regulates shipping. predicts that by 2050, the industry’s emissions could be 30% higher than they were in 2008.

To make this change, stricter regulations are required. The IMO adopted an initial regulation on energy efficiency for ships. in 2011The minimum fuel efficiency requirements per kilometer are set by the. another oneThis June, the goal was to reduce carbon intensity of ships by 40 percent by 2030.

Those standards have “basically codified a business as usual trend”, says Faïg Abbasov, the shipping program director at the Belgium-based non-profit Transport & Environment. The June measure requires shipping companies to give their vessels an A-E grade on energy efficiency and submit a “corrective action plan” for any ships that receive a D or E for three consecutive years. Abbasov stated that the scores will not be publicized and that no mechanism exists to force ships with poor performance to improve.

2018 was the IMO set a goal of cutting the industry’s carbon pollution at least in half by 2050. But it hasn’t adopted any binding emissions reduction targets or regulations to achieve the target and even if it did, the goal is still far short of what’s needed to remain in line with the Paris agreement. Industry observers attribute this to the slow pace of rule-making at IMO. corporate influenceAt the UN agency, where industry representatives are often appointed to serve as state delegation members.

“There’s very little doubt” the shipping industry has stalled IMO climate regulations, said Aoife O’Leary, the CEO of Opportunity Green, a non-profit focused on international climate issues including shipping.

A patchwork of regulations

However, there is hope for change. The EU is moving to regulate shipping emissions within its emissions trading system. A phase-in period will begin in 2023. The following is the proposed lawBy 2026, shipping companies will be required to pay for the carbon they emit when they travel between EU ports and to the EU.

Separately, the EU proposingA fuel mandate would force the industry to use a greater percentage of low- and non-carbon fuels on its ships. In April, the US committedTo pursue a zero-emission shipping industry by 2050.

While the shipping industry has pushed back against the idea of a patchwork of climate regulations across different nations, O’Leary said these could compel the IMO to take more ambitious action. “If you look at the history of IMO regulations, they’ve often acted because the EU or the US have acted on their own,” she said.

Climate is a topic that the industry seems to be more interested in. The International Chamber of Shipping announced its March 2018 results. proposedA carbon levy of $2 per metric ton of fuel, to be used for research and development of clean shipping technology. This proposal is in addition to a much more ambitious proposal from the Marshall Islands to tax merchant ships to the tune $100 a metric tonBunker fuel will be discussed at the IMO meeting in November.

Platten of the International Chamber of Shipping wouldn’t say whether the industry would support the specific fuel tax proposed by the Marshall Islands. But he said that shipping businesses “welcome the discussion and debate of market-based measures” to drive down emissions and make low and zero carbon synthetic fuels more economically viable. In October, the ICS called for next zero emissions for the industry by 2050 and double the ambitions the IMO.

The quest for zero carbon fuel

Transforming the shipping industry requires that zero-carbon fuels and the infrastructure to transport them must be made commercially available. All three of the hydrogen, ammonia, and green methanol can be made from renewable energy. The process involves splitting water in an electrolyzer to make hydrogen. Green methanol can be dropped into ships with minimal modifications, but the other two will require significant changes to ship designs and operational procedures.

Ammonia, hydrogen and other gases are at room temperature. They will need refrigerated storage tanks to be stored as liquids. Ammonia can also be toxic to humans and marine life, raising safety concerns and environmental concerns. Hydrogen, however, has a very low energy densityIt is more expensive than oil, so ships that use it would need to have larger fuel tanks or refills much more frequently.

It will take time and money to prove that alternative fuels can be safely used on commercial vessels.

“What we are really looking at is decades of investment and innovation ahead of us,” said Bo Cerup-Simonsen, the CEO of the Maersk Mc-Kinney Moller Center for Zero Carbon Shipping, a research and development center. “It’s fair to say that we’re talking billions,” he said, “but I think the trillions come when we start to scale this up to become industry wide.”

Researchers estimatedThe industry will be on a path towards full decarbonization by 2050 if zero emissions fuels account for 5% of its international shipping fuel mix by 2030. The Global Maritime Forum’s Getting to Net Zero Coalition believes that target is achievable based on recently announced plans, including the EU’s 2020 Hydrogen Strategy, which calls for building at least 40 gigawatts of renewable hydrogen electrolyzers by 2030, as well as China and Japan’s goals to ramp up hydrogen fuel production.

‘We’re not there just yet’

Cerup-Simonsen is positive, despite the daunting task ahead. The number of large companies expressing interest in carbon-free shipping is growing “day by day”, he said, as is interest from their customers. “You’re seeing mining companies, some of the big retailers, big auto manufacturers starting to demand a greening of their supply chains, including shipping,” Cerup-Simonsen said.

Madeline Rose, Pacific Environment’s climate campaign director, recently stated that large, consumer-facing companies could be crucial in driving change within the shipping industry. led a reportOn the shipping pollution associated 15 major retail brands including Amazon, Walmart, and Target.

In 2019 alone, the report found that these companies were responsible for three coal fired power plants’ worth of carbon pollution through their US shipping imports. Despite their recent climate pledges, many of the companies in the report fail to account for marine pollution when reporting on their corporate emissions.

Amazon signed a deal with Unilever and Ikea. pledgeOctober: To move goods only on ships using zero carbon fuel. This will be 2040.

While retailers demanding cleaner shipping could motivate shipping companies to bring new options online faster, Abbasov of Transport & Environment is doubtful that voluntary corporate pledges will drive transformative change. He believes regulations are needed for alternative fuels to be more economically viable and to prevent corporate greenwashing.

“Once there are regulations, once the technology has become very common, individual companies can take one extra step and go further than the law says,” Abbasov said. “For shipping, we’re not there just yet.”