By M. Marin

NYSE:CXW

Recent trends demonstrate stability in revenue streams

CoreCivic’s (NYSE:CXW), 1Q22 revenue was $453.0 million, compared with $454.7 million for 1Q21. The slight revenue decline can be attributed to the earlier than expected reduction in ICE population at CXWs La Parma prison facility, while the facility transitions to state detainees as part of a new contract with Arizona. CXW’s recent sale of noncore revenue-producing real estate assets also contributed to the decrease in revenue.

The relatively flat revenue performance demonstrates the stability of contracted revenue streams in companies, however. CXW was able offset about $15 million of quarterly revenue by new contracts and other initiatives.

The broader macroeconomic inflationary climate is having an impact on 2022 results. This includes increasing labor costs, particularly for registry nursing staff, as the company raises staffing levels. Although CXW is proactively managing G&A expenses where it can, 2022 results could be sensitive to exogenous factors including wage inflation and fluctuating COVID-19 cases impacting occupancy rates, as well as to how quickly the company can hire new personnel. We believe Title 42 has potential revenue upside.

TTM at a targeted level; additional initiatives to enhance shareholder value possible

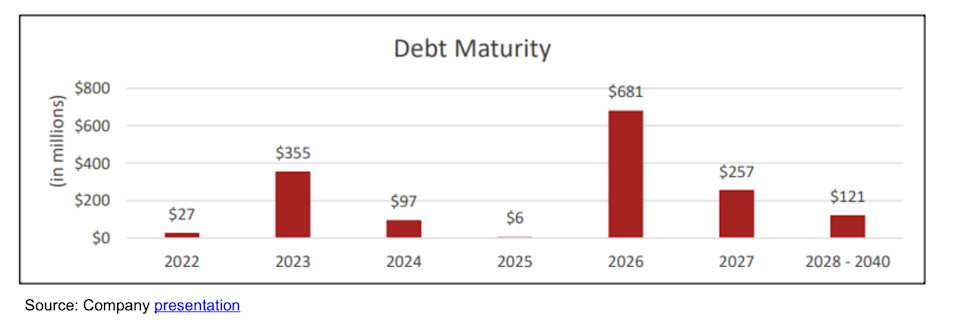

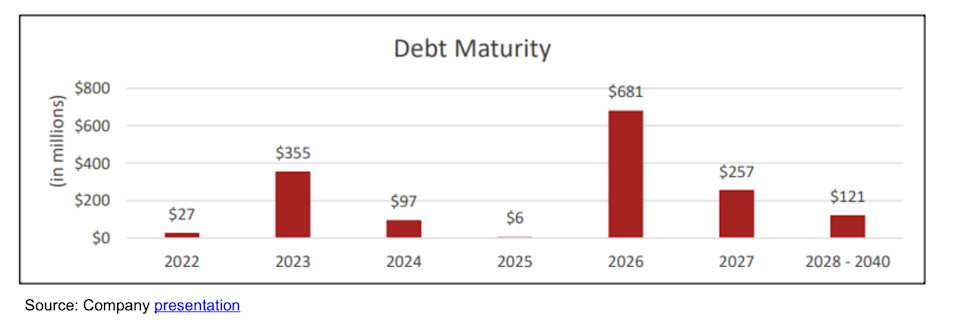

The company has continued to pursue its stated goal of lowering its relative debt levels and strengthening the balance sheet. TTM leverage ratio (net debt to adjusted EBITDA) was 2.75x at the end 1Q22, a decrease of 3.7x at 2020 and within the CXWs target range of 2.25x-2.75x. We believe the company has substantial liquidity. It has cash of $378.2 millions at the end 1Q22, with no major debt maturities prior to 2023, and no funds drawn against its revolver. The company expects to announce a new credit facility in near-term.

Management indicated that it is possible to request authorization for a stock repurchase program. The company believes it is better placed than others in a rising interest-rate environment, as it has no immediate need to access capital markets and has low levels of variable rate loans.

After Title 42 ends, expect potential revenue upside

CXW could also benefit from the possible termination of Title 42 in the latter part of this month. Officials expect that the flow of migrants will increase once Title 42 is ended. Preliminary U.S. Customs and Border Protection data suggests that authorities detained 200k+ migrants at the southern border in February. This would be the highest monthly total for August 2021 even before Title 42s repeal. Title 42 will likely result in a rise in ICE capacity demand. We see the potential for occupancy rates to rise at several CXW facilities, which could lead to incremental revenue.

Title 42 was passed during the Trump administration’s pandemic in an effort to deter immigrants to the U.S. and to provide a public health justification for the prevention of COVID-19 spreading. It was based upon legislation that gave the government the “power to prohibit, whole or in part the introduction of persons or property” to stop a contagious illness from spreading.

The CDC supports the end of Title 42 due to increased vaccination rates in the U.S.A and in migrants countries of origin. However, Title 42 was extended during the pandemic to accommodate rising case numbers. Recently, the Biden administration announced that Title 42 would cease by May 23, 2022. This has raised concerns that the administration might not have the capacity to handle an increase in southern border immigration once Title 42 ends. Several states have filed lawsuits to stop the termination of the immigration measure.

As detention capacity becomes more in demand,

If the government expects that the flow of migrants to the southern border will increase significantly after Title 42 ends, there are concerns that ICE doesn’t have sufficient detention capacity. ICE has recently closed detention facilities that were deemed insufficient in order to meet the expected increase in asylum seekers seeking asylum in the U.S. This is consistent with recent directives by Homeland Security Secretary for an overall overhaul of detention facilities. Although the current administration has stated that they want to eliminate private-managed detention capacity, we believe it is unlikely that ICE will be able to achieve this goal in the near-to-mid-term.

Title 42 will likely lead to an increase in ICE capacity demand. We expect that occupancy rates at many CXW facilities will rise. CXW centers operate under occupancy guarantees that are higher than actual occupancy levels. This is a large proportion (around two-thirds), of which many are located in CXW. CXW will generate incremental revenue once actual occupancy reaches or passes guaranteed levels.

SUBSCRIBE to ZACKS SMALL CAPITAL RESEARCHSubscribe to our newsletter to receive our articles, reports and other information emailed to you every morning. Please visit our WebsiteAdditional information on Zacks CR.

DISCLOSURE Zacks SCR has been paid by the issuer directly, through an investment manager or an investor relations consulting company, for providing research coverage for no less than one-year. The Zacks SCR offers research articles. Zacks SCR is paid quarterly for services rendered to or concerning the issuer. Full Disclaimer HERE.