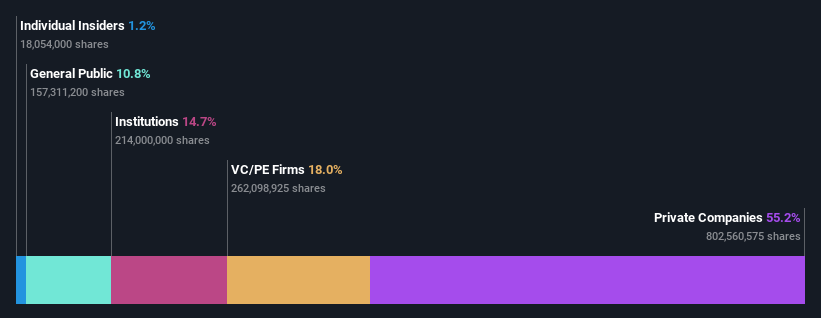

It is important to understand the ownership structure in order to get a feel for who is really in control of Zheneng Jinjiang Environment Holding Company Limited. Private companies hold 55% of the company’s shares. In other words, the group has the greatest upside potential (or downside risk)

The result was that private companies collectively scored highest last week with the company reaching S$647m in market cap after a 11% gain in stock.

Let’s explore each type of owner for Zheneng Jinjiang Environment Holding. Let us start with the chart below.

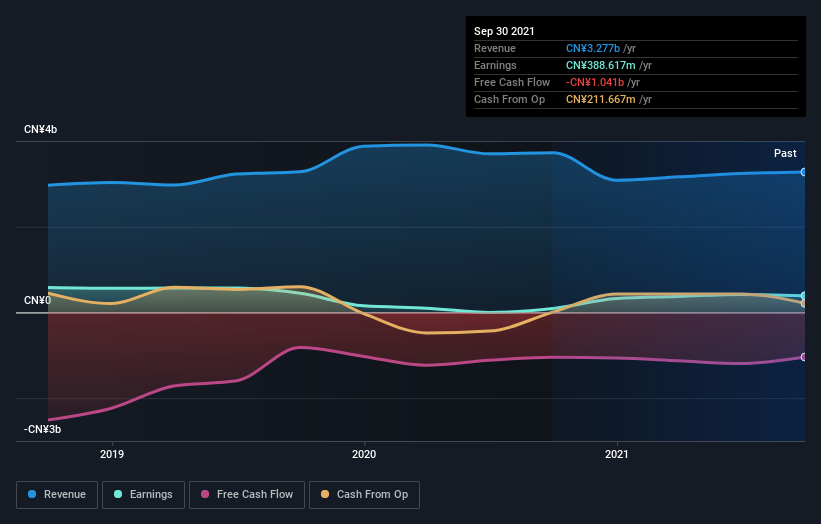

Our latest analysis on Zheneng Jinjiang Environment Holding

What does the Institutional Ownership tell us about Zheneng Jinjiang Environment Holding

Institutional investors often compare their returns to those of an index. They may consider buying larger companies that are included within the relevant benchmark index.

Zheneng Jinjiang Environment Holding already owns institutions on the share register. They actually have a significant stake in the company. This can indicate that the company is trustworthy in the investment community. It is important to not rely on institutional investors’ validation. They also sometimes make mistakes. It is not unusual for a stock to drop dramatically if two large institutional investors attempt to sell it at the same moment. Check out the Zheneng Jinjiang Environment Holding’s past earnings. Keep in mind, however, that there are many other factors to consider.

Hedge funds don’t own shares in Zheneng Jinjiang Environment Holding. Zhejiang Provincial Energy Group Company Ltd. is the largest shareholder of the company, owning 30%. Hangzhou Jinjiang Group Co. Ltd. and Harvest Fund Management Co. Ltd. hold 23% and 15% respectively of the outstanding shares.

We did some digging and found that the top two shareholders collectively own more than half the company’s shares. This suggests that they have significant power to influence the company’s decisions.

While institutional ownership can add value to your research, it’s also a good practice for research on analyst recommendations to get a better understanding of a stock’s expected future performance. We are unable to find any analyst coverage on the company so it is likely that it is flying under the radar.

Insider Ownership Of Zheneng Jinjiang Environment Holding

Although the exact definition of insider is subjective, most people consider board members insiders. The shareholders’ interests should be represented by the answers of the company management to the board. Notably, top-ranking managers sometimes serve on the board.

When leadership thinks like the true owners of a company, insider ownership can be a positive sign. However, insider ownership can give enormous power to a small number of people within the company. This can lead to negative outcomes in certain circumstances.

Our latest data shows that Zheneng Jinjiang Environment Holding Company Limited shares are owned by insiders. The insiders collectively have S$8.0m in the S$647m company. This indicates some alignment. Click here to check if insiders are selling or buying.

General Public Ownership

The general public, mostly made up of individual investors, has some influence over Zheneng Jinjiang Environment Holdings with a 11% ownership. If the decision is not in accordance with other large shareholders, this size of ownership may not be sufficient to change company policy.

Private Equity Ownership

Zheneng Jinjiang Environment Holdings is owned 18% by private equity firms. This shows that they can influence key policy decisions. Private equity can sometimes stay around for the long-term, but they generally have a shorter investment time horizon and don’t invest much in public companies. After a while they might look to sell and redeploy their capital elsewhere.

Private company ownership

Private Companies may own 55% of Zheneng Jinjiang Environment Holding stock. Private companies could be related. Sometimes insiders can have a stake through a holding in private companies, rather than as an individual. Although it’s difficult to draw broad conclusions, it is worth considering as an area of research.

Next Steps

It is worthwhile to think about the different ownership groups of a company. But there are other important factors. We have discovered that there are other important factors. Zheneng Jinjiang Environment Holding: 3 Warning Signs(2) cannot be ignored! You should be aware of these things before you make an investment here.

Of course This stock might not be the best.. Take a look at this. Free FreeCheck out this list of companies that are worth your attention.

NB. The figures in this article are based on data from the 12 months ending on the last date of each financial statement. This may not be consistent to full-year annual report figures.

Give feedback on this article Concerned by the content? Get in touchGet in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article is by Simply Wall St. It is general in nature. Our commentary is based on historical data and analyst projections. We do not intend to provide financial advice.It does not make a recommendation to buy, sell, or trade any stock. It also does not consider your objectives or financial situation. We are committed to providing you with long-term focused analysis that is based on fundamental data. Our analysis may not take into account the most recent price-sensitive company announcements and qualitative material. Simply Wall St holds no position in any stocks.