TThe world’s largest online retailer will release its quarterly and Future earningsAfter-hours on Thursday February 3, the situation may not be as bright as usual. Amazon.com, Inc.AMZNAlthough ) may seem to have all the world’s ecommerce shoppers in its grasp, the company is vulnerable to larger macroeconomic factors.

The latest tech and market selloff has not been kind on AMZN, as shown in the Amazon price chartTipRanks

Michael Pachter from Wedbush Securities published his hypothesis. He stated that AMZN, despite its supply and labor problems during the holiday season, is poised for growth in its overall profitability. Amazon Web Services, fulfillment through Amazon, as well as its advertising business are some of its most notable successes.

Pachter gave the stock a Buy rating and set a $3,950 price target. This target suggests that there could be a potential upside of 42.22% over the next 12-months.

Amazon cannot operate in the current supply constraints and difficult labor market, despite its dominant vertical integration. The company has made great investments in its independence from logistical players. It has increased its localized warehouse footprint and leased planes and ships. It even manufactured its own shipping containers.

Pachter explained that the latter is especially important in today’s market. Shipping containers rose from less than $2,000 before the pandemic, to more than $20,000 after it. There were also delays of several weeks.

This type of insane price inflation forces Amazon to take matters into their own hands and increase its supply of containers. Pachter said that even though Amazon has made costly investments to improve its delivery control, 30% of Amazon’s packages still rely upon outside delivery services.

Amazon is experiencing wage inflation, which has already accelerated, in addition to its shipping costs.

The analyst expects to see gloomy results for the year-end on Thursday. However, he knows that the company is in a healthy state and that any unimpressive earnings report could be due to shorter-term headwinds.

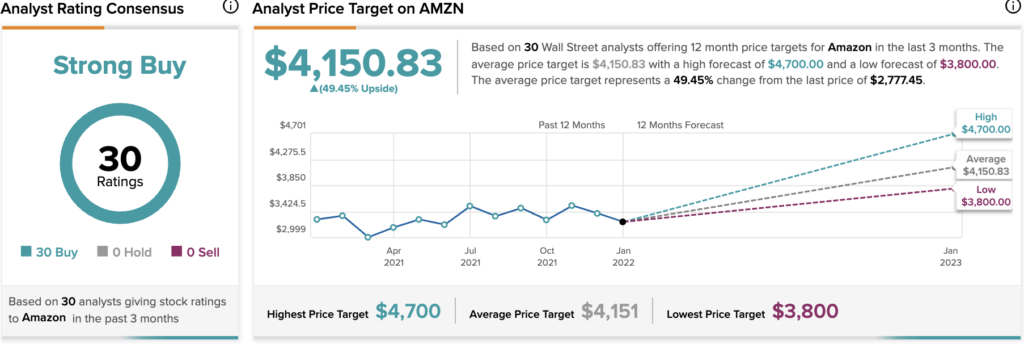

TipRanks shows that AMZN’s analyst rating consensus is a Strong Buy. This consensus is based upon 30 Buy ratings. Amazon’s price target average is $4,150.83. This suggests a possible upside of 49.45% in the 12-months. AMZN closed Wednesday trading with a closing price of $2777.45 per share.

Download the TipRanks mobile appNow

TipRanks has great ideas for stock trading at attractive valuations.Best Stocks To BuyTipRanks’ new tool,, unites all equity insights from TipRanks.

Read moreDisclaimer&Disclosure

These opinions and views are solely those of the author. They do not necessarily reflect those expressed by Nasdaq, Inc.