[ad_1]

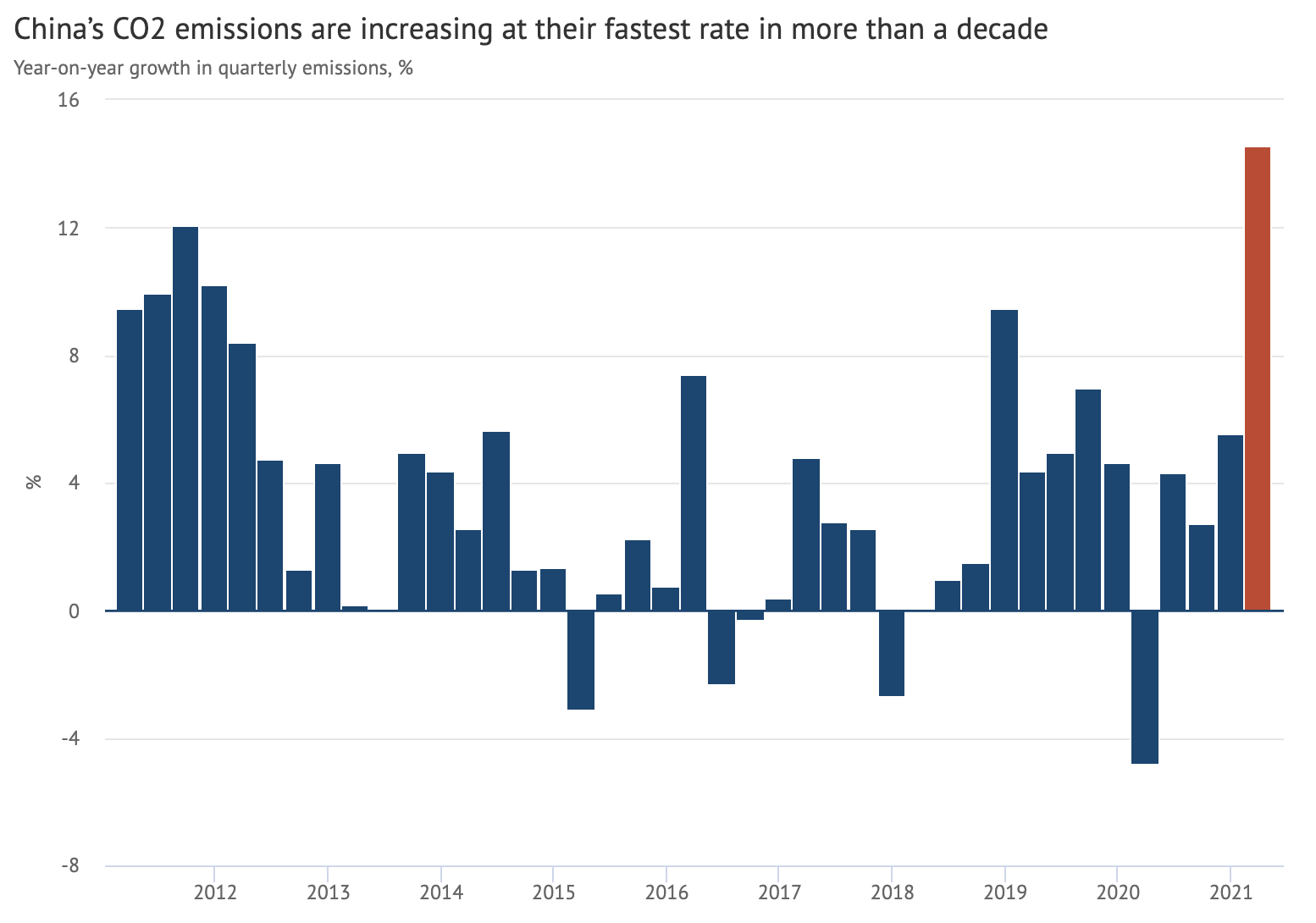

China’s carbon dioxide (CO2) emissions have grown at their fastest pace in more than a decade, increasing by 15% year-on-year in the first quarter of 2021, new analysis for Carbon Brief shows.

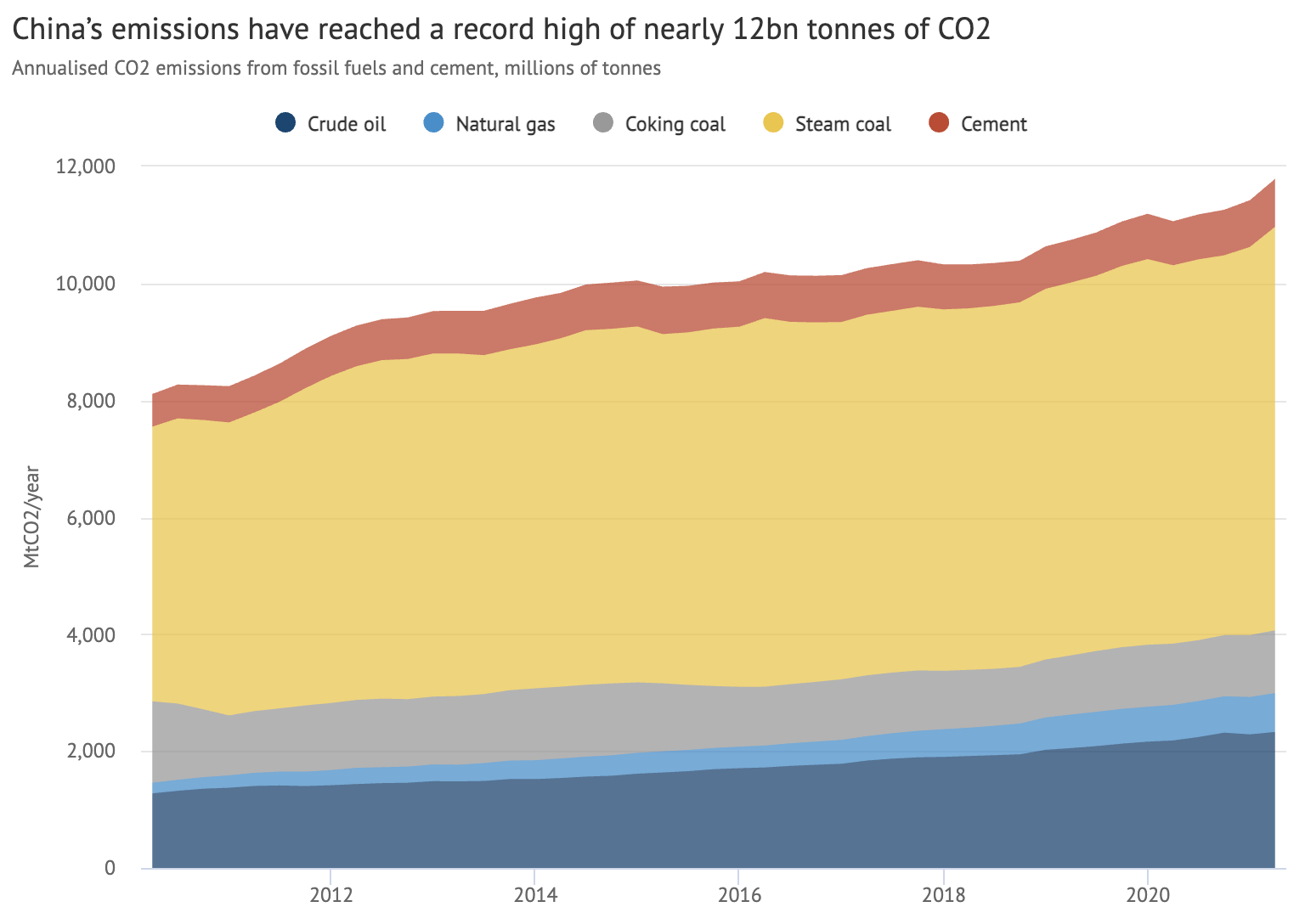

The post-pandemic surge means China’s emissions reached a new record high of nearly 12bn tonnes (GtCO2) in the year ending March 2021. This is 600m tonnes (5%) more than the 2019 total.

The analysis is based both on official figures on the domestic production, import and exported of fossil fuels and cement as well as commercial data about changes in stored fuel stocks.

The rebound is evident in the CO2 surge coronavirus lockdownsIn early 2020, there will be a post-Covid economic rebound that will include growth in steel, cement and construction.

If emissions in 2021 as a whole match the growth seen over the past 12 months, there would be little room for further increases to 2025, under the targets of China’s 14th five-year plan(14FYP).

Fastest growth

In the first quarter of 2021, China’s CO2 emissions from fossil fuels and cement production grew by 14.5%, relative to the same period a year earlier.

This is evident in the chart’s red column. Changes from previous quarters are shown in blue. This highlights the impact coronavirus lockdowns had on the first quarter of 2020.

Year-on-year change in China’s quarterly CO2 emissions from fossil fuels and cement, %. Emissions can be estimated starting at National Bureau of Statistics dataOn the production of different fuels, and cement China Customs dataInformation on imports and exported WIND InformationData on inventories changes, available IPCCThese are the default emissions factors annual emissions factorsPer tonne cement production up to 2018. Monthly fuel consumption data are compared with annual data. annual Statistical CommuniquesTo and from National Energy Administration dataThe first quarter of 2021 saw a rise in fossil gas and coal consumption. Chart by Carbon Brief Highcharts.

This estimate of quarterly emissions growth is consistent, but slightly lower than recent figures from the independent. Carbon Monitor academic research group, which provides estimates of “real-time” emissions data.

Even against the pre-pandemic quarter of 2019, January-March 2021 saw growth of 9%. This indicates that this year’s increase is not just a rebound from 2020’s lockdowns.

The latest increase helped push China’s emissions to a new record high of nearly 12GtCO2 in the 12 months to March 2021, as shown in the chart below. This is almost 600MtCO2 (5%) more than the total for 2019, which was not affected by the coronavirus pandemic.

Annual Chinese CO2 emissions, from cement and fossil fuels, in millions of tonnes per annum, since 2010. Emissions are estimated starting at National Bureau of Statistics dataOn the production of different fuels, and cement China Customs dataInformation on imports and exported WIND InformationData on inventory changes using default IPCC emissions factors annual emissions factorsPer tonne cement production up to 2018. Monthly fuel consumption data are compared with annual data. annual Statistical CommuniquesTo and from National Energy Administration dataThe first quarter of 2021 saw a rise in fossil gas and coal consumption. Chart created using Carbon Brief Highcharts.

Emissions in the year to March 2021 grew by nearly 7% year-on-year and by 10% relative to the year to March 2019 – respectively, the fastest rates since 2012 and 2013.

Charting the sources of emission growth

China’s rapid growth in emissions can be attributed to its recovery from the coronavirus pandemic through a wave of stimulus spending.

Covid-19 lockdowns may skew the baseline to year-on–year comparisons. However, this section will be comparing 2021 data with the corresponding periods for 2019.

This is in line with the most recent official statistical reporting and analysis in China.

This means that around 70% of the increase of emissions in the first quarter 2021 was due mainly to increased coal use. Growth in oil demand contributed 20%, and fossil gas demand 10%.

The power sector accounted for 60% of the rise in coal use, followed by the metals sector (15%) and the building materials industry (10%, cement, and glass) as the next largest contributors.

These figures are based data on apparent coal- and gas demand, as also on oil production and imports. National Energy Administration WIND Information.

In the power sector, total electricity generation in January-April 2021 increased by 11%, wind by 34%, nuclear 19% and solar 18%, based on National Bureau of Statistics data.

The decline in hydropower output – a result of variations in rainfall – caused by 8% decreases in hydropower output, saw a decline in non-fossil fuel sources. Thermal power generation, which is dominated by coal was up 12%.

The expansion in thermal power provided 73% of overall growth in production. This means that clean energy would have had to grow almost four-times as fast to keep up with the rise in demand.

The industry drove power demand. 18% of the growth in demand was due to this sector. This account accounted for 80% and is increasing its share. reported byChina Electricity Council.

Services saw the same growth in power demand as industry. Cargo, real estate, and other services were among the fastest-growing, due to expansion in construction and industry.

Industries downstream that are consumer-facing are reportedlyLow demand and high commodity prices are causing difficulties.

Real-estate development is the primary driver of steel and other industrial expansion.

Official figuresThe floor area under construction increased by 13% over the first four months of 2021 compared to 2019.

The National Bureau of Statistics reported that the production of elevators, lifts, and escalators increased by 85%. This is a proxy of construction activity. WIND Information.

Steel industry emissions targets

While emissions from China’s steel sector have been increasing rapidlyIn recent years, there have been many ambitious emissions reduction targetsIndustry-specific regulations are being established.

These targets would involve the sector’s CO2 emissions peaking before 2025 and falling 30% from the peak by 2030.

The goals are the steel industry’s proposed response to the central government’s call for emissions from major energy-consuming industries to peak by 2025, achieve “steady” reductions by 2030 and “substantial” reductions by 2035.

The steel industry’s proposed targets have major significance for China’s emissions trajectory.

Based on data about coal and power consumption, the steel industry is responsible for more that 30% of total China coal use. This has been the case since the beginning. main sourceDemand growth.

The emissions target does not include electricity use for steel production or electric steelmaking from scrap. However, the targets have implications that go beyond steel.

The plan to reduce steel emissions is mainly predicatedA major increase in electric steelmaking using scrap metal could potentially reach almost 40% of steel production by 2030.

This compares with the current shareOnly 10% of electric steelmaking

If steel output volumes level off and the supply of scrap is fully used for steel production, this alone would be enough to deliver an almost 30% reduction in emissions from the sector – as 30% of primary steelmaking and direct emissions would be replaced with electric arc production.

Because of the lower cost of construction, the industry can help to stabilize or reduce steel demand.

The emissions reduction plan will only be effective if the current increase in steel demand for construction slows. This goes to the heart of China’s macroeconomic policy.

The growth in steel demand has been significantly higher than government forecasts and targets over the past five years: While GDP growth was within target range, it was much more steel-intensive that expected.

2020 saw steel production rise by 40% projectedFor example, the 2016 five-year plan was a revision of the 2016 plan. The steel production grew by 31%, while the GDP grew 32%.

If the need for steel continues to grow as fast as China’s GDP, then total demand could rise more quickly than the level able to be supplied by increasing output from scrap. It would also prove too difficult to meet. plansTo pilot hydrogen and other noncoal-based steelmaking.

As a result, continued growth in steel demand at similar rates to GDP would lead to increases in coal-based steel supply and emissions, in spite of the sector’s proposed targets.

2007 saw the establishment of major steel industry organizations announcedThey were going to achieve a 100MtCO2 reduction through steel recycling and other actions. The truth is that steel production and CO2 emissions increased three-fold over the next decade after the post-financial crisis stimulus.

China’s ambition for the steel industry emission reduction plan is therefore essential. “high-quality” growthEconomic transformation that is less dependent on construction after the economic policy response of Covid-19 caused a setbackTo this end.

The steel sector proposals are one indicator that this might be possible.

Subscribe to the China Briefing

The proposals highlight the fact that the total amount of steel embedded in China’s capital stock is close to the level where demand is saturated in most developed countries.

However, the current rise of steel demand is driving investment in new production capacities.

Based on data from the National Bureau of Statistics, the largest increase in fixed asset investments in January-April was in the smelting of iron and steel metals. WIND InformationThis is more than 60% higher than two years ago, and even surpassing investment in medicine production.

Unless this investment is directed into electric steelmaking rather than more blast furnaces for coal-based steel, it could be difficult to meet the sector’s proposed emissions targets.

Five-year plan challenge

The acceleration in emissions growth poses a potential challenge for meeting China’s 2025 targets for energy intensity and non-fossil energy, set in the 14th five-year planPublication date: March

The targets leave space for emissions to increase by around 5–10% from 2020 to 2025, depending on the GDP growth rate. Additionally, the five year period is seen asIt is crucial that emissions peak in the second half if the decade. Then, emissions will begin to decline rapidly in the second.

If CO2 kept going up at the current rate until the end of 2021 – an approximately 9% annual increase from 2019 – then there would be virtually no space for further emissions growth during 2022-2025, meaning emissions would have to stay flat or fall to meet the 2025 targets.

The International Energy Agency(IEA) projectedA 6% increase in emissions from 2019 to 2021 would also be expected. This would mean a slower than 1% annual growth in emissions from 2022 forward.

Rebalancing the economic recovery would be necessary to achieve such a slowdown.

The economic policy response was responsible for the emissions-intensive recovery achieved to date. deeply embeddedIn times of recession, economic structures that support construction and industrial sectors will be a benefit.

The pandemic response in other parts of the world has worsened the domestic situation by increasing demand for Chinese exports and boosting Chinese industry.

NumerousChinese analysts notedThe divergenceBetween recent growth in realty, major industries and exports on the one hand and consumption the other.

The government has made room for structural reforms and set a GDP target this year. well below consensus forecastsBy not setting any target for the next five year.

In addition, as the analyst reports linked above indicate, the retail and service industries are starting to recover. This will reduce the need for construction spending to maintain the GDP growth. However, the credit-fueled growth of the past year has led the to renewed concerns about debt levels.

These factors could allow a clampdown on “low-quality growth”, directing investments and spending towards services and high-tech sectors, and lowering the energy intensity of growth.

If the government follows this approach, it should mean a tightening of construction and real estate spending that would bend China’s emissions trajectory downwards.

Data sources

The data for the analysis was compiled using data from the National Bureau of Statistics and the National Energy Administration, China Electricity Council, China Customs official data releases and WIND Information, an industry-data provider.

Data from multiple sources was cross-referenced. Official sources were used whenever possible. Wind Information data was adjusted to match.

The CO2 emissions estimates are based upon the National Bureau of Statistics default fuel calorific values and the IPCC default emissions factors. The cement CO2 emissions factor is calculated using. 2018 data.

Only data on oil product consumption was available for oil consumption. Therefore, crude oil consumption can be estimated using production and imports.

If official releases do not contain changes from 2019-2021, these are calculated using the linked release and any previous iterations. However, the latest release is linked to.

Sharelines from this story

[ad_2]

Source link