The buy-now, pay-later (BNPL), company Affirm (AFRM -3.13%)Recent quarterly results showed strong performance, beating analyst estimates on revenue and earnings for the quarter ending March 31, according to recent reports. Max Levchin, founder and CEO of Affirm, stated that the company plans to achieve “a sustained profit run rate” on an adjusted basis before the end 2023 fiscal year. The stock surged last week due to the news. However, Affirm appears to be in good shape. Here are some reasons why investors should be cautious.

Credit concerns

BNPL allows consumers to buy items without having to pay any money upfront and then pay it off in installments. Affirm is a technology company that allows merchants to offer a variety of products. BNPL options. The company has formed many large partnerships. Amazon,Walmart,ShopifyIt has been able to significantly increase gross merchandise volume across its platform thanks to these.

Source: Getty Images

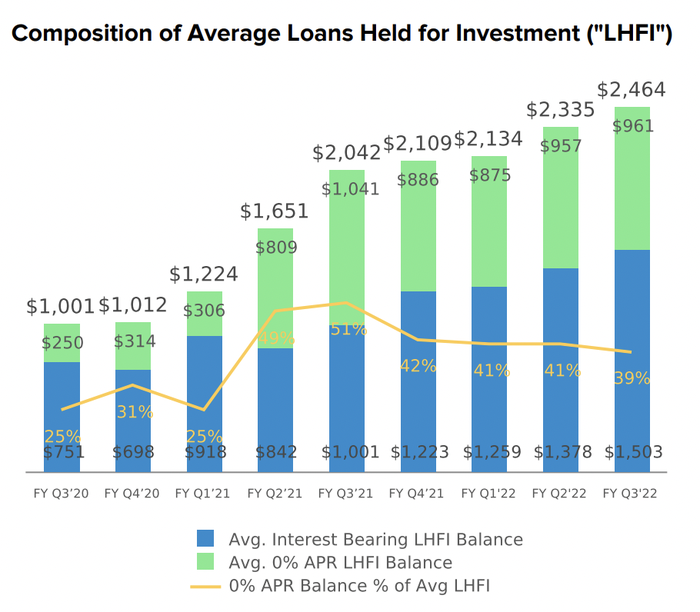

Affirm’s BNPL options offer short- and long-term BNPL loan options. Some are without interest, while others have annual percentage yields of 10% to 30%. Split pay is a product that covers purchases up to $250. It can be paid off in six to eight weeks. As Affirm’s products have been developed with new partnerships, more loans have begun to earn interest.

Image source: Affirm.

Nearly 61% (or 61%) of Affirm’s loans that were held for investment on its balance sheet were interest bearing at the end the quarter ended March 31. Affirm has a loan loss allowance of 6.4% on its balance sheet. However, the company is unable to assess the credit quality of the borrowers who hold these loans.

The company grades loans with a proprietary scoring algorithm, but doesn’t provide information about borrower demographics. However, the greater the chance that a borrower will default, the more interest they’ll have pay. Although delinquency trends are stable at the company, consumers are still strong and haven’t felt the effects of rising interest rates.

Sure, the Federal Reserve is now Rates increasedAlthough it is possible to make multiple payments, it can take several weeks before the real impact is felt. We have heard of many BNPL borrowers not paying their bills when credit conditions were more stable. This debt could be one of the first to go unpaid if consumers get into financial trouble. Affirm may have to seek funding from its capital markets partners if it faces credit quality concerns. This is a problem that has recently plaguedStart.

Be careful

Affirm had a strong quarter, and appears to be on solid footing in terms of credit quality. Levchin, a former founder of PayPal, a well-known techno genius, so perhaps Affirm is superior in credit underwriting, but it can be difficult to beat the Fed or a rising interest rates environment.

The current high inflation levels will continue to place pressure on consumers and harm their finances. Higher interest rates could lead to a decrease in funding or investors may demand lower returns. This could slow down Affirm’s growth. These are all important factors to consider when deciding whether to invest in Affirm. Also, make sure that the current valuation is a risk-reward ratio you are comfortable with.