James Butterfill is Investment Strategist for a major European digital asset investor firm CoinShares.

____

Inflation has been a constant threat to investors over the past 10 years. Investors have invested a lot of money in quantitative easing (QE) and hoped it would kick in. Perhaps one of the most plausible explanations is that the transmission mechanisms haven’t worked as expected, with QE often being used in an unproductive way, where companies have taken advantage of low bond yields for stock buybacks rather than growth initiatives. It took a world-wide health crisis (COVID), which exposed the fragility of the global logistics system. It highlighted supply bottlenecks that have contributed to an increase in inflation not seen since June 1982.

Bitcoin’s sensitivity to Fed actions

We have seen the most recent Minutes of the FOMCThe US Federal Reserve (Fed), which is increasingly concerned about inflation in the US, has begun to reconsider their tapering strategy. They are considering 4 interest rate increases in 2022 instead of the consensus of just 2 6 months ago. The US Federal Reserve could end tapering and increase interest rates once again, as they did in 2015.

What will happen with Bitcoin (BTC), when rates rise? Bitcoin rose 51% six months after the 2015 rate hike. However, we believe Bitcoin has grown significantly and will behave differently. It will likely be in line with inflationary assets and real assets. Analyzing the behavior of other real assets during rate hikes in the past is likely to give an indication of how Bitcoin may behave.

The anatomy behind interest rate hikes

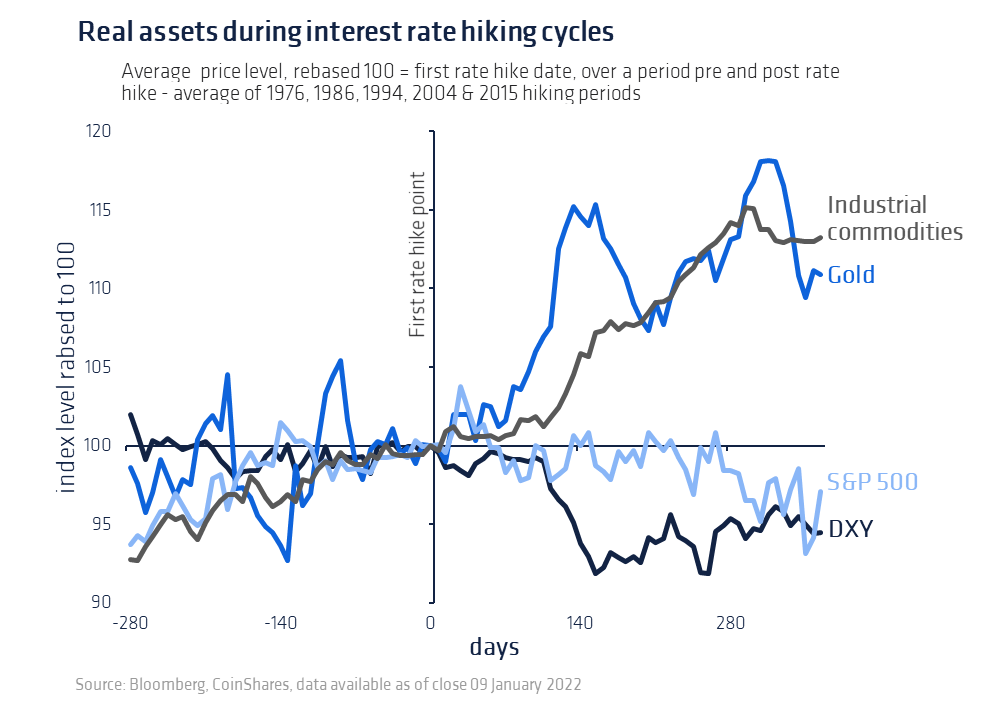

Although every rate hike cycle in history is different, there are some commonalities. To best represent today’s scenario we have identified five out of the potential nine periods post-Bretton Woods tightening cycles. The closest periods to today are the December 1976, December 1986 and February 1994, June 2004 and 2015. These periods represent periods when rates were either falling, or relatively low for a long time before. We are encouraged by the surprising consistency found in each of these five periods.

During rate increases, gold and industrial commodities tend to appreciate

Gold is an example where performance hasn’t been consistent though: in 1976, 1986, and 2004 prices rose 22%, 25%, and 11% respectively, whilst in 1994 prices fell by 2.6% one year after the first hike. The rises in 1976, 1986 and 2004 were likely due to inflation. However, this was not the case in 2004, which was more controlled. The 1994 real interest rate increase of 3% was a key difference. In other periods, the real interest rate remained flat or even negative. This confirms that rising real rates are often a negative thing for gold. Another real asset, industrial commodities, behave similarly during rate-hiking cycles. Technically, the S&P 500 is a real asset. It tends to rally initially, but then starts to sell off due to tightening credit conditions affecting corporate profitability.

Contrary to popular belief, the USD sells off quite often

Prior to rate hikes, the USD tends not to fluctuate or increase but has invariably fallen by an average 7.7% within a year. This is counterintuitive because a reduced money supply results in fewer dollars being in circulation. The most likely explanation is that markets tend not to fully price the possibility of a stronger economy or improving the job market before it happens. The USD seems to be acting in a similar fashion. Since November 2021, the USD has been strengthening against many currencies while Bitcoin, which trades in the opposite direction, has been selling off.

The Fed is not ahead of the curve, increasing the chance of a policy error

Monetary policies should be proactive. As inflation is a slow indicator about the economy’s state, it could be argued the Fed is already behind. Keep in mind that monetary policies have a delayed impact on the economy for between 1-2 years. Therefore, interest rate hikes that start today are unlikely to have an immediate effect.

Fed’s high-risk conundrum has been caused by QE and extraordinarily low interest rates. As QE becomes less effective and interest rates rise, there is a greater risk of a disorderly correction in equity and bond markets which have been so dependent on the stimulus. While the Fed has a mandate for inflation control, it also has a mandate for stable prices. It is difficult to see how the Fed can manage both.

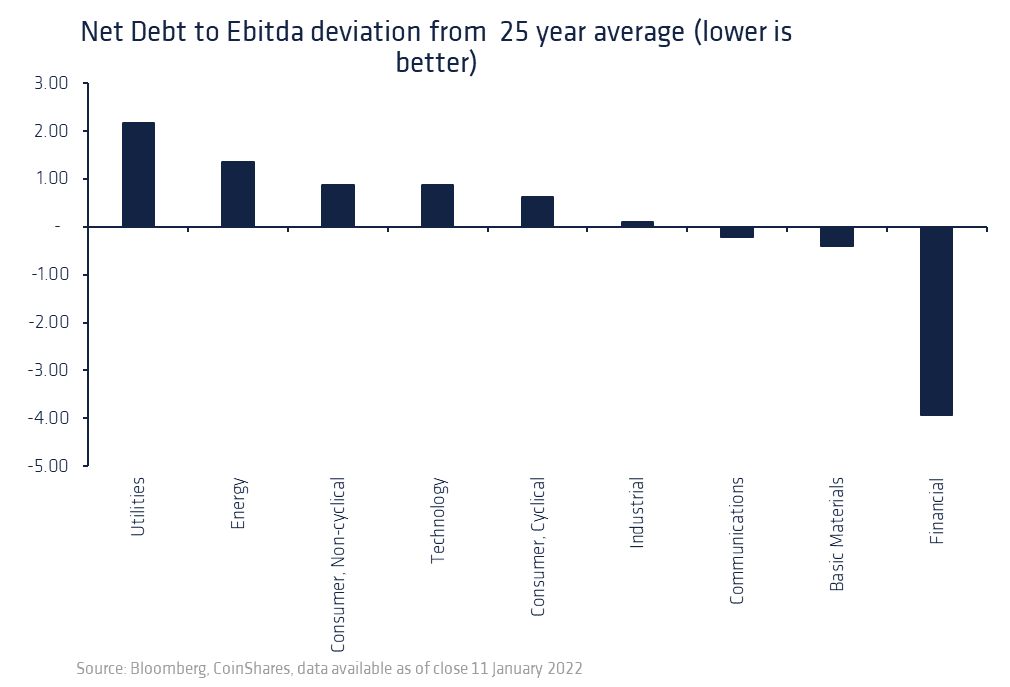

The FED’s firepower (the rate at which interest rates can rise) must also been considered. Household debt service ratios are healthy. An average of 9.1% of household income is spent on servicing debt, which is the lowest level in records. Corporations also appear healthy with net debt ratio to EBITDA (earnings prior to interest, taxes depreciation and amortization), at 1.3 years, compared with the long-term median of 1.7. This suggests that the Fed is able to raise interest rates quickly enough to not stress the economy.

There are certain sectors of the economy that have net debt to EBITDA which is not as healthy as others, especially utilities, energy, healthcare, which are in a worse financial position than before the 2008 financial crash. Although technology net debt is at its highest level since 1998 it remains low relative to other industries. Unintended consequences of raising interest rate too aggressively could include a rise of defaults and unemployment within these crucial sectors of economy, leading to greater social unrest and political instability.

Real assets are likely be of benefit

We believe Bitcoin will behave in a similar manner to gold and other real assets due to its fixed supply and price in US dollars. We’ve already seen that Bitcoin is very sensitive to interest rate hikes in January 2021 and December 2021. Bitcoin has fallen by almost 30% from its peak in January, which we believe is a result of inflation and the likelihood of more rate hikes in 2022. Longer term, we see a high chance of a Fed policy mistake (waiting too long before raising interest rates too aggressively), and the USD selling off. Both of these are likely to be supportive for Bitcoin and other real assets.

_____

The piece first appeared in CoinShares 2022 Digital Asset Outlook.

_____

Learn more

– How the global economy might affect Bitcoin, Ethereum and Crypto in 2022

– IMF Warns of Dangers of Fed’s Rate Rise, Brazil Says Inflation ‘Won’t Be Temporary in West’

– Arthur Hayes Tells Crypto Traders ‘It Pays to Wait,’ Stronger USD Coming

– Two Main Macro Scenarios in Play for Bitcoin & Crypto in 2022 – CryptoCompare

– Inflation is the biggest test yet for central bank independence