Rachel Luna/Getty Images Entertainment

Introduction

I have yet to write an article about Cigna (NYSE:CIHowever, I did purchase the stock about a full year ago when I suggested that it be “buy” for members my investing service, The Cyclical Investor’s Club on 3/1/21. It has performed fairly well in absolute terms since then and I honestly haven’t paid much attention to it.

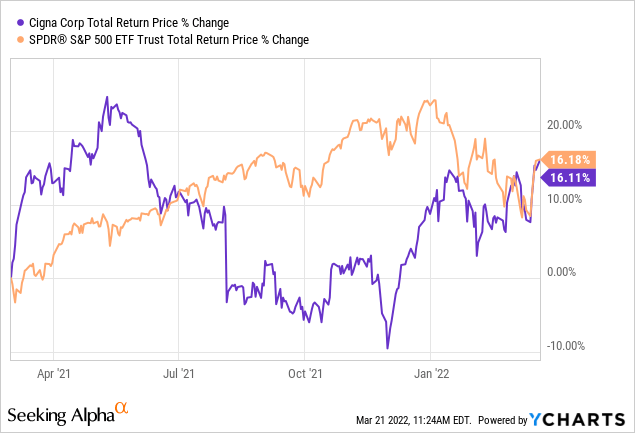

While the ride has been a bit more difficult, Cigna’s return has equaled that of the S&P 500. They also produced results more or lesser in line with their earnings growth during this period.

In this article, I will argue that in the current late-cycle environment CignaBecause of its steady earnings growth, and its relatively defensive nature, stock would make a solid addition for most investors to their portfolios. It is not subject to rising energy prices or broad tech selloffs that could lead to major market indices falling further.

Before Analyzing Cigna

There are many proven valuation methods that investors often use. Many can be traced back at a particular investor or a broad school. Many investors follow one or more of these schools or mimic past investors. I’m a little different as I create my own valuation strategies. Many of my techniques are based on lessons from historical investors such as Lynch and Fisher, Buffett, and Dalio. However, they are not identical. I tend to be more concerned about and watch for things than most investors, so I use my own set guidelines and rules that are specific to my strategies.

One of these guidelines is that I don’t usually buy stocks of businesses that have recently participated in large M&A. I define “big” as a company that is more than 20% of the market capital of the acquirer. Normally, I wait three years before I buy stock after it has been through big M&A. But, if the price is really good and I have more cash, I might consider buying it sooner. This M&A rule can be attributed to many reasons. The first reason is simple. Usually, the buying company overpays for the company it is buying. It takes several years for the stock price and the deal to be evaluated (usually after the details have been written down). The second reason is that large acquisitions are often made by management in response to competitive pressures. There is usually increased disruption risk when a business feels the need to make a major purchase. It can also throw off my valuation metrics which makes it difficult for me to quickly value the stock (and I like being able to value quickly as it gives me an edge).

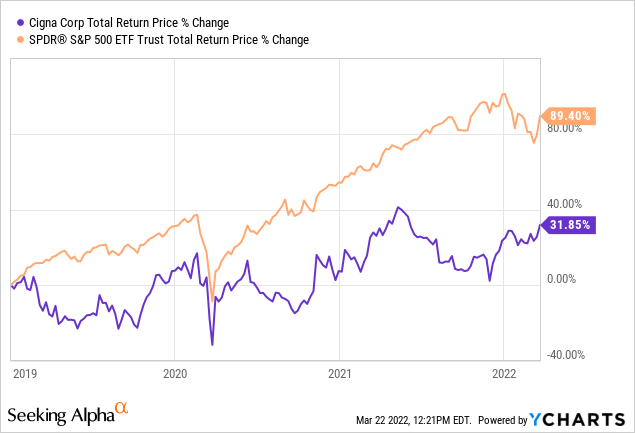

Cigna acquired Express Scripts in a major acquisition in 2018. Express Scripts was a company I was following at the time, and it seemed like Cigna paid a fair price. However, I don’t usually know enough about the value of a stock after it has been bought. Cigna’s stock was bought by me because I was at least somewhat familiar. Cigna now has the full three-year waiting period. I feel more comfortable writing publically about it, as Cigna has passed this initial test. Cigna has returned only about 1/3 of the S&P 500’s returns since closing that deal. This is evident.

Now that we have addressed this issue, let’s get into the Cigna valuation process.

I use the analysis to calculate what I consider the main drivers of future total return: Market Sentiment returns, and Business returns. I then add these expected returns together to create a 10-year CAGR and use it to value the stock.

Before I start this analysis, I make sure to check the long-term earnings patterns of the business in order for me to be certain that it is suitable for this type of analysis. If the history of the earnings is not long enough or is too cyclical or erratic, I either stop analysing the stock or use a more appropriate analysis.

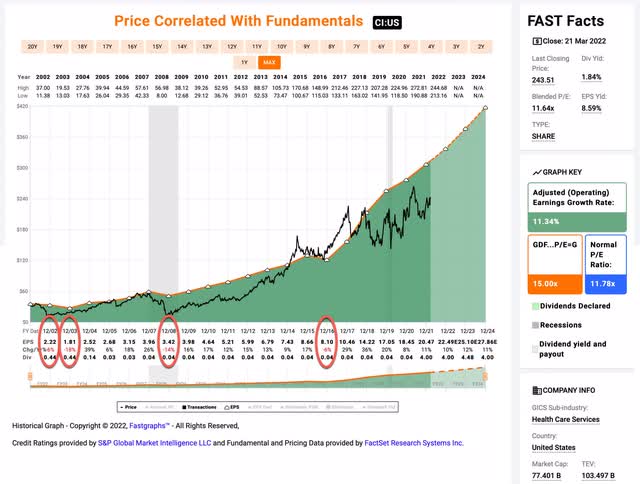

FAST Graphs

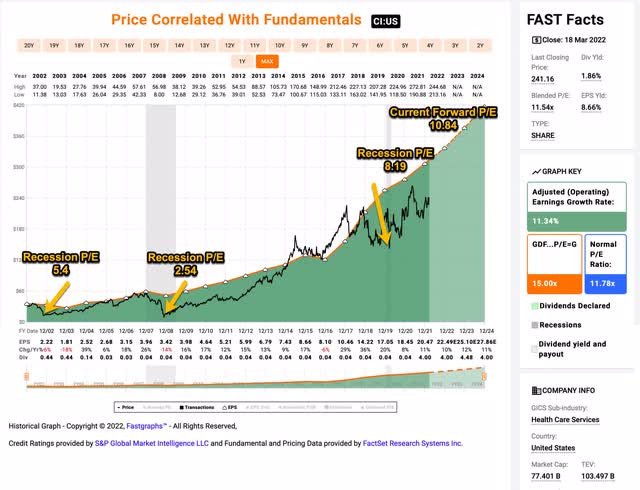

Cigna’s 20-year earnings history can be found on FAST Graphs. EPS has grown at an average rate of 11-12% for most years. Analysts expect similar growth for the next three. Cigna has been through three official recessions over the past 20 years. Cigna’s earnings growth declined for two years during the 2001/2 recession for a total -24%. Earnings growth dropped -14% during the 2008 recession. Cigna saw a modest drop in earnings growth of -6% during the 2016 mid-cycle. I would classify this overall earnings cyclicality in the low-to-moderate range. Cigna has all the basic requirements to complete the Full-Cycle Analysis that I’m about sharing. Its earnings history isn’t particularly cyclical and its earnings have shown solid growing.

Market Sentiment Return Expectations

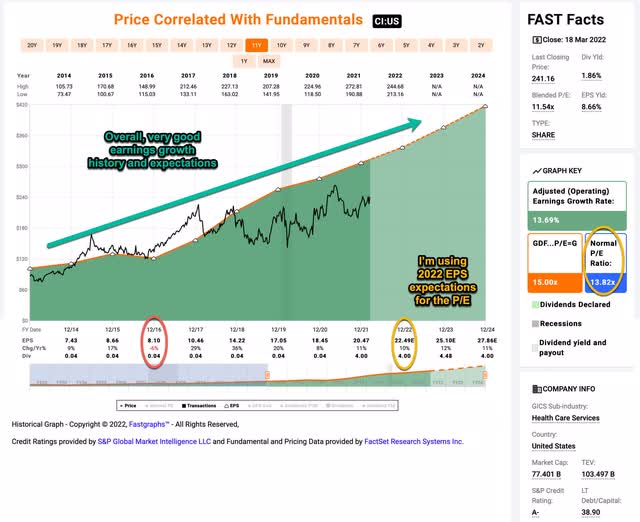

To estimate the potential returns over the next 10 year, let’s first look at what return we might see if the current economic cycle’s P/E multiple returned to its mean. This cycle will be started in fiscal year 2014, and will continue through 2022’s estimates due to the recent recession.

FAST Graphs

Cigna has an average P/E of 13.82 between 2014 and the present (the blue bar highlighted in gold on FAST Graph). Cigna currently has a P/E of 10.84 based on 2022’s forward earnings estimates, also circled in golden. If the 10.84 P/E was to return to the average P/E 13.82 over the next 10 years, Cigna’s current price would rise. This would result in a 10-Year CAGR. +2.43%. This is the annual return that sentiment mean reversion can give us if it takes at least ten years to revert. If it takes less time, the return would likely be higher.

Business Earnings Expectations

We have previously looked at what would happen if the market sentiment returned to the mean. This is entirely determined and influenced by the mood of market sentiment. It is often unrelated to or only slightly connected to the actual business’s performance. We will now examine the actual earnings. This section aims to determine how much money we would make (expressed as a CAGR%) over the next ten years if the business were purchased at current prices and we kept all the earnings.

This includes two components: the earnings yield and the rate at which earnings can be expected grow. Let’s start by looking at the earnings yield. This is an inverted PE ratio, or the Earnings/Price ratio. Current earnings yield is approximately +9.20%. This is how I think of it: If I bought the entire company right now for $100 I would make $9.20 per annum if earnings remain the same for the next ten years.

Next, I will estimate the company’s earnings growth over that time period. This is done by finding out the earnings growth rate during the previous cycle and then applying that rate to the next ten years. This involves calculating the annual EPS growth rate from 2014 to take into account each year’s decline or growth and then backing off any share buybacks (since fewer shares will increase the EPS).

Cigna issued a lot of shares to Express Scripts for purchase. I will use the buybacks both before and after the purchase. This should lead to a more conservative assumption of earnings growth.

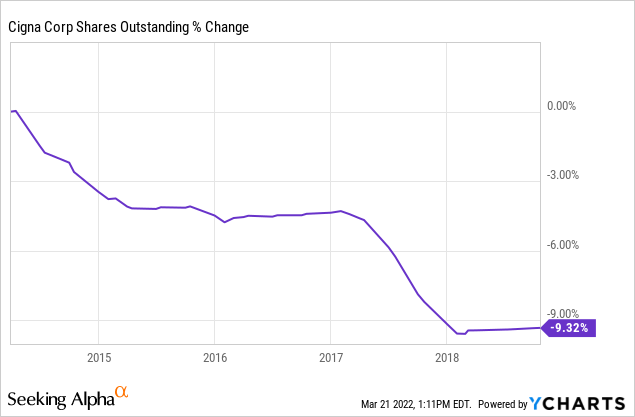

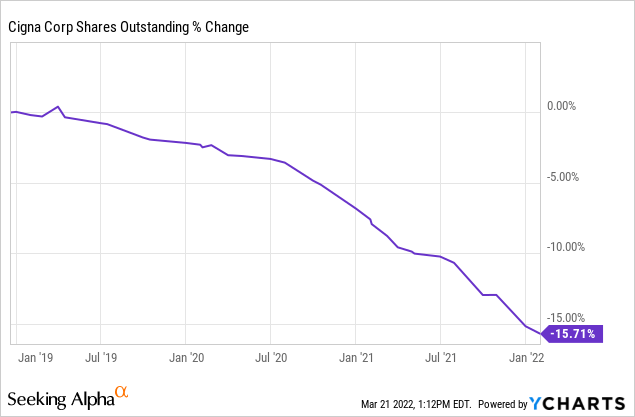

They bought back 9.32% of the outstanding shares between 2014 and late 2018.

Over the past three years, they have repurchased an additional 16% of outstanding shares. Overall, I believe they have bought back approximately 27% of the company’s shares since 2014. I will adjust my earnings growth estimates for the decrease in shares. I will also adjust for the -6% decrease in EPS growth over this period.

After doing this, I calculate an annual earnings rate of approximately +10.73%. Although it is less conservative than FAST Graph’s +13.69% number at this time, it is still in line with analysts’ future expectations and Cigna’s most recent performance. Therefore, it seems like a reasonable earnings increase estimate.

Next, I will apply the growth rate to current earnings and look forward 10 years to get a final 10-year estimate of CAGR. This is how I see it: If I bought Cigna’s entire business for $100, it would return $9.20 plus +10.73% annual growth in the first year. The amount would then grow at +10.73% per annum for every 10 years. I want to know what amount of money I would have at the end 10 years on my $100 investment. I calculate that it would be approximately $265.14 (includes the original $100). This is what I get when I plug that growth into the CAGR calculator. +10.24%CAGR estimate for expected business earnings returns over the next 10 years.

10-Year, Full-Cycle CAGR Estimate

There are two main areas where future returns could be found: market sentiment returns, or business earnings returns. Cigna’s future returns will be +2.43% if the market sentiment is equal to the last cycle for the next 10 years. If the earnings yield is similar to the last cycle and the growth rate is the same, the company should achieve a +10.24% 10-year average CAGR. When we combine the two, we get a 10-year full-cycle CAGR of +12.67%Today’s price

My buy/sell/hold range is for this category of stocks: Stocks with a CAGR above 12% are a Buy, below a CAGR expected to be 4% is a sell, and between 4%-12% is a Hold. Cigna is a “Buy” at the current price. I only take small, 1%-weighted trades when using this strategy. If the price drops significantly, I reserve the right to add an additional position of 1% weight.

Recession P/E is an additional consideration

Cigna’s second consideration is downcycles and Cigna stock’s likely decline in a recession. Since we are at the end of the economic cycle, I do not recommend holding stocks that are likely fall steeply during recessions. I have also sold most stocks in my portfolio with a history of earnings or price declines during recessions.

It is difficult to predict how Cigna’s stock would perform in the next recession. The last real recession was in 2008/9, which was quite a while ago. This was under very different circumstances from today. Below is a FAST graph with some additional annotations by me. It displays the monthly low recession percentages for Cigna for the three most recent recessions.

FAST Graphs

Cigna’s current forward price/e is 10.84. During the Great Recession, the P/E was as low as 2.54. Part of the reason was not due to the recession, but because many believed that President Obama and the Democratic Congress would effectively nationalize the health insurance. I believe the next recession will be very different in that regard. I wouldn’t anticipate the P/E to drop that low again. The P/E dropped to 5.4 in the 2001/2 recession. It fell to 8.19 in 2020, which is a significant increase. I’ve decided to use the 8.19P/E as a recession forecast for the next recession. I believe Cigna has a better chance of a recession this time around than in previous recessions. This number may be a bit optimistic for me, and Cigna might fall further than that, but I believe that if the stock has a 10 P/E (or less), even if it falls more during a downturn, it will rebound quickly so there won’t really be much to worry about.

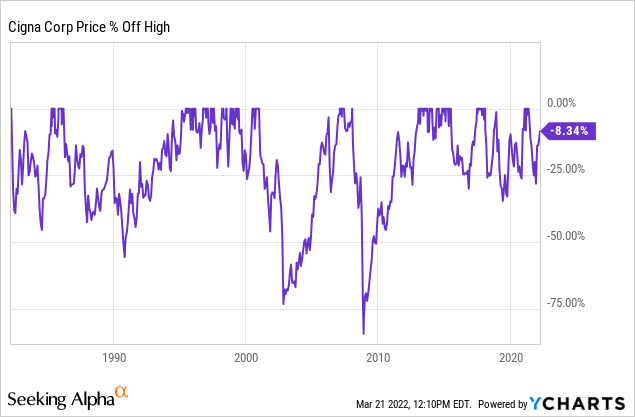

The above chart shows Cigna’s historical price drawdowns. This chart alone would make me believe that Cigna was in a highly cyclical industry. Cigna’s earnings drawsdowns aren’t quite as severe. They are just -24% in 2001 and -14% in 2008/9 respectively, and -6% in 2016. The price fell by more than 75% during the 2001 and 2008 recessions. Although I wouldn’t expect a steep price drop in the next recession, I would be willing to take a position if it did happen. I want investors to understand the possibility of a drawdown, even though I believe the odds are low. I also want them to be ready to purchase another stock if the stock falls below 60% from its highs.

I think that healthcare will be considered a defensive sector during the next downturn given the current situation with supply chain issues and rising interest rates.

Investors who think a recession is coming may want to buy stocks at a price that is closer to the recession. I prefer stocks to be priced within 20% of the recession PE during downturns. If the recession P/E were 10, then I wouldn’t buy stocks until the current P/E was below 12. If you feel that the 8.19 recession P/E would be reasonable to use, you could expect a buy price around $230 per shares. This was not something I thought about when I bought my position one year ago, when we were well out of a recession. With a solid business, I would likely use the higher P/E and then plan to purchase more if the stock falls -60% from its highs. This would give me a second deep buy price of $109 per share.

Conclusion

Overall, I believe that Cigna is a good investment. The stock should not be in recession anytime soon. It is expected to return very good long-term returns. Cigna is unlikely to be affected by economic problems as much as other businesses. Political threats are unlikely to occur anytime soon. The stock trades at a very reasonable value in absolute and relative terms. If there is a severe recession and the stock price drops a lot, it could be added to or held through the downturn as it will likely turn the other way.