[ad_1]

This story was first published in the Guardian and is reproduced here as part of the Climate Desk collaboration.

The crypto crash will not reduce the sector’s climate impact any time soon, an economist has warned, even though the environmental footprint of digital currencies is in theory set by their market value.

“Unless Bitcoin collapses further, there’s no reason to expect a decrease in environmental impact,” said Alex de Vries, a data scientist at the Dutch central bank and the founder of Digiconomist, which tracks the sustainability of cryptocurrency projects.

His research shows that while the increase in a cryptocurrency’s price encourages more computer capacity to be dedicated to it—Carbon emissions are rising—that capacity takes a long time to disappear after the value declines, so the climate impact persists.

Cryptocurrencies work by validating their transactions through huge numbers of “miners” who use their computers to solve extremely complex math problems in exchange for the chance of getting tokens as a reward, in a highly energy-intensive process. De Vries estimates that the Bitcoin network consumes approximately 204 terrawatt hours (TWh), of electricity per annum, which is roughly the same energy consumption as Thailand and more than that of all 23 sovereign countries.

Other cryptocurrencies add to that footprint: Ethereum, the token that underpins the NFT boom and the “decentralized finance” sector, has an annualized footprint of around 104TWh (equivalent to Kazakhstan, and more than all but 34 nations), while even Dogecoin, a lighthearted spinoff of Bitcoin famed for its community’s positive attitude, consumes an estimated 4TWh annually.

Those figures have barely changed over the past month despite $1 trillion being wiped off the crypto sector, and other measures of the amount of processing power devoted to “mining” similarly show little decline.

All major cryptocurrencies use electricity in proportion to the price. This determines the amount of the reward that is given to miners. For Bitcoin, for instance, the reward for successful mining is 6.25 Bitcoin every 10 minutes—currently, about $210,000.

The reward is worth more energy if it has a higher value. This was evident as Bitcoin’s price rose from $8,000 to $60,000 in October 2019 and then to $60,000 two year later. However, the sector’s energy consumption also rose, rising from 73TWh up to its current peak.

But while an increase in the price of cryptocurrency quickly leads to an increase in the carbon emissions of the sector, a crash like the one seen in past month doesn’t do the reverse. “It likely stops the environmental impact from going up any further,” said de Vries, “but a Bitcoin price of $25,200 is sufficient to sustain an annual electricity consumption of 184TWh.”

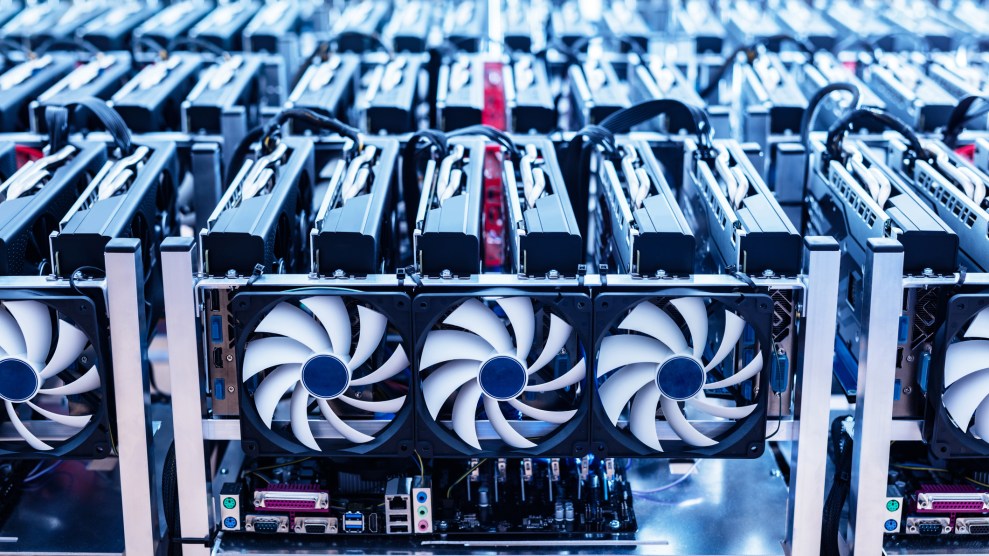

That’s because the cost of cryptocurrency mining is split over two main areas: buying the hardware and paying for electricity. When prices are on the rise, miners buy new computers—expensive graphics cards for Ethereum or purpose-built “rigs” for Bitcoin—but once they are already set up, it’s worth switching them off only when the cost of electricity alone is higher than the expected revenue.

In a paper Published in the journal JouleLast year, de Vries estimated that a massive crash in the price of Bitcoin, back down to $8,000, would be required to meaningfully reduce the total emissions of mining—and even then, it could sustain an energy consumption of up to 60TWh per year.

The sector could contract further due to the ongoing turmoil in cryptocurrency markets. Wednesday morning, tether paid out $1.5 billion more to depositors who had withdrawn their money from its bank-like function. In the last week, the slow-motion bank run has seen $9 billion of its reserves withdrawn, more than 10 percent of its total market cap and well over twice the cash-on-hand it declared it had at the beginning of the year.

Andreessen Horowitz is a prominent venture capital firm that is one of the main financial backers for the cryptocurrency sector. that we may be entering a “crypto winter”Echoing the warnings of Brian Armstrong, Coinbase chief executive, valuations could be depressed for some period.