lorozco3D/iStock via Getty Images

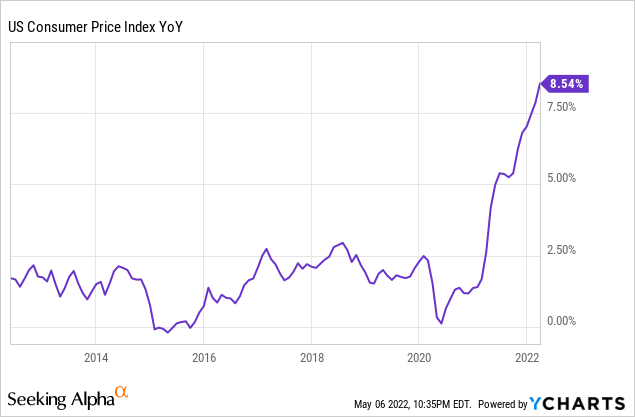

Inflation is at an unprecedented rate, it is not secret. In fact, U.S. inflation – which Elon Musk, a leading businessman, claims is causing a panic among many. ClaimIt’s much worse than reportedThe official CPI numbers have reached four-decade highs at more than 8.5% year-over year.

Businesses that are profiting from the current state the economy are the exception, not the rule. Consumers are being squeezed by rising costs and businesses are paying higher input costs. It is even harder to find businesses that are undervalued, have a healthy financial position, and have solid long-term business prospects. They are the beneficiaries of the soaring inflation. However, we believe that we have identified such a company in Energy Transfer (NYSE:ET).

This article will outline five reasons why we believe it is poised for continued outperformance in the high inflation environment, along with some of its risks.

Reason #1: Energy Benefits from Inflation

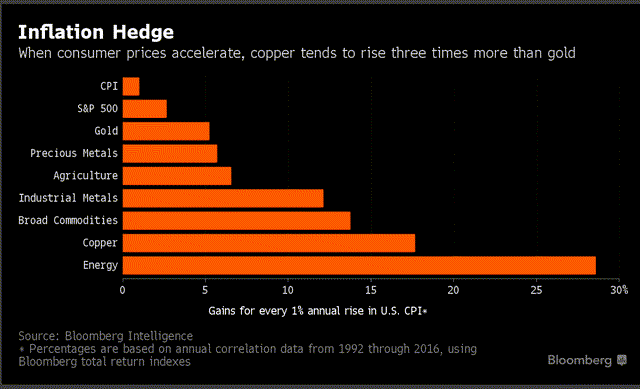

The chart below shows clearly that the energy sector is the strongest inflation hedge. It has crushed gold and other precious metals as well as agriculture and other commodities by a considerable amount.

PIN IT

PIN ITEnergy (Bloomberg)

The current environment is a more energy-demanding one. As COVID-19 headwinds recede and global economic activity reopens, global energy supply chains are being constrained by increased regulation and restrictions in the United States. Additionally, sanctions and other conflict-driven disruptions are affecting the flow of Russian energy. In an inflationary environment, energy prices are rising faster than usual.

This bodes well for ET’s unit prices, as it has been shown to be highly correlated in the past with energy prices. ET has seen an increase in unit prices since 2007, for example. Very close correlationWith the energy sector (VDEEspecially when it is compared with its Relationship to the S&P 500 (SPY).

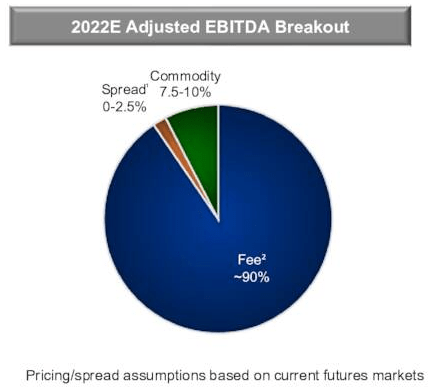

Long-term, rising energy prices are even more important for ET’s fundamentals. They strengthen its customers’ balance sheets, which in turn improves the security of its contracts. It also incentivizes higher production, which in turn drives demand for its midstream infrastructure. Higher commodity prices give ET a boost in its optimization and marketing business, which will impact the 10% expected 2022 adjusted EBITDA, which is commodity price sensitive.

ET EBITDA Sources (Q1 Earnings call)

The current environment is positive for ET’s export oriented assets, as the U.S. is in high demand for energy exports. IntensifyingDue to increased demand in Europe in the wake the war with Russia, ET has recently signed numerous deals. OneSouth Korea

Reason #2: An Increasingly Lean Business Model

ET is well-positioned to manage inflationary headwinds more effectively than one might think. This is due to the business model being increasingly efficient, and management’s keen focus during COVID-19’s leaner days on operational efficiency. Management During the Q4 2020 earnings calls:

We discussed cost reduction measures in our corporate offices and field operations during previous calls. For full-year 2020, we achieved G&A and OpEx savings of over $500 million. We expect to see about $300 million to $3550 million of this recurring in 2021.

Many of these savings continue today, and will likely increase due to inflationary pressures.

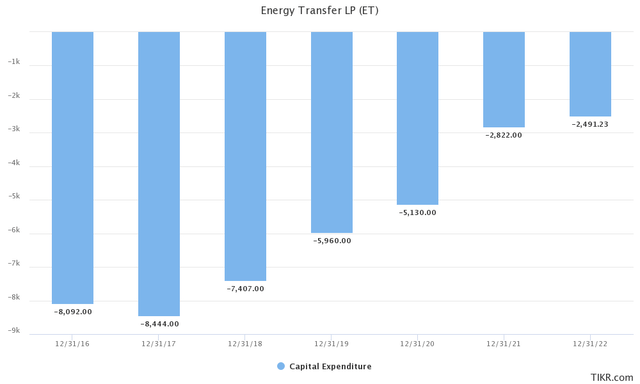

In recent years, ET’s capital spending budget has declined as growth investments have been cut. This makes ET less sensitive towards inflationary cost pressures.

PIN IT

PIN ITET CapEx (TIKR.com)

Reason #3: Inflation-Linked Contracts

Another reason why inflation should boost ET is because its pipeline contracts are linked with indexes that should cause an increase in cash flow in the next months. Management will be speaking on the Q3 2021 earnings conference. :

An index is included in almost all of our contracts, if not only in our transportation and fractionation liquids, but also in our crude contracts. It is usually a FERC Index… Next July, we expect this to increase significantly. We’ve heard as high as 5% to 6%.We do have these increases in the vast majority (if not all) of our rig contracts, as well as in many (if not all) of our gas contracts. We have it in most of our gas contracts, whether it is the CPI index or the FERC Index and our liquids. Inflationary increases in costs will not harm us, but we’ll still benefit.

Reason #4: Strong Current Cash Flow and Distributions

One of the main reasons tech stocks have crashed so badly in the past year was rising inflation. This is because companies that aren’t profitable or pay high dividends face increasing inflation. Because future cash flows are devalued to the present when calculating the net value of an investment, this is why tech stocks have crashed so hard. The discount rate used is usually higher for higher interest rates and inflation rates. This means that cash flows that are expected to be received in a future well are much less valuable than cash flows that are expected to be received in a near future.

ET is, however, the epitome today of strong cash flow and high distribution payouts for unitholders. It boasts a 19.2% distributable (or “DCF”) yield at the current price and a forward distribution yield in excess of 6.73%. Management’s management is even more appealing. ObservationsThese distribution increases would continue for the next quarters, until the annualized rate of $1.22 is reached. This would result in a 10.5% return on the current unit price. ET’s intrinsic value, with its promise to massive cash flow today, is therefore more resilient to rising inflation and interest rate than other investment options on the market today.

Reason #5: A Margin of Safety is provided by a cheap valuation

Last, but certainly not least, ET remains undervalued relative to its history and relative to investment-grade peers.

Its current forward EV/EBITDA of 8.22x is significantly lower than its 5. year average of 9.32x, and also lower than peers such as MPLX (8.02).MPLX) (9.63x), Magellan Midstream Partners (MMPEnterprise Products Partners (11.05x)EPD) (9.74x), and Enbridge (ENB) (13.20x).

As such, it is protected from rising interest rates that could cause yield expansion and multiple compression in large parts of the stock market.

There are risks

The bull case for ET is quite clear-cut and compelling in our opinion, but there are risks.

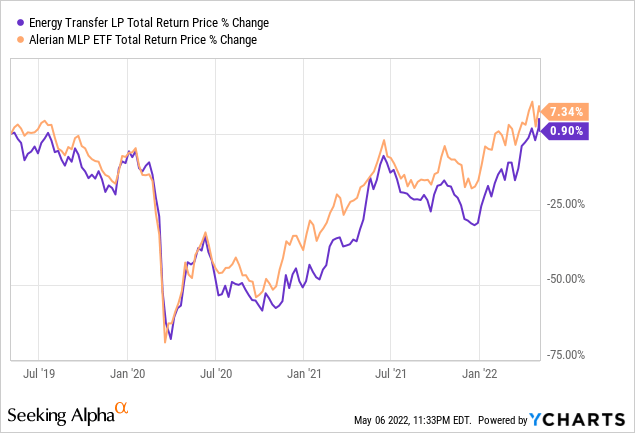

First and foremost, ET has a poor track-record of generating unitholder return. Despite the fact that Chairman and founder Kelcy Warren has a large number of units and adds to it regularly, the common equity unit total returns have been below the midstream sector.AMLP) in recent years:

This is largely due in part to poorly executed acquisitions and growth plans that have generated negative headlines for both the partnership as well as eroding returns of invested capital.

Units also saw a huge 50% quarterly distribution cut in 2020 due to the fact that the balance sheet was too leveraged from heavy capital spending and low returns.

Mr. Warren’s 2021 plan has raised concerns that management might abandon its current aggressive approach to paying down debt and growing distribution. Comment that:

I would like to buy someone

Referring to a chemicals and polymers business. Although such a transaction could prove to be accretive for investors it is not a good track record and investors are concerned that ET could become yet another low-leverage, high yielding reliable income growth investment.

Concerns about the ET MLP structure and the hydrocarbon energy industry continue to weigh on unit prices. The partnership is now issuing a K1 tax form to unitholders every tax year. This forms is in addition to the growing aversion of unitholders to investing in hydrocarbons. meteoric riseESG investing in the United States and the perception that the demand for hydrocarbons will drop substantially as the world electrifies, there is a real flight capital from the midstream MLP industry that has left multiples very low. ET has been especially hard hit by ESG investing in the United States. This is due to Warren’s close relationship and friendship with prominent Republican politicians, such as Donald Trump Rick PerryET’s many confrontations with environmentalists and Native American activists groups over its pipeline projects.

Investor Takeaway

ET is not a risk-free investment. It has had a turbulent past. It appears to be poised to continue crushing market in current high inflation conditions due to its bullish energy environment, its increasingly lean business model and inflation-linked contracts.