“They” tried to rally equity on Friday morning. They really tried. Stocks, including Apple (AAPL), traded “in the green” for about half an hour after the opening bell. That was it. The day was over. The beating was constant for the last six hours of the regular session. It only increased as the weekend neared. Two days. It was enough to cool the beast.

Amazon’s (AMZN’s) first quarter loss in seven years was last week. This was on top of the firm’s slowest growth in revenue ever. The last week saw what appeared to be a positive quarter for Apple, but also a warning sign from the largest consumer electronics firm ever. Warning that Covid-related shut downs in China could cause revenue loss of up to $8B. Oh joy.

There’s more. There are many more. There is more.

However, domestic factors might have been the primary catalysts. The FOMC meets this Wednesday and will decide on the monetary policy by this Wednesday. As last week, March’s new home sales disappointed, March’s employment costs rose well above expectations, April consumer confidence sank, and March Personal Income was absolutely trounced. This is March’s second consecutive month of absolute troubling. This indicated a continuation in the four quarter streak that has seen a decrease in discretionary income over the last week’s first estimate for US Q1 GDP “growth”.

Many economists attempted downplaying the US Q1 GDP report last week. This was despite the fact that the consensus of Wall Street economists was at +1.1% while the Atlanta Fed’s GDPNow model was at +0.4%. Can we really trust any group’s reaction to that report? They do this because it is what they do. They as a whole… failed to perform their main occupational function. This suggests that at least some Wall Street economists might be copying each other’s work. They blamed a lack of inventory building for the problem, but were unaware that inventory building had almost exclusively supported H2 2021’s economic growth.

It is true that public spending at all levels of government contracted in the first quarter. This trend is likely to reverse this quarter. However, it is clear to me that the need to eliminate helicopter money is having an effect on public spending. This means that some people are spending money they do not have to in order to maintain their household standards of living. This is happening at the same time that household costs and the cost of running a business on debt are about to explode… just like the “sloshy” excess liquidity is about get less sloshy every month.

On Wednesday, The Beast checks in. Two days later, April Jobs Day. Wage growth and job creation are impossible to match the year-over-year consumer inflation rate. It’s all just peachy. Building inventory… 4eva

Equities

I know you already know some. Let’s talk about it. Let it sink in. We are now more aware of how “risky” the mood is as valuations fall in an effort to find the right level as monetary conditions tighten. The Nasdaq Composite fell 3.93% last Wednesday, making it -21.16% so far in the year, as well 26.01% from its November high. The Nasdaq Composite produced 13.3% in April alone, making this the worst month for the index since Oct 2008. The S&P 500 has lost 3.27% over five days, which makes it 13.31% lower for 2022. The S&P 500 is now down -14.25% from January’s high.

The worst part of Friday’s beatdown was that the two major large capital equity indexes closed at session lows, and undercut lows set earlier in week. The Nasdaq Composite also undercut the March 2021 lows as well as those of February and March this year. Friday actually saw the Nasdaq Composite slip back to December 2020. That’s right. All of the Nasdaq magic has been repriced.

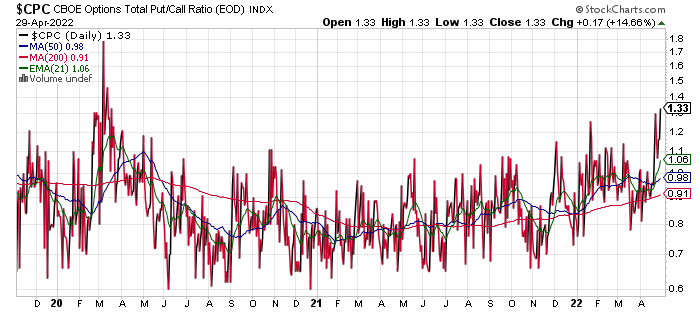

Readers will notice that the CBOE Options Total Call/Put Ratio ended Friday at levels never seen since March 2020.

All 11 SPDR sector-select SPDR SPDR ETFs ended last week in red. Ten of the 11 sector SPDRs closed lower by 1% or more. Materials (XLB), however, did better at -0.86%. Eighteen sectors saw a drop of 2% or greater, while six of the eleven gave up 3%+ and four gave up 4%+. The Consumer Discretionaries and the REITs (XLRE), which were down 7.36% & 5.61% respectively, led the meltdown over the past five days.

Bottom Line

China’s Covid policy will continue slowing its manufacturing base and its ability to operate its seaports. The war in Europe, which includes European and global actions taken by the European Union to slow Russian aggression, will continue to limit world supplies of energy and agricultural commodities. There is nothing we can do, monetarily, to change these conditions. The exception being the US multinational corporations, which are now realizing that they must shorten their supply chains. (As if these past two-plus year had not already taught us that lesson.

All messages, subtle and not so subtle, were sent to the US financial market to signal the possibility of aggressive increases in short-term to short-term interest rates. This will be accompanied by a near equal reduction in central bank balance sheet holdings. In such an environment, where do equity prices belong?

FactSet reports that 55% of the S&P 500 have already reported their first quarter results. 80% of those companies have exceeded earnings expectations, while 72% beat sales. The current (blended), rate of earnings growth for this quarter is 7.1%. This is an increase of 6.6% from one week ago but still the slowest growth rate since 2020. The quarter’s revenue growth rate is 12.2%, up from 11.1% the week before. These numbers aren’t terrible. It’s not about the numbers, but what companies say during earnings calls about supply chain limitations, inflation, rising costs of doing business. From 7% a week ago, earnings growth expectations for Q2 are now at +5.5%.

The S&P 500 traded last week at 18.1x 12 month forward-looking earnings, which is lower than the average of 18.6x over the past five months. It is important to understand that the entire five-year window was a window that included only fiscal and monetary conditions that were at most “accommodative” but possibly quite perverse in the upward bias experienced in risk asset discovery. The 10.9 times average forward-looking PE for the S&P 500 over 10 years (still using FactSet) is 16.9 Is this the direction US equities are heading? Is this low enough? Is it too high? The conditions for price discovery are so distorted that no one knows how to price the purity of the market. All hail purity. As if it were possible to find out.

Trend Identification

Each new low in the indexes represents both a setback and an opportunity. There will be a change in trend. The trend is currently lower. There will be rallies. Some will be aggressive. All that is fine and dandy is tradable. To see a change in trend, any rally must be confirmed. Picking bottoms is like gambling without confirmation. Technically, both the S&P 500 Index and Nasdaq Composite are close to being oversold. (Honestly, they aren’t there yet. It doesn’t make anything cheap just because it is cheaper than it was before. It doesn’t matter if something is expensive or cheap in one environment.

I think there could be an unexpected rally in the market this week. There will be lots of news. There will be plenty of market-moving keywords. Adapt. The algorithms will hunt. Instead, hunt them. If you are the wind, they will not beat you on a consistent basis. Be a wall. You might be able to make a stand somewhere and another… You might even get nailed. This environment favors trading over investing (with the exception for professional short-sellers which is a very difficult skill. Until we witness a change in trend, it is followed up by a volume-based confirmation. Fear. No emotion. Your enemy has no fear. No emotion. Learn to fight in this war. The last war is over.

Economics(All Times Eastern).

09:45 – Markit Manufacturing (Aprrev): Flashed 59.7.

10:00 – ISM Manufacturing Index (Apr). Expecting 57.7, last 57.1

10:00 – Construction Spending (Mar). Expect 0.8% m/m, Last 0.5% m/m.

The Fed(All Times Eastern).

Fed Blackout Period.

Highlights of Today’s Earnings (Consensus EPS Expectations)

Before the Open: (MCO, 2.89)

After the Close:

(Apple and Amazon are two of the holdings in this category. Action Alerts PLUS members club. Want to be notified when AAP buys or sellers these stocks? Learn more.)

Receive an email alert whenever I write an Article for Real Money. Click the “+Follow” link next to my name to access this article.