The Federal Reserve is expected increase its benchmark interest rate several times this fiscal year in an effort to curb stubbornly high inflation. Expectations range from four to seven increases this year. Banks and lenders will increase borrowing costs when the Fed raises its benchmark rate. Consumer spending and demand decreases when mortgages, credit cards, or other debt are more expensive. Businesses also have to pay more for their operations. Investors may be able to see more value in bonds, certificates or deposit, and other assets that are less risky than stocks if interest rates rise.

Why Does the Stock Market Care About?

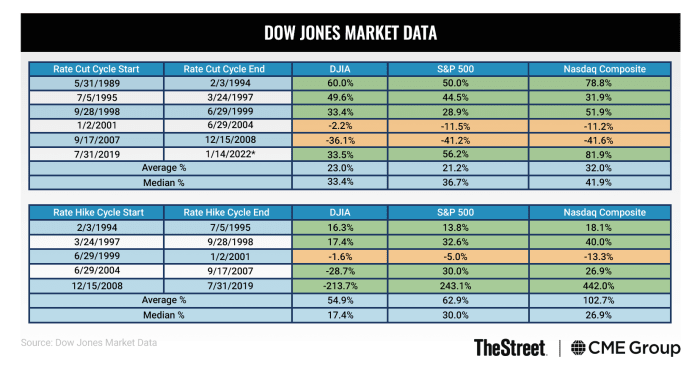

First, let’s analyze how stocks historically perform when interest rates rise. Are higher interest rates always associated with a weaker stock-market? It has been proven that increasing rates are good for stocks. In the past, the S&P 500 has shown resilience around Fed hikes. According to Dow Jones, the average return of the Dow Jones Industrial Average over a Fed-rate hike period is almost 55%. The average return of the S&P 500 is a gain in 62.9%, while the Nasdaq Composite has had a positive return in excess of 102.7%. These numbers may be exaggerated because of the huge gains that occurred between December 2008 to July 2019.

The market usually cares about two things. One is the possibility that the U.S. will slow down and the second is the prospect that bonds or other investments might become more attractive than stocks. Rates are rising to slow down, not stop, economic growth. A strong economy can be very beneficial for companies, but tightening monetary policy will increase economic activity.

Scroll down to continue

How can investors navigate the rising rate environment? Financial conditions can be difficult for highly profitable and well-capitalized businesses. This is why historically, they perform best when they are tightening. A strong economy can help lift cyclical sectors like materials, industrials and energy. The Fed’s hiking cycles usually begin at the same time as a strong economy. Financial stocks also tend to outperform. Goldman Sachs reports that strong balance sheet stocks outperformed weaker balance sheets stocks by 24% in a Fed hiking cycle.

Investors may be more interested in bonds, certificates or deposit, and other assets that are less risky than stocks if rates rise. History shows a different picture.