[ad_1]

Fossil fuel companies have access to an obscure legal tool that could jeopardize worldwide efforts to protect the climate, and they’re starting to use it. Countries that continue to push for those efforts could be hit with huge losses.

Over the last 50 years, more than 50 countries have signed There are thousands of treatiesThese treaties protect foreign investors against government actions. These treaties are similar to contracts between national governments and are meant to encourage investors to bring in projects that promise local jobs and new technologies.

However, these agreements are a step towards reducing the impact of fossil fuels on climate change.

The treaties permit investors to sue governments in order to receive compensation. This process is known as investor-state dispute settlementISDS stands for International Standard Declaration of Safety and Dangerous Sites. Investors could use ISDS clauses as a way to demand compensation for government actions to limit fossil fuels. This could include cancelling pipelines or denying drilling permits. TC Energy, a Canadian firm, is seeking compensation. More than US$15 trillion over U.S. President Joe Biden’s cancellation of the Keystone XL Pipeline.

In a study published in Science May 5, 2022 we estimated that The $340 billion could be borne by countries.There are legal and financial consequences for cancelling fossil fuel projects that are covered by treaties with ISDS clauses.

That’s more than countries worldwide put into climate adaptation and mitigation measures combined in Fiscal year 2019, and it doesn’t include the risks of phasing out coal investments or canceling fossil fuel infrastructure projects, like pipelines and liquefied natural gas terminals. This means that the money that countries might have spent to build a low carbon future could be used to fund industries that are already in decline. Climate change has been knowingly fueled, severely jeopardizing countries’ capacity to propel the green energy transition forward.

Massive potential payouts

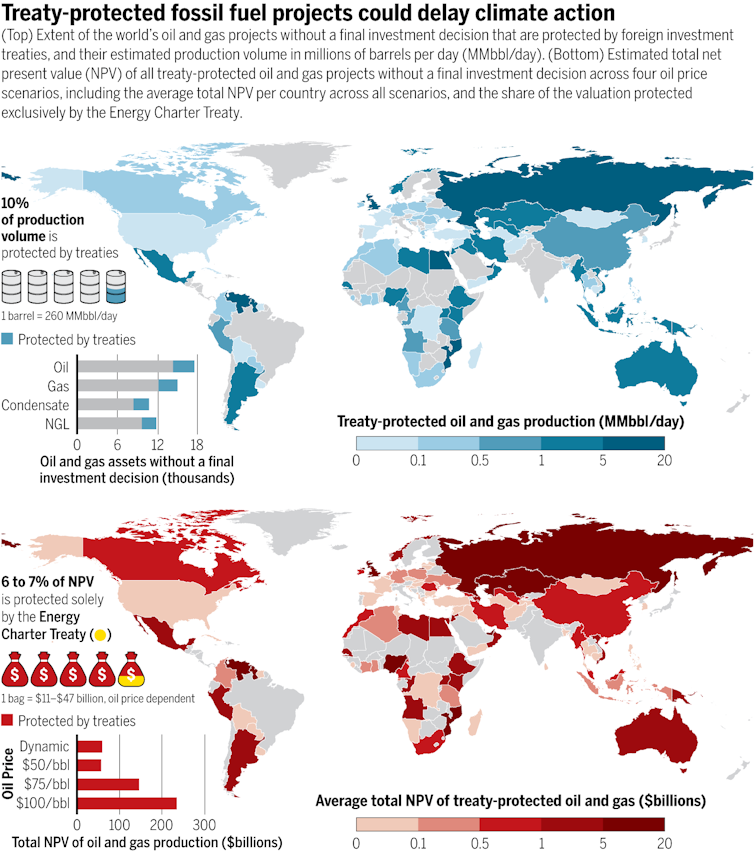

Of the world’s 55,206 upstream oil and gas projects that are in the early stages of development, we identified 10,506 projects – 19% of the total – that were protected by 334 treaties providing access to ISDS.

This number could be higher. Due to limited data, we could only identify the headquarters and not the corporate structures of the investment companies. We also know that Law firms advise clients in this industryStructure investments to ensure ISDS access through processes such subsidiary use in countries with treaty protections.

Tienhaara, et al., Science, 2022

We found that depending on future oil and gas prices, the The total net present value of these projectsIt is expected that it will reach $60 billion to $234 trillion. Foreign investors could sue to receive financial compensation if countries cancel these projects.

This would place several low- and medium-income countries at serious risk. Mozambique and Guyana could each suffer losses of over $20 billion from ISDS claims.

Countries that cancel oil and gas projects in the development phase but not yet producing are at greater risk if they do so. We found that around 12% of those projects are protected by investment agreements worldwide. Investors could sue for $32 billion-$106 billion.

Annulling projects that have been approved This could be extremely riskyFor countries like Kazakhstan, which could suffer losses of $6 billion to $18billion, and Indonesia with $3 billion to 4 billion at risk,

There could be more claims if you cancel coal investments or fossil fuel infrastructure projects such as pipelines and liquefied gas terminals.

Countries already feel regulatory chill

There have been At least 231 ISDS-related casesSo far, it has not involved fossil fuels. Just the threat of massive payouts to investors could cause many countries to delay climate mitigation policies, causing a so-called “regulatory chill.”

Both Denmark and New ZealandFor example, it seems that a number of companies have specifically designed their plans for fossil fuel phaseout to minimize their exposure towards ISDS. SomeClimate policy ExpertsMany have suggested that Denmark may be considering 2050 as the end of oil and gas production to avoid conflicts with existing exploration license holders.

New Zealand banned any new offshore oil exploration for 2018, but did not cancel any existing agreements. The climate minister acknowledged the need for a more aggressive strategy. “would have run afoul of investor-state settlements.” France revises a draft lawBy 2040, ban fossil fuel extraction and allow oil exploitation permits to be renewed after the. Vermilion, a Canadian companyThreatened to launch an ISDS lawsuit

Secure the green energy transition

These alarming findings can be avoided by countries with the right legal and financial strategies.

The Organization for Economic Cooperation and Development Currently, we are discussing proposalsThe future of investment treaties

One simple way to do this is for the countries to either terminate or withdraw from the treaties. Some officials have Be concernedAlthough there are unknown effects of unilaterally ending investment agreements, other countries have already done it. Economic consequences with little or no real economic consequence.

For more complex trade agreements countries can negotiate to eliminate ISDS provisions. Did when they were replacedThe North American Free Trade Agreement with Mexico-Canada.

Additional challenges stem from “sunset clauses” that bind countries for a decade or more after they have withdrawn from some treaties. This is the case with Italy. Withdrew from Energy Charter Treaty2016 It is Currently stuckIn an ongoing ISDS case, Rockhopper, a U.K. company, over a ban for coastal oil drilling.

The Energy Charter Treaty is a special agreement covering the energy sector that has been the largest contributor to global ISDS threats in our dataset. Many European countries are Currently in considerationHow to avoid the same fate that Italy and decide whether to leave the treaty. If all countries parties to a treaty are able to Together, we can withdrawThey could Together we can sidestepThe sunset clause is reached through mutual agreement.

The global transition

Climate change mitigation is expensive. Actions GovernmentsBoth the private and public sectors are Both are requiredTo slow down global warming and to keep it at bay From fueling more devastating disasters.

In the end, the question is who will pay – and be paid – in the global energy transition. We believe it would be counterproductive at best to divert vital public finance from mitigation and adaptation efforts to fossil fuel industry investors, whose products created the problem.

[Like what you’ve read? Want more? Sign up for The Conversation’s daily newsletter.]