Dan Morehead, the CEO of cryptocurrency-focused hedge fund Pantera Capital has said the ongoing correlation between stocks and cryptocurrencies will be short-lived.

Morehead, through the company Blockchain Letter Because cryptocurrency is an asset class that stands out against rising interest rates, it is likely that the sector of cryptocurrency will grow at a faster pace.

According to the executive, the correlation was due to investors taking the tapering measures of the Federal Reserve.

He acknowledged that crypto is not always cash-oriented, but it acts like gold, gaining an edge over traditional assets influenced primarily by interest rates.

Furthermore, the hedge fund stated that the ability for cryptocurrencies to move away from equities would be due to the sector’s relatively small market.

It’s like gold. It can behave in a very different way from interest-rate-oriented products. I think when all’s said and done, investors will be given a choice: they have to invest in something, and if rates are rising, blockchain is going to be the most relatively attractive, the executive said.

He also stated that the correlation would begin to decouple in the next weeks.

Both the equity and cryptocurrency markets experienced high volatility at the beginning of 2018, with digital assets showing a large correlation to tech stocks.

Despite the correlation, assets like Bitcoin have performed better that traditional asset classes. According to Finbold’s previous report, as of February 13, Bitcoin’s 30-day ROI had outperformed the top six tech stocks by an average return of 12.24%.

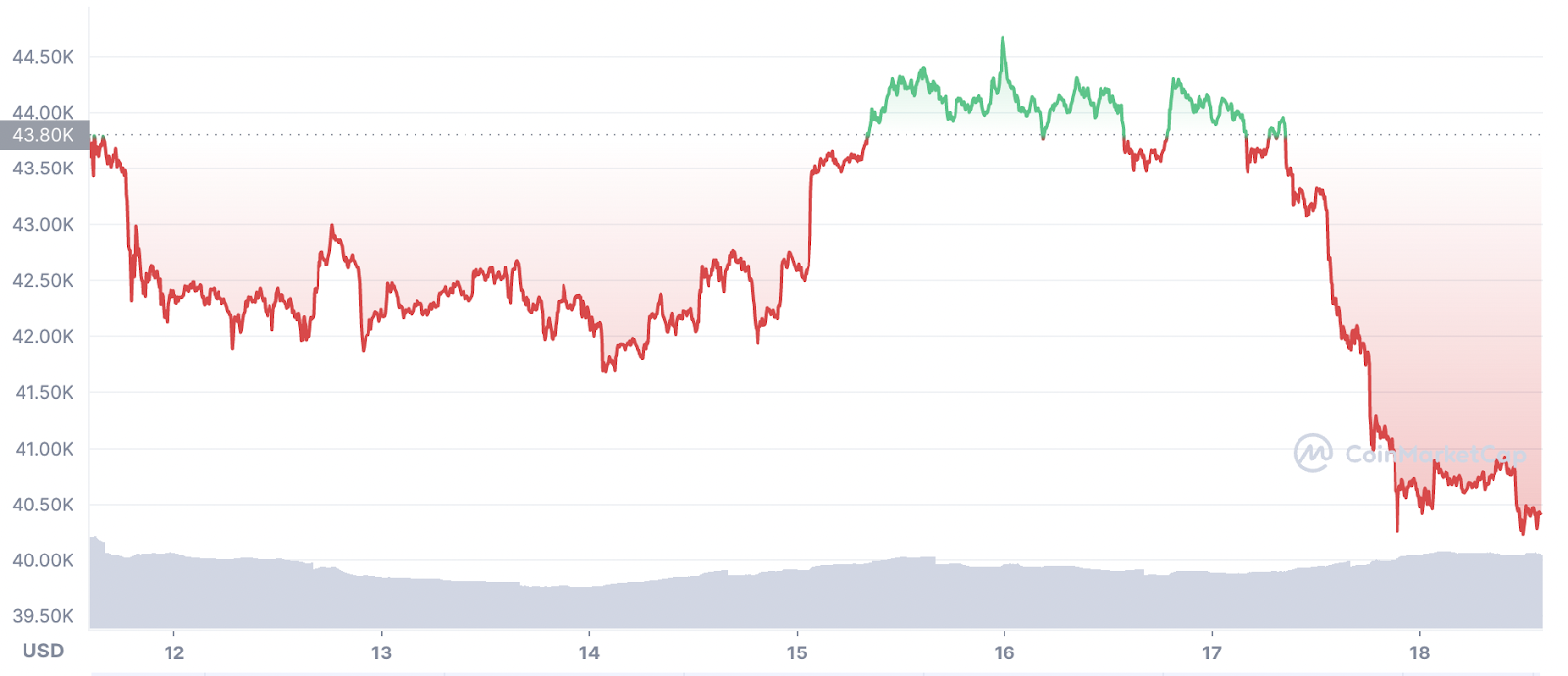

Bitcoin was trading at $44,400 as of press time, down almost 8% over the last seven days.

Morehead maintained, however, that Bitcoin would thrive in an environment of interest rates increases.

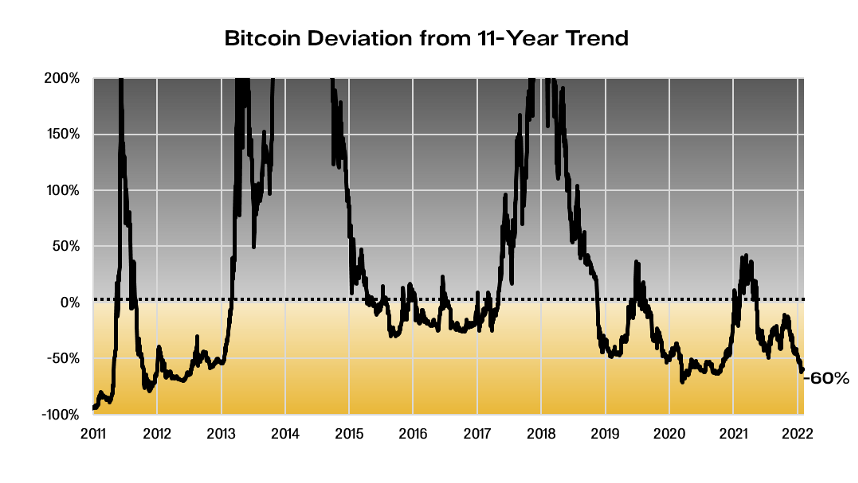

Bitcoin trading below the 11 year trend

The company’s analysis also indicated that Bitcoin is currently trading 60% below its 11-year trend. According to him, the trend indicates that the odds of Bitcoin trading at an extreme level is not likely to change and that the markets will rebound.

Morehead also identified some of future drivers for interest cryptocurrency aside from rising interest rates. He pointed out the U.S. Bond Bubble, which he predicted would burst shortly.

The CEO provided an interesting perspective on the declining crypto price by suggesting that crypto holders might be selling different digital assets to pay tax.

The hedge fund found that cryptocurrency capital gains of $1.4 trillion were recorded in 2021. This directly contributed to the 2022 market correction.