[ad_1]

Better information leads to better decisions – this is the idea behind a regulatory device known as “Disclosure required.” Mandated disclosures are all around you, from calorie counts on fast food restaurant menus to conversations with doctors around informed consent.

The U.S. Securities and Exchange Commission’s proposal to expand these ideas to the climate impacts of U.S.-listed companies may be the most significant experiment in mandated disclosure. Climate disclosure rules would require publicly traded companies that disclose information about their emissions and how it manages climate risks to investors.

Companies are facing climate change-related risks, and it is easy to spot them. ExxonMobilThis company produces and sells fossil-fuel products that contribute to global heating. hidden vulnerabilities existFor businesses throughout the U.S.

Largely as a result of Investors are desperate for more informationClimate risks As well as pressureFrom green GroupsAccording to them, disclosure is key to climate-conscious investing. Gary Gensler, Chair of the SEC, has been announcedThe commission would use its statutory authority in 2021. Climate-related disclosures are required.

The SEC Get started nowTo examine proposals for climate-risk disclosure regulations at its March 21, 20,22, meeting.

We are law students. Work on legal issues involving business and regulation. Here’s what you need to know about climate disclosures and some of the challenges the SEC faces in adopting them.

What investors want to know

Investor pressure comes from two directions.

First, investors may want to avoid companies that are affected by climate change. The company’s products may be Regulated in the futureBecause of their effect on the climate, or its supply chain may become more expensive over time. Investors want to know which businesses are able to adapt to changing circumstances and maintain profitability.

Second, many investors are interested in ESG investing, which involves assessing companies’ commitments to environmental, social and governance factors. Today, ESG investingAccounts US$17.1 Trillion — or 1 in 3 dollars — of the total U.S. assets under professional management. The SEC’s challenge is to ensure that claims about the sustainability of a company do not become untrue. Based on reality.

Continue reading:

ESG investing has a blindspot that makes it difficult to believe the industry’s $35 trillion sustainability promises. Supply chains

A flood of voluntary disclosure has resulted from the trend towards ESG investment. 90% of companiesIn the S&P 500Publishing voluntary reports that provide statistics about things like carbon emissions or how much renewable energy they use is encouraged.

Some large investors require disclosure. For example, BlackRockMultinational asset manager Managing Global Assets with $10 Trillion under its Control, requires companies it invests to disclose certain climate information. The United KingdomClimate disclosure will be required starting in April 2022. European UnionThere are reporting rules in place.

The U.S. has taken a long time to establish mandatory climate disclosure requirements. Public companies are only subject to a more general requirement. Legal standardThey did not materially mislead the investors. The SEC Publication of guidanceIn 2010, to encourage climate disclosures It was not enforcedHowever, they failed to prompt standard disclosures.

Rule-bending and the effectiveness of disclosure

Research on the wider application of mandated disclosure, such is for home mortgage lending Labeling consumer productsThis shows that it is difficult to craft effective disclosure regulations.

One reason is that companies can evade disclosing relevant information while still adhering to the letter of law. These “Rule-bending” can be very creative. Take the example of a New York City restaurant that was subjected to a health inspection grading regulation. Disguise its “B” rating by simply adding “EST” to its display of its grade. Disclosure regulations can also fail when they don’t effectively communicate valuable information.

A Study of one type of climate disclosure – emissions labels on consumer products – found mixed evidence as to whether consumers altered their behavior in response. Rule-bending is possible human tendenciesTo reduce or filter out warnings, provide an avalanche information that confuses or overwhelms the intended recipient.

Expect court challenges

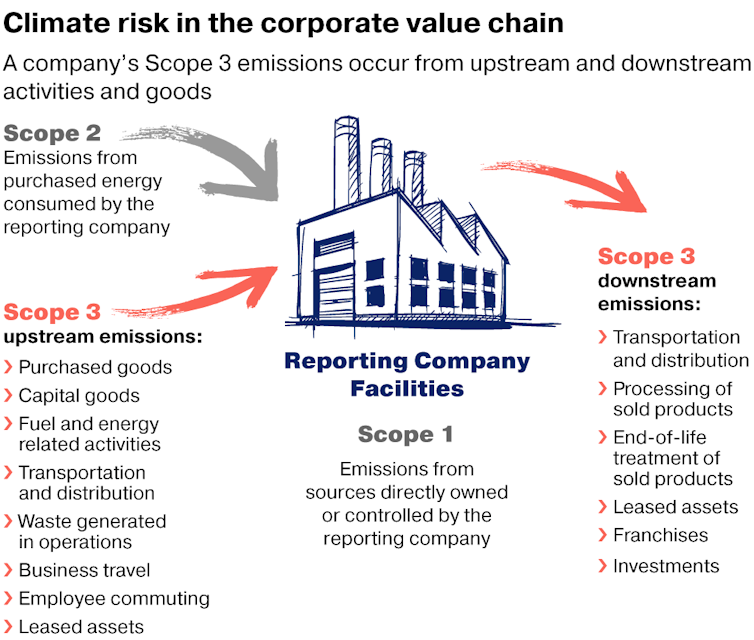

One challenge the SEC has grappled with is whether it has statutory authority to require companies to disclose their “Scope 3” Emissions. These are emissions that a company doesn’t directly control, such as emissions from the use of its products or emissions in its supply chain.

A company like Amazon may have extensive upstream Scope 3 emissions in its suppliers’ transportation networks. General Motors would have significant downstream emissions when its gas-powered vehicles are driven.

Chester Hawkin/Center for American Progress

The SEC’s three Democratic commissioners, who make up a majority of the commission, According to reports, they have split. on whether certain Scope 3 emissions can be viewed as “Material” to investors and therefore subject to disclosure.

“Material” is definedas information that a reasonable person would consider essential in making an investment choice.

Some climate disclosures are being criticized by some, including Many Republican state general attorneysAccording to this, the SEC does not have the authority to require financial disclosures. Missouri’s attorney general wrote that requiring climate reporting would impose “Large administrative and cost-intensive burdens” on publicly traded companies. A group of senators suggested that assets related to greenhouse gases would be added to the stock exchange. Transfer to private companies. West Virginia’s attorney general Threatened to sue SEC.

There would be a range of costs associated with disclosure. Some companies already monitor their emissions closely. Scope 3 emissions would result in high costs for many others. An example is an oil company. All vehicles that use its fuel must be able to measure their emissions.

The Administrative Procedure Act permits courts to invalidate SEC rules. These are deemed arbitrary and capriciousBecause the agency did not provide sufficient justification to choose the proposal over other options. This risk is well known to the SEC. A prior oil-and-gas extraction disclosure rule invalidatedA court ruled 2013 that it was arbitrary, capricious.

Be cautious

The SEC’s forthcoming climate risk disclosure rule will not be the final effort to use information to shape the private sector’s response to climate change.

These future moves will be affected by the actions taken by the SEC now. It is no surprise that it is taking its time, and proceeding cautiously.

This article was last updated March 10, 2022 with the SEC listing climate disclosure rule on its March 21, agenda.

[More than 150,000 readers get one of The Conversation’s informative newsletters. Join the list today.]

[ad_2]