JHVEPhoto/iStock Editorial via Getty Images

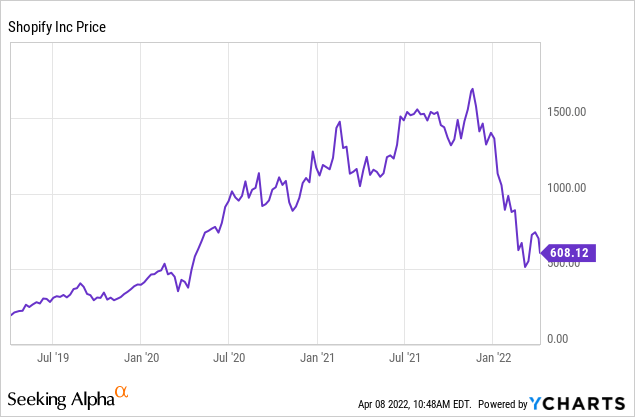

Shopify (as at the time of writing)NYSE:SHOP) is down more than 65% from its all-time high. You might have missed it if you didn’t blink. It took just 3 months for the damage started to take place.

WeWe live in what Tom Lee refers to as a treacherous stock market and are far from solving the major macro issues of the day. The natural question about Shopify shares is, how far can they fall? A fellow Seeking Alpha contributor suggested that Shopify shares will be cut again. dropifyBelow $400 This is due to a still high valuation multiple as well as revenue estimates revisions to the upside. I believe that the recent price decline reduces risk and increases potential future returns. This makes shares more attractive than ever before. Although I’m not able to predict short-term price movements I believe the current negative market surrounding “long-duration” assets offers a good buying opportunity for many growth stocks, especially Shopify.

Shopify Stock: There Are Concerns In the Short Term

Shopify is a stock that has been made a victim by its own success. It’s a classic “pandemic” stock. It has experienced more than quintupling in the years since the pandemic began, only to crash down again. Shopify’s growth is slowing and this is what is troubling shareholders.

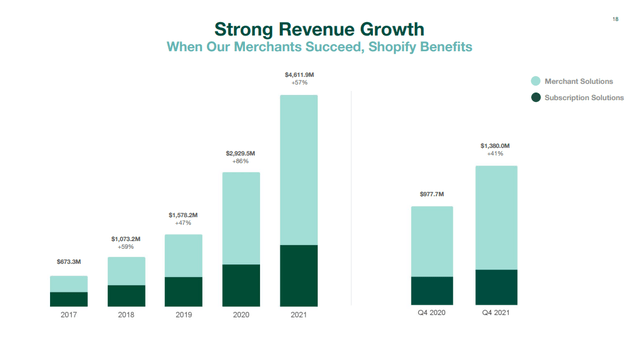

Q4 2021 Shopify Investor Presentation

In the chart above, you can clearly see the tailwinds that COVID provided to businesses in 2020 and 2021. You can also see the slowdown through 2021. Shopify began the year 2021 at 110% yoy growth, and ended it at 41%. The current revenue estimates for 2022 are between $5.7 billion to $6.5 billion with a consensus estimate at $6.1 billion. This would mean a growth rate of between 27% to 41%. Although I am quite confident in predicting SaaS companies easily surpassing analysts’ expectations, Shopify’s case is not so good. Shopify’s money comes mainly from non-recurring merchant solutions, but also because of existing headwinds or tough comparables.

Management has not issued revenue guidance since the COVID era. However, they did give a cautionary warning about their 2022 outlook. Last earnings release:

We anticipate: Three factors are responsible for the lower year-over-year revenue growth in the first quarter 2022 and the highest in the fourth quarter 2022. First, we don’t expect the COVID-triggered acceleration ecommerce in first half 2021 from lockdowns government stimulus to be repeated in the first quarter of 2022. Second, the terms we have changed with theme developers and apps result in two changes from last year’s quarter. Shopify’s rev-share on partners’ first one million dollars of revenue each resets on January 1, and Shopify’s shift from gross to net revenue recognition due to our revised contract terms. These terms, which were not implemented until the second half last year, will have a negative impact on Subscriptions Solutions revenue for the first half 2022, especially the first quarter.

You can see the grim picture for Shopify’s 2022.

The scope of the business is expanding beyond 2022’s top-line growth. Investors should also be aware of Shopify’s recent decision by Shopify to double down on its Shopify Fulfillment Network. This was discussed in detail during the last earnings call. Shopify management wants to own more fulfillment centers. This will enable Shopify’s ability to deliver packages in less than two days to more than 90% of the U.S. residents. Although this sounds exciting for merchants and investors, it raises concerns about how the move will affect profitability and cash flow. Management also noted its plans to invest all gross profit dollars back in the business, the margin profile long-term, and whether Shopify is going beyond its core competencies (execution risk). This move, while potentially very beneficial for the business, is not well-received by the market, especially in a market that is looking to stabilize and earn.

Moreover, Apple’s AAPL (a bit less talked about by investors) mobile advertising changesShopify could be affected in an indirect way, most likely negatively. Management noted in the Q3 2021 earnings conference that “…”Apple’s IDFA changes are more difficult to spot“. One quarter of a year earlier, they admitted that “.It will decrease the effectiveness of some ads“, but it also added that it would also further “Incentivize merchants in search of new ways and multiple ways for buyers to connect, on top of increasing prices for ads“. The main concern is that Shopify’s GMV and, by extension, revenue and profits, are directly affected if merchants’ ads are less effective. Stratechery’s Ben Thompson Has written extensivelyShopify may end up offering advertising services, given the fact that Shopify is heavily dependent on Facebook (FB) in this regard. These ad changes will present challenges to Shopify’s businesses, creating more problems for investors. It will be difficult to determine which part of the revenue deceleration is due to COVID normalization (which it totally fine), and how much is due to the decreased efficacy Facebook ads (which would make things a little more worrying)..

Shopify’s Business Is Still Strong

I know many investors who would not stop their analysis at that point. An out-of-favour stock in a tough marketplace, decelerating economic growth, uncertain outlook and compressing margins. There is also execution risk. Why would you want this?

Shopify is a high-quality business with a lot of potential. Let me highlight some of the characteristics that make Shopify a great investment.

- Shopify, which is experiencing secular growth tailwinds in entrepreneurship, should be able compound revenue growth of between 20-30% over the next ten years.

- A large and expanding addressable market (estimated at $160 million recently).

- Shopify has high flexibility: Shopify evolved from a simple ecommerce website provider to include apps, POS and Payments. Plus, shipping, capital, international expansion and Fulfillment. Shopify has many opportunities to expand its platform.

- High switching costs, network effects and brand can provide strong competitive advantages.

- Tobi Ltke is the founder. Insider ownership of nearly 10% and a high Glassdoor rating.

- Strong balance sheet, $7.77 billion in cash, $0.9 billion in loans

- High profitability in the future is indicated by medium-high gross margins of 54% and a highly scalable model.

- Strong stock performance in the past, beating the market significantly since the IPO.

Follow Hamilton Helmer’s Footsteps

Although I believe in my own analytical skills, it helps me to be reassured by other respected investors. Hamilton Helmer, a business strategist and investor, is one such investor. He is also the author of the book. 7 Powers. At the End of 2021His fund STRATEGY CAPITAL LLC had 25.75% of its portfolio in Shopify.

STRATEGY CAMPAIGN LLC Holdings as at Dec 31, 2021. (whalewisdom.com)

Strategy Capital uses a concentrated, long-only approach that is based primarily on fundamental value and extended holding times. Their main focus is to identify businesses that have high “power”, i.e. You can build long-lasting competitive advantages that result in high free cash flow generation. Helmer is a master of competitive advantages and one of the most knowledgeable people in the world on this topic. Shopify is Helmer’s largest position, which shows me that he believes in Shopify’s power and potential future returns. The fund will release its updated positions between the end Q1 2022 and mid-May 20,22. I will be closely watching to see if there are any changes to the Shopify position.

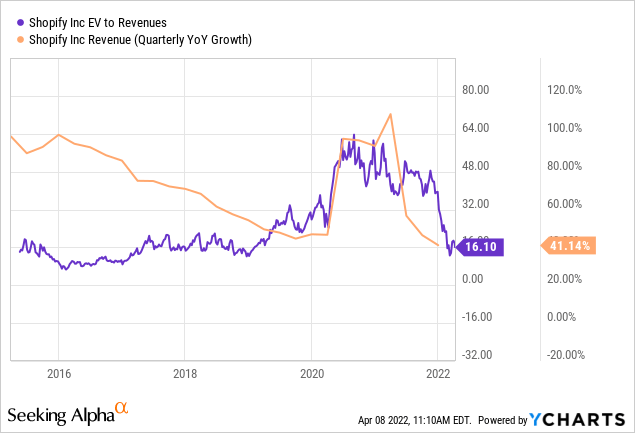

SHOP Stock Valuation has Come Down To Earth Again

Shopify is also trading in its historical multiple range of EV to revenue:

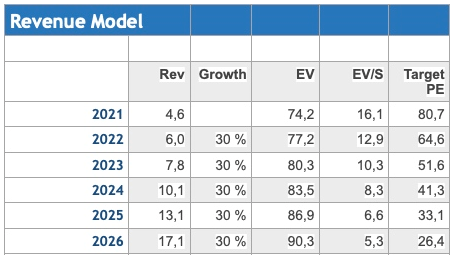

Although investors were a bit too optimistic when the stock was selling at 50 times its sales, it is now quite attractive. It is true that its growth rate has been decreasing (and will continue falling in 2022), which means that shares are still trading at historically high levels relative to their growth. However, I believe shares were undervalued for a long time after the IPO. So referring only to historical multiples can be misleading. Below is a simplified forecast. It assumes a 30% revenue growth over the next five years, a 4% annual dilution, and a 20% net margin of the target PE (or hypotheticalPE).

Author

Shopify will likely have net margins of less than 20% by 2026. They will still see plenty of opportunities for growth and investment. Shopify’s $17 billion revenue growth will not stop. I’m not saying that Shopify is trading at bargain prices. However, this could be the case in hindsight. The table above illustrates that Shopify’s valuation does not seem out of the ordinary and does not rule out future market-beating returns.

I am happy with my Shopify position of 5% and I am open to the possibility of increasing my Shopify position at these levels. I am aware that the company’s near-term outlook is not ideal and that there could be further downside to the market. I think the 65% price decline was exaggerated considering the company’s strong fundamentals. The next earnings report is due at the end of April. I expect it will be weak in terms growth and outlook. It will be interesting to observe how the market reacts to these low expectations.