By

BRUCE KAMICH

SPG,

XLRE

There are many Real MoneySubscribers have emailed me to ask about investments in light of my bearish views on 2022. Readers have asked me about the healthcare sector, real estate, and energy. This makes a lot more sense.

Let’s take a look at the charts.

Below is a daily bar chart for SPG. It can be seen that prices have risen over the past 12 months. SPG is trading below the declining 50 day moving average line, but higher than the more important and rising 200 day line. The rising 200-day line was successfully tested in January. January has a lower trading volume than December. As many traders see it as a buying opportunity, the trading volume rises when prices cross the 200-day threshold. It becomes difficult to believe that traders have stepped up to buy when volumes are increasing.

Although the On-Balance Volume (OBV) has been lower since November, it could be turning around now to the upside. An earnings beat could be the catalyst. The Moving Average Convergence divergence (MACD oscillator) is close to a cover shorts buying signal.

Below is a weekly Japanese candlestick chart from SPG. We can see that prices have been in an uptrend and have recently tested the rising 40 week moving average line. In the last three months, the weekly OBV line has been somewhat soft or stalled. In a take profit signal, the MACD oscillator is lower.

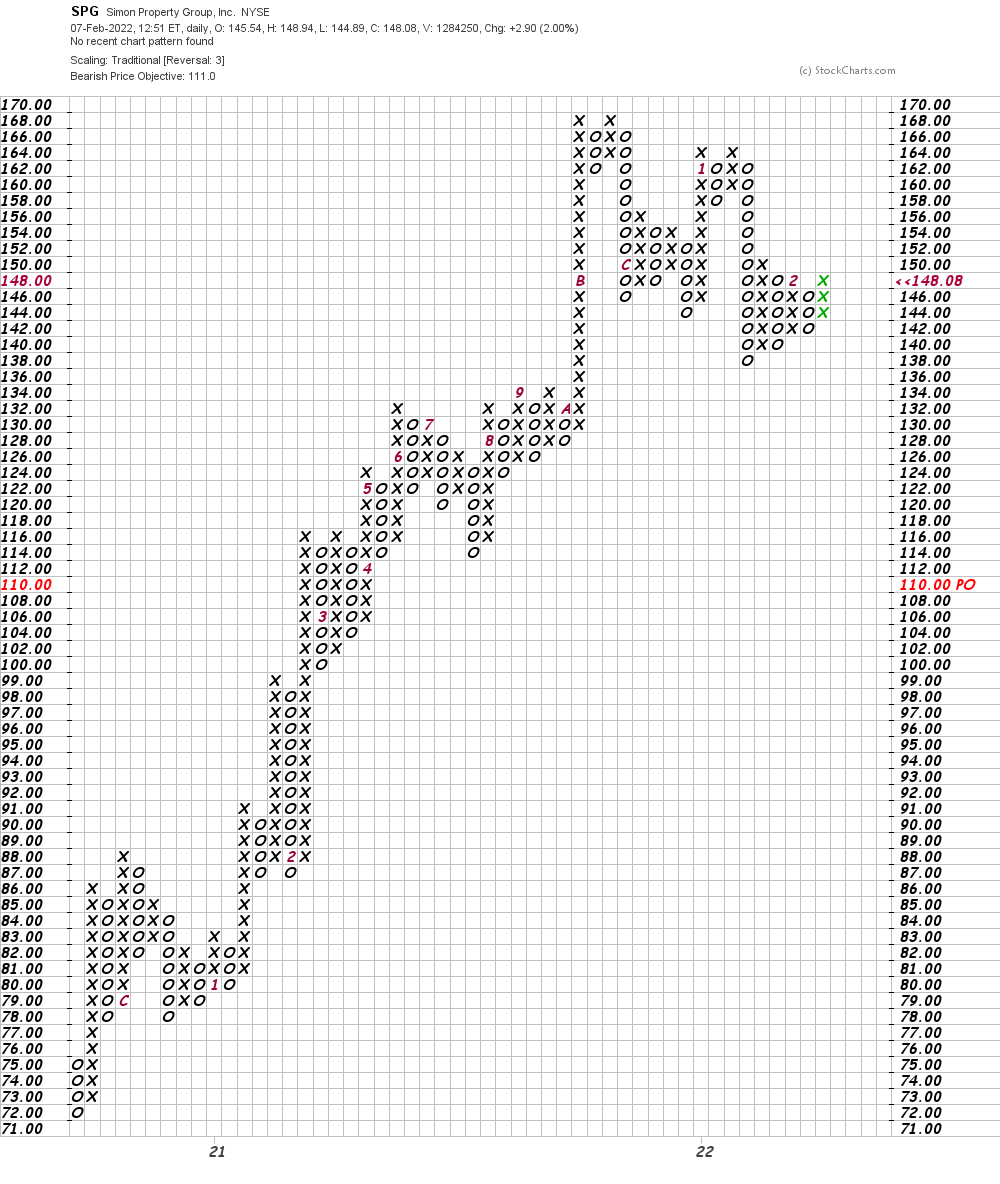

Below, you can see a potential downside target price in the $111 region in this daily Point and Table chart of SPG.

Receive an email notification whenever I write an article about Real Money. Click the “+Follow” link next to my name to access this article.

Please contact us if you have any questions Here.

Email sent

Thank you, your email to Successfully sent

Oops!

We’re sorry. We were unable to send your email. .

Please contact customer supportLet us know.

Log in or sign up to email our authors

Email Real Money’s Wall Street Pros to get more analysis and insight

Already a subscriber Login