curraheeshutter/iStock via Getty Images

Published on Value Lab 31/3/22

It’s becoming harder to find good-priced opportunities on the market, as a ‘no other’ environment sees equities being bought up despite supply side concerns being very real. industries. Stagflation is the current trend. We continue to work on Subsea 7.OTCPK:SUBCY), a stock on the Norwegian markets, that has the sort of commodity exposures we like without the excessive price tag. We give it a buy rating, despite inflationary pressures that could be fought. It has good exposure to the commodity market as it is, and will likely stay that way.

Talking About Its Markets

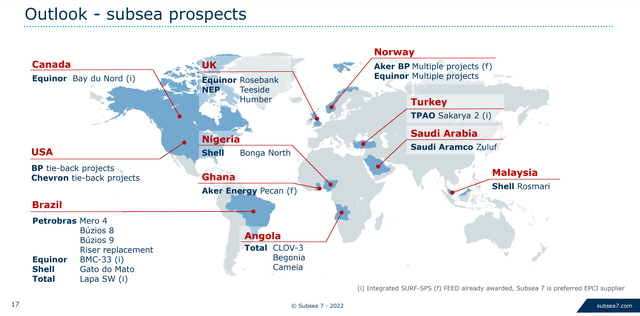

Subsea 7 performs major offshore installations, primarily in the oil and gas industry. However, they also do work for renewables. There is a strong market for offshore wind, particularly in the offshore energy sector. TechnipFMC is (FTI) the other major player in this industry. They are partnering with players such as Schlumberger, Aker BP (OTCPK;DETNF), and Equinor to build rigs for highly lucrative projects, including many in the Norwegian Continental Shelf. Svedrup and the other NCS projects are a nice bonus, but it is not surprising that the company has a lot of v.ery Global focus.

Markets |)

Subsea’s two major growth drivers are not well reflected by their price. The price has slipped slightly YTD and another with a longer-term outlook. Subsea 7 will be seeing more business because of high gas prices and the necessity for traditional byproduct gas to bottled and sold, due to Russia’s stranglehold in European supply. Subsea 7 has a longer-term outlook because gas is a more attractive commodity during the transition to renewables. The second reason to expect more developments is of course high oil prices. Even if oil costs fall due to the entry by backward players such as Iran and Venezuela, a more friendly approach towards these countries could mean more business. As globalization slows, the company may need to stay onshore. This could also be a reason for the company to reconsider the renewable transition. Geopolitical developments have made this more likely.

Finally, the company is exposed to renewable energy, particularly offshore wind developments. Companies such as rsted (OTCPK.DNNGY), are active here and have enjoyed a nice rise in stock prices over recent years due to the hopes behind these developments which have proven very profitable. The renewable unit is being CombiniertA small, listed, renewable pureplay engineering company was created with another Norwegian entity. It will hopefully be OSB-listed soon. Subsea will own more than 70% of the combined company, and shareholders of the other entity receiving shares in the pureplay company Seaway 7. Subsea will see the results of Seaway as they consolidate their control and will be able to reflect the fundamental picture. It is currently not worth it. $60 MillionSubsea holds a mere 15% of its market cap, which means that the value of Subsea is only about 15%.

A Look at FY Results and Valuation

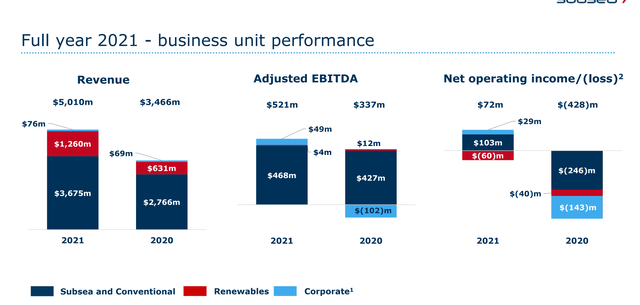

Growth has been positive for the company and has been somewhat profitable, except in the renewable division.

FY Data (Q4 2021 Pres Subsea 7

The operations of Seaway 7’s renewable division are still a profit area. As major offshore wind projects continue development, further growth is expected in revenues.

The main reason that profitability didn’t seem so favorable was because, in the process of adjusting substantial property write-downs in 2020, the corporate segment took more losses than the operating businesses. As an ongoing metric, the adjusted figures are the ones that you should follow. They do reflect issues in procurement and the Q4 is the source of the weakening profit growth.

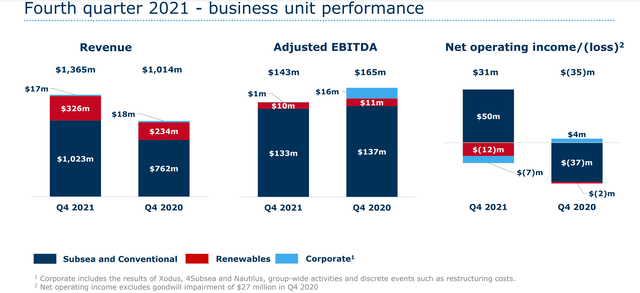

Q4 Data (Q4 2021 Pres Subsea 7

Inflation is a concern. It has led to a decline of 15% in EBITDA in Q4 YoY. The valuation provides a margin for safety, even assuming that these cost increases cannot be passed on. The company trades at a valuation of approximately $3.5 billion after accounting for minority interests, net debt, and other factors. 5x EBITDA. A well-positioned company can earn a 5x multiplier with profit growth and commodity exposures that allow for secular expansion horizons for Subsea 7.

Conclusions

Inflation is the main risk, as procurement as an engineering company poses a risk to profitable growth. With the commodity markets being what it is, and renewable accounting for 25% revenue, we don’t see why this stock should be a laggard multiple. However, oligopoly positioning helps in pricing power to avoid procurement issues. Its price has actually fallen 4% since the start of the year. We see lots of upside and rate it as a buy.