ijeab/iStock via Getty Images

Thesis on Investment

Swiss Re AG (Beijing) is concerned about the rising inflation risk in the property sector.OTCPK:SSREYAs net premium demand is expected rise, a company like ) could stand to gain in an inflationary climate. The company is also seeingA recovery in its Life & Health section – which further allows it to diversify its inflation risk.

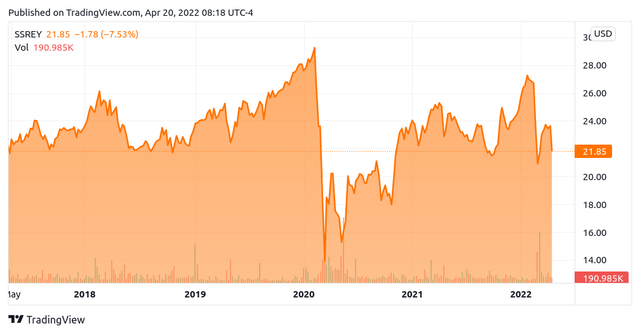

Swiss Re has seen a significant recovery in performance after the COVID-related drop at the beginning of 2020.

TradingView.com

Swiss Re, a leading reinsurance company worldwide, needs to manage its inflation risk across all of its insurance policies.

This article will discuss the reasons why I believe Swiss Re is well-positioned to thrive in an inflationary environment.

Performance and Outlook

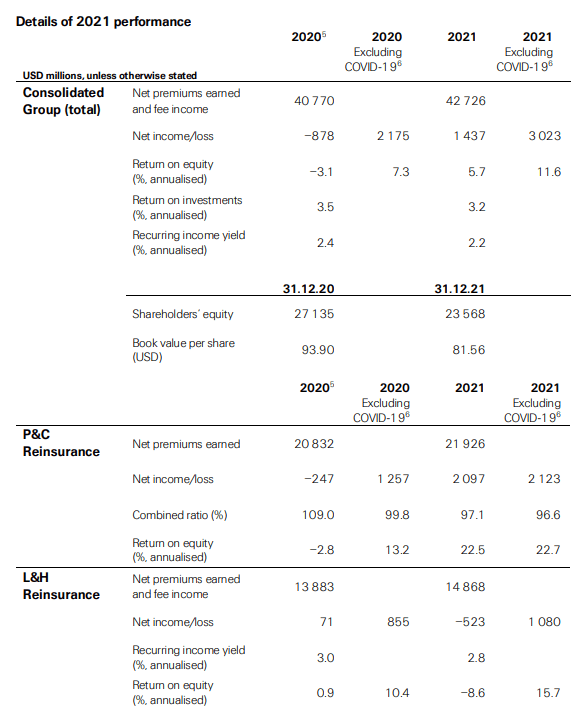

The most recent version of the website is available. quarterlyData shows that net premiums have increased in both the Life & Health segment and the Property & Casualty segment since 2020. However, the combined ratio of P&C (both including COVID-19) has decreased significantly from the year before.

Swiss Re News Release 25 February 2022

P&C Reinsurance makes up the largest percentage of net premiums earned among all business segments of Swiss Re. We have seen a decline in the combined ratio, which is encouraging as it means that the company is paying less in claims and expenses than it collects in premiums.

In an inflationary climate, the Property & Casualty sector is invariably exposed. Rising property prices mean that future insuring claims will likely be more costly.

However, I believe that the inflation impact could actually work in Swiss Re’s favor, resulting in higher premium demand.

Swiss Re is a reinsurance firm that assumes risk from insurers looking to reduce losses in their own portfolio. In this context, insurers will likely increase their reinsurance policies to offset the risk of higher property prices resulting in more expensive claims. This means that Swiss Re has the potential to increase net premiums in this segment.

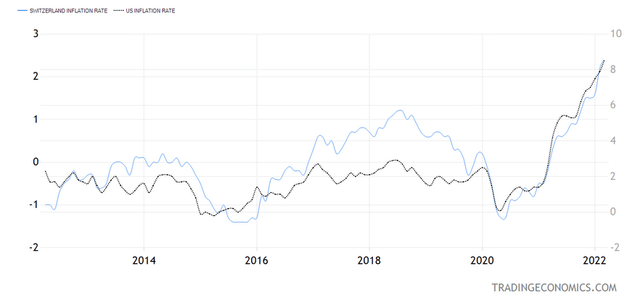

Inflation in Switzerland is much lower than the United States from a macroeconomic perspective. It is currently at 2.4%, 8.5%, and 3.4%, respectively, at the time.

tradingeconomics.com

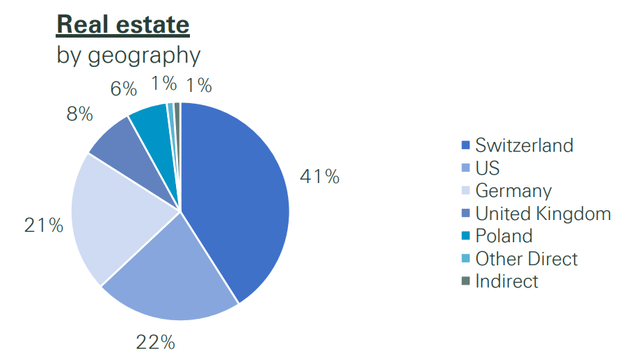

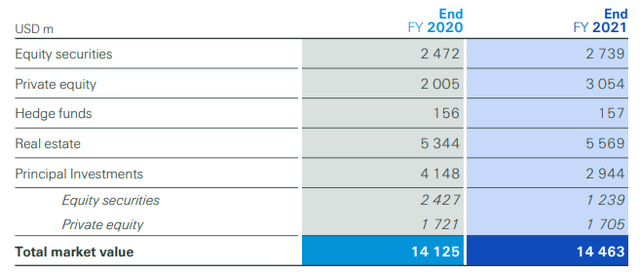

Notably, when analyzing company’s realty ExposureWe see that Swiss Re’s exposure is 22% to U.S. realty, compared to 41% in Switzerland.

Swiss Re: Annual Results 2021

Furthermore, we see significant gains in equity securities, private equity, real estate, and other investments when we look at the company as a whole.

Swiss Re: Annual Results 2021

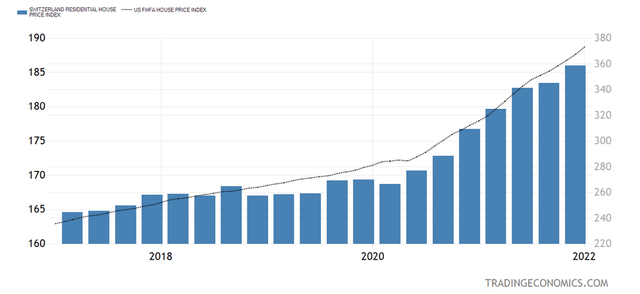

The company’s geographical diversity seems to be a positive factor in terms of Swiss Re’s real-estate exposure. Swiss Re is protected from sudden downturns by its limited exposure to the U.S. markets, even though U.S. realty prices have been rising significantly compared to Switzerland. Inflation is threatening to push housing prices to unsustainable levels. The US housing market could see a correction in the long-term. The Swiss housing price index has increased by just under 15% in the past five years, while that of the United States has increased by approximately 50%.

tradingeconomics.com

High levels of inflation are a threat to real estate market viability, as prices eventually reach a level where potential homeowners cannot afford the higher costs. Inflation in Switzerland has been lower than the general trend. I believe that Swiss Re is taking sensible steps to reduce its risk by retaining a large part of its real-estate exposure within Switzerland.

Despite the fact that Swiss Re’s Life & Health section suffered significant losses due to the COVID-19 pandemic and more deaths, the net income was still up 26%To USD $1.1 billion by 2021, excluding COVID.

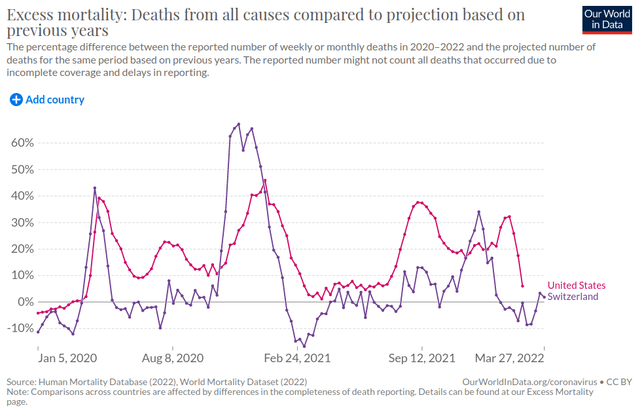

The pandemic is not over, and there could still be significant seasonal outbreaks. However, excessive deaths in the United States of America and Switzerland have been decreasing steadily and have not recovered to the levels at the end 2020.

ourworldindata.org

From this perspective, a continued recovery of the L&H sector after COVID is welcome and would help Swiss Re significantly reduce the inflation risk across the P&C segments.

Valuation

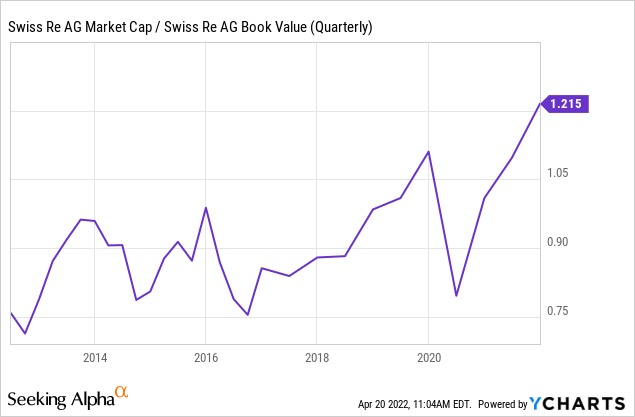

We can see that Swiss Re’s market capitalization is now higher than its book value, which is a key metric for valuing life and health insurance companies with significant exposure.

YCharts.com

Despite Swiss Re’s stock prices recovering significantly since early 2020 and continued losses in the Life & Health sector contributing to the company trading at a substantial premium on the basis above metric.

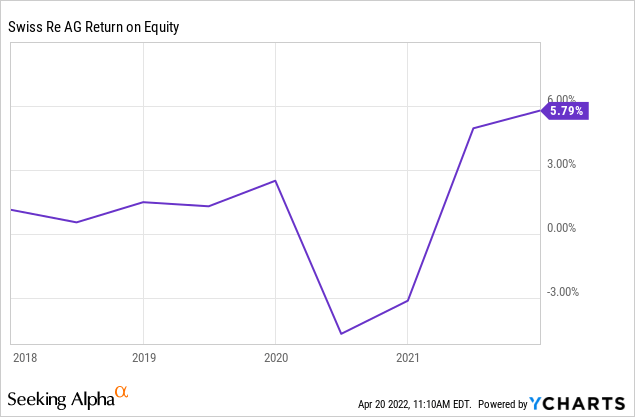

With that being said Swiss Re’s return-on-equity is at a 10-year peak, which means that the company is generating more income than shareholder’s equity.

YCharts.com

Swiss Re is now more expensive than ever on the basis of market cap to book value. However, I think the stock has potential upside if the return on equity continues to grow.

Risques

There is always risk in an inflationary environment. Swiss Re is no exception.

One, Swiss Re’s growth is dependent on steady net premium growth. The company is in a strong position to grow net premiums as more insurance companies seek to diversify risk exposure to higher property prices. However, sustained high inflation could have a negative effect on property values. DemandProperty insurance is in high demand.

While the threat of COVID-19 has receded on the Life & Health sides, any further outbreaks or an increase number of deaths could place further strain on the company’s ability return this segment to profitability. In other words, Swiss Re will continue pay out more claims than it will collect from new premiums.

Swiss Re is able to manage inflationary risk across its portfolio. However, it is still a reinsurance firm that takes on risk by offering insurance policies across Property & Casualty as well as Life & Health. Swiss Re could be negatively affected if these markets experience significant volatility.

Conclusion

Let’s conclude that almost all companies are currently exposed to inflationary risk. Swiss Re is no exception. Swiss Re is no exception. It appears that Swiss Re has designed its investment portfolio to minimize property inflation. If prices don’t rise too much, the company can still increase net premiums as property insurance demand rises.

Swiss Re’s Life & Health division is also recovering, which allows it to diversify away form inflation risks.

Overall, I believe that Swiss Re is well-positioned for success in today’s inflationary environment.