[ad_1]

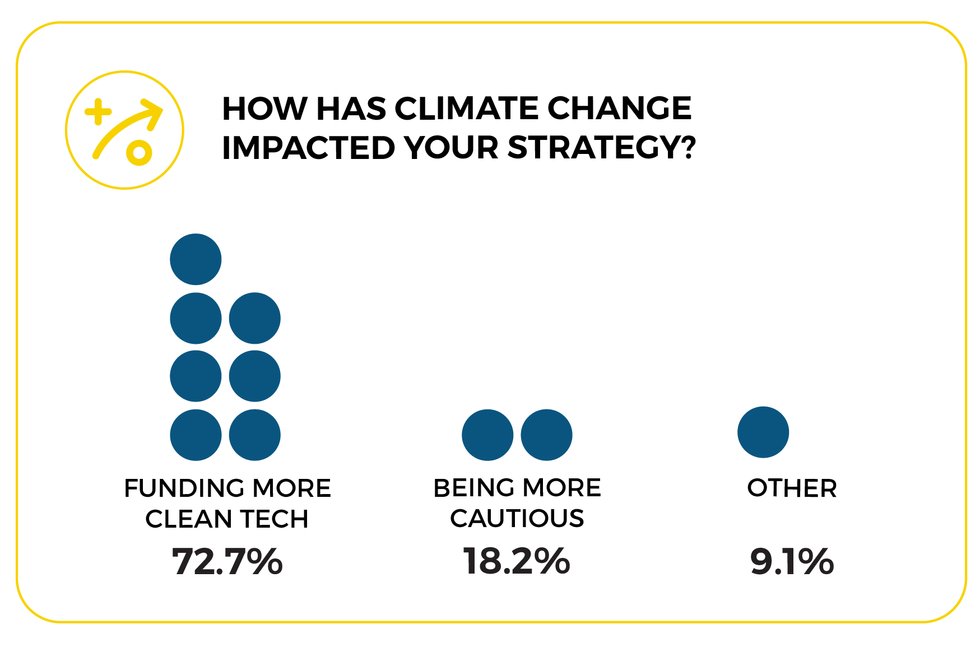

Many of the top venture capitalists from Los Angeles claim that they have changed their investment strategy due to climate change. Some are responding by investing more cash in clean-tech startups.

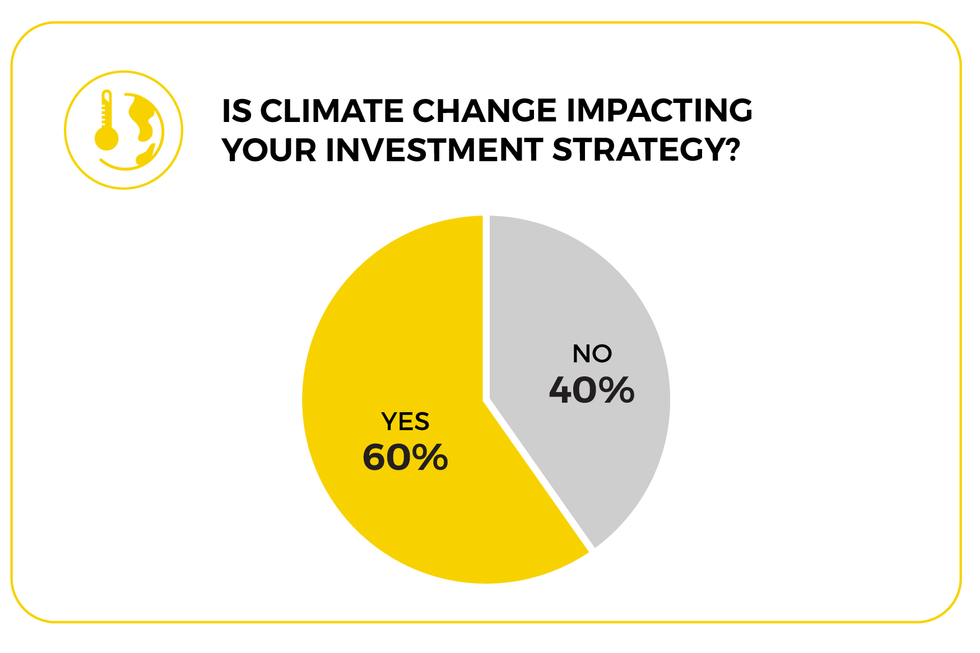

60% of the more then two dozen investors are majority. polled by dot.LAClimate change is affecting how they invest, according to them.

This is a trend that is fueling a record year for the sector as investors put billions behind Southern California companies like electric vehicle maker RivianHome energy storage firm Swell.

As of late October, Pitchbook tracked $6.4 billion in Southern California “climate tech” deals this year — nearly twice as much as in the entirety of 2020. According to Pitchbook, the vast sector includes everything from clean energy generation and electric transportation to the production of plant-based protein (a.k.a fake beef).

Most venture capitalists polled stated that the climate crisis has motivated them to invest in more clean-tech startups. One investor stated that they were always looking for innovative solutions to these problems.

Climate investments have risen dramatically worldwide. Pitchbook accounted for $30.8 billion in related deals in the third quarter of 2021. In its latest climate report, Pitchbook stated that the industry could produce 500-1000 unicorns over the next few years.

What Can Tech Do That Isn’t?

The White House believes that the yet-to be developed tech will play an important role in the solution to the climate crisis’s response. This is the promising fundraising trend.

“I was told by scientists that 50% the reductions necessary to reach net zero are going be made using technologies that we don’t yet have. It’s just a fact,” U.S. Former Senator and Climate Envoy John Kerry saidIn May.

Dr. Deepak RajagopalProfessor at UCLA’s Institute of the Environment and Sustainability sees the environmental problem less as a technical one and more socio-political at the aggregate level and behavioral at the individual level.

For years expertsHave warnedThat tech alone cannot solve the crisisEmerging tech often produces unexpected results.

“My research on the life cycle assessment of technology always showed that every technology has unintended effects and it is an ethical question if these unintended consequences are worthwhile.” Rajagopal explained to dot.LA that there is no solution that doesn’t have some kind of negative impact.

Dr. Greys SošićThe University of Southern California, which studies supply chain sustainability, calls the rise of clean tech investments “commendable,” but urges a holistic approach.

“I am curious what is happening to the rest their investments?” Are there any trends in reducing investment in “dirty” startup ventures? Until this happens, we cannot make a lot of progress,” said Sošić. “Adding clean tech startups to your portfolio without making additional changes seems more like greenwashing that making a serious effort for the environment.”

By Size, Largest Clean Tech Deals in Southern California

Data from Pitchbook.

Candice Navi, Lead image and infographics

From Your Site Articles

Related Articles

[ad_2]

Source link