LeManna/iStock via Getty Images

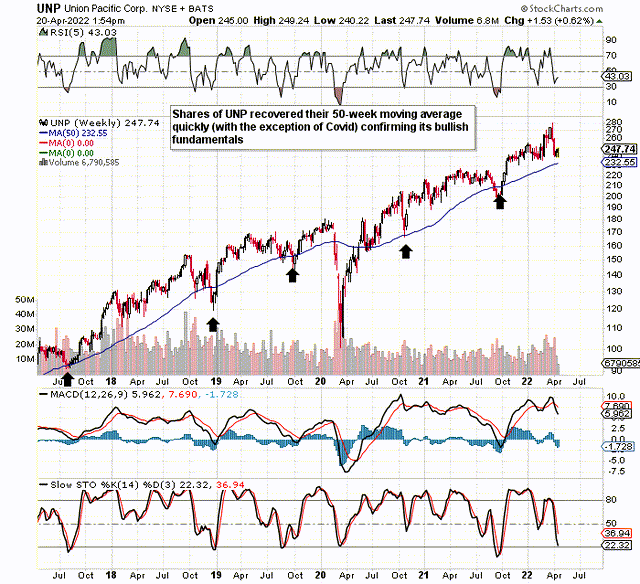

We can pull up a 5-year chart for Union Pacific Corporation (NYSE:UNP) (Railroad Business), we can see that shares have managed to remain above their 50-week moving average (Approximate 200-day moving average) with the exception of the coronaThe virus-induced breakdown that we witnessed in the early phases of 2020. This is consistent with bullish fundamentals, regardless of the stock’s recent valuation.

Bullish investors could actually use the stock’s 50 week moving average (taking into consideration a margin of error as a stop-loss below UNP’s prevailing price). Why? Because investors can benefit from not only capital appreciation but also the dividend offered by Union Pacific by investing in line with the trend. Union Pacific, a stock with a low beta (Implied volatility of 25%), is actually a dividend-oriented stock.

Union Pacific Bullish Trend – Stockcharts.com

With the IMFRecently, it was announced that inflation will continue for some time. This should be a warning to income investors. It is possible to have a devastating effect on a retirement account if there is prolonged inflation. Income investors mistakenly believe that a significant drop in inflation over the next few decades will protect their nest eggs. Protecting your purchasing power is about ensuring your money grows above the inflation rate. Inflation rate averageFrom today until you retire

Let’s say that you have 12 years to live and your investment performance is 3% lower than the inflation rate. This means that the portfolio’s cash flow will have a 30% decrease in purchasing power over the next 12 years. Your purchasing power is now reduced by half if we increase the duration (until retirement). We want to be on the other side. We want to ensure that the dollars we have today outperform inflation, which basically means that they will grow faster then the greenback.

Union Pacific currently yields a dividend of 1.92%. Despite UNP’s current dividend yield being 26% higher than the sector median (1.52%), growth is the main factor for income investors.

Strong dividend growth rates not just protect purchasing power, but also encourage confidence in future earnings growth. As you can see, even though Union’s dividend growth has slowed down in recent years, Union’s growth rates are still significantly higher than the sector and are at least keeping up with the current (vital) inflation.

| Duration | 10 Year | 5 Year | 3 Year | 12 Months |

| Dividend Growth – UNP | 15.39% | 14.27% | 11.92% | 10.57% |

| Dividend Growth – Sector | 8.86% | 7.27% | 6.15% | 6.74% |

Union’s cash flow was almost $6.1 billion in fiscal 2021. Over the past five year, Union’s free cash flow has increased by nearly 9% per annum. Union has been aggressive in stock repurchases, even though the dividend has outpaced growth in free cash flow. The number of shares outstanding has dropped from 802,000,000 in fiscal 2017 to 628 million today. This means that the cash flow dividend payout has declined from 48% to 46% over the past five year, despite dividend payments increasing by 40%+ during this period. (Impressive)

Union’s reported debt to equity ratio has increased to 0.65 from a current 2.05, but investors need to look at how Union has changed. For example, Treasury stock has more than doubled in value to $47.7billion. This means that the claimed amount of shareholder equity ($14.16billion) is much higher.

Union’s dividend growth will be influenced by more than just strong cash flow and a solid balance sheet. Earnings per share grew 26% in fiscal 2021. This year, 17% of bottom-line growth is anticipated. Over the past five year, EPS has increased by approximately 14.4% per annum on average. This should encourage investors to believe that current dividend growth rates will continue.

Union Pacific is a smart dividend play. Dividend growth rates have remained in strong double digit territory. Present cash flow, balance sheets, and earnings trends all point to continued growth in the payout. It is all about growth in the current environment. The yield comes in second. Let’s find out what else is possible. Q1Earnings bring.