[ad_1]

The floods affecting Australia’s eastern seaboard are a “1 in 1,000 years event”, according to New South Wales Premier Dominic Perrottet. But that’s not what science, or the insurance industry, suggests.

As extreme weather events become more frequent and severe in Australia, businesses and homeowners are seeing rising insurance costs.

As insurers consider the cost of insurance claims and factor future risks into their calculations, premiums have risen sharply in the past decade. The Latest report from the Intergovernmental Panel on Climate Change, published this week, predicts global warming of 1.5℃ will lead to a Fourfold increaseNatural disasters.

Rising insurance premiums have created a crisis of Australian underinsurance.

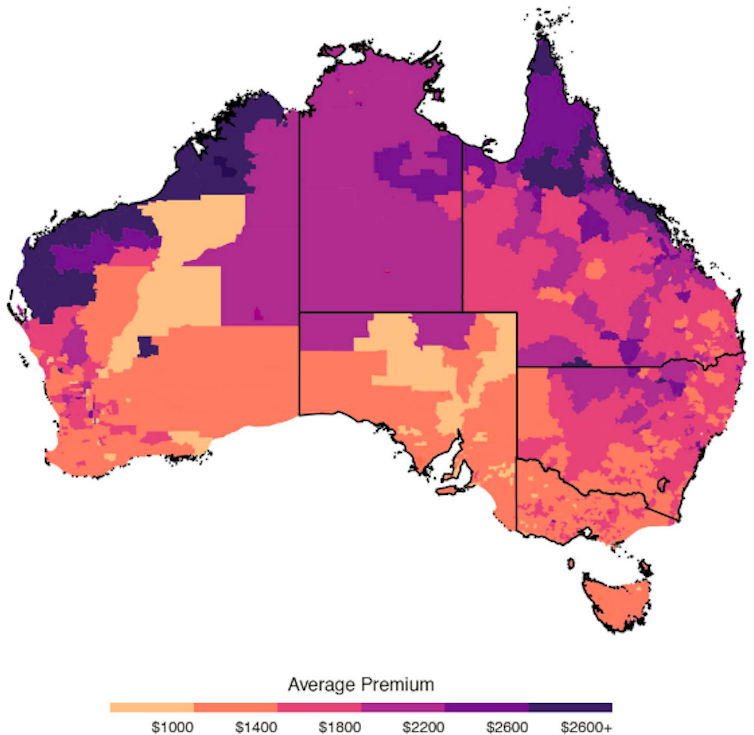

The Australian Competition and Consumer Commission was asked by the federal government in 2017 to investigate insurance affordability in northern Australia. It is here that destructive storms and floods are the most common. The commission delivered its report. Final report2020. It found the average cost of home and contents insurance in northern Australia was almost double the rest of Australia – $2,500 compared with $1,400. The rate of non-insurance was almost double – 20% compared with 11%.

Average premiums for combined home and contents insurance, 2018–19

ACCC analysis data from insurers., CC BY

While the areas now experiencing their worst flooding in recorded history aren’t part of the riskiest areas identified by the insurance inquiry, the dynamics are the same.

Financial ruin will result for those who aren’t insured or underinsured. Insurance premiums will rise. As a consequence, more people will be underinsured or drop their insurance completely. This will increase the social disaster that will follow the next natural catastrophe.

So what are you going to do?

Insurance affordability: How to tackle it

There are two main methods to reduce your insurance premiums.

One is to decrease global warming. This is not something Australia can do on its own, but it is a part of the solution.

The other option is to reduce extreme events’ damage by building more disaster-resistant buildings or not rebuilding areas high-risk.

However, the federal government has placed most of its eggs in a new basket with a plan for subsidising northern Australian insurance premiums.

Jason O’Brien/AAP

This won’t do much for those affected by the current floods. It won’t even do much to solve the insurance crisis in northern Australia.

The reinsurance pool, a blunt instrument

The federal government has committed A$10 million to a new 2021 budget Reinsurance pool for flood and cyclone damage, “to ensure Australians in cyclone-prone areas have access to affordable insurance”. This pool was created by legislation Now before parliament.

The government is claiming that it can lower insurance costs by acting as wholesaler in reinsurance markets, in which insurance companies insure themselves against the risk from crippling insurance payouts.

Insurers will be able to lower their premiums if they have discounted reinsurance.

Continue reading:

There is a national insurance crisis. It is not going to be fixed by the Morrison government’s $10B ‘pool plan’

However, there is no guarantee that insurers will pass down their lower costs to customers. This means that the benefits of the pool cannot be predicted.

Its costs are also rising. In effect, the government is shifting risk away from the insurers to it, subsidizing insurance premiums in certain parts of the country from the public purse.

The ACCC inquiry was very interested in the idea of a pool for reinsurance. Although there may be some benefits, the ACCC concluded that the risks outweigh any potential rewards.

We don’t believe a reinsurance pool is necessary in order to address northern Australia’s availability issues.

Targeting and mitigating

Beyond the problems mentioned, there are two important failures in the reinsurance plan.

First, subsidising insurance companies doesn’t target help to those who need it most: low-income households.

There is increasing evidence that natural disasters are occurring and the government’s response to them is being studied. Contributing to greater inequality.

The South Australian Council of Social Service explains in this a Report published this week, improving insurance access for people on low incomes at risk from natural disaster requires targeted support, such as promoting non-profit “mutual” insurance schemes.

Continue reading:

Inequality is increased by natural disasters. The lack of funding for recovery could make things worse

Second, only mitigation can reduce the cost of natural catastrophes. Public works include building levees, upgrading stormwater system, planning burns, and improving buildings (reinforcing doors, shuttering windows and managing vegetation around homes).

The ACCC’s insurance report identifies a range of ways mitigation strategies can be tied into insurance pricing. Yet none of these has been incorporated into the Morrison government’s response to the insurance crisis.

The federal government is the only one that supports the reinsurance pool. Reinsurance is not supported by the ACCC or the insurance industry, nor by community sector advocacy groups.

A reinsurance pool for all of Australia?

For those areas in NSW and Queensland that are now flooded, and the rest of the country not covered by the reinsurance pool as well, the steady rise in insurance costs will continue. This will push ever more homeowners out of the insurance safety Net.

We need to find better solutions for the insurance crisis than what is being offered in northern Australia. A reinsurance pool cannot be a national solution because it isn’t the solution for northern Australia.

There are no quick fixes, but there are clear maps that have been compiled from a wide range of inquiries and reports about insurance and climate vulnerability. The federal government should be more than just a blanket subsidy for insurance companies.