By

BRUCE KAMICH

UNH

It’s time to go over the charts again.

Below is an updated daily UNH bar chart. It shows that prices have risen in recent days, but not to the same extent as their late December/earlyJanuary highs. UNH is above 50-day moving average, but its slope remains neutral. The rising 200-day moving median line intersects at $430. It was last tested in October.

The On-Balance Volume (OBV), line is increasing and reached a new high in January to confirm price gains. This indicator should be monitored closely for any shift in direction. The Moving Average Convergence Divergence oscillator (MACD) is below the zero line, but has crossed to its upside for a cover shorts sell signal.

Below is a weekly Japanese candlestick chart from UNH. It shows a mixed picture. The longer-term trend is still positive, with prices rising above the rising 40-week moving median line. To confirm the price gains, the weekly OBV line shows a smooth 3-year advance. The MACD oscillator crossed to the negative for a take-profit sell signal.

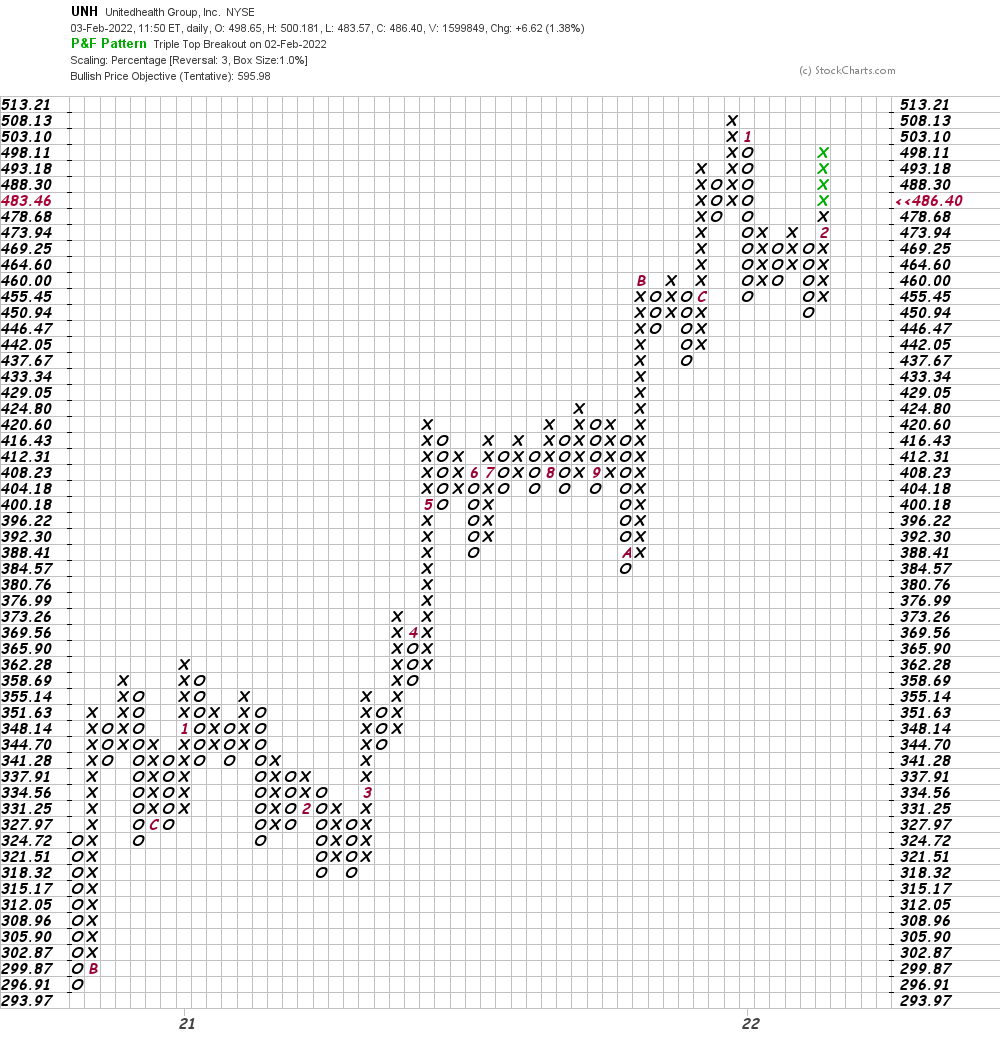

Below is the UNH Point and Figure chart. We still see an upside price target, but a trade at $446 would likely weaken this chart.

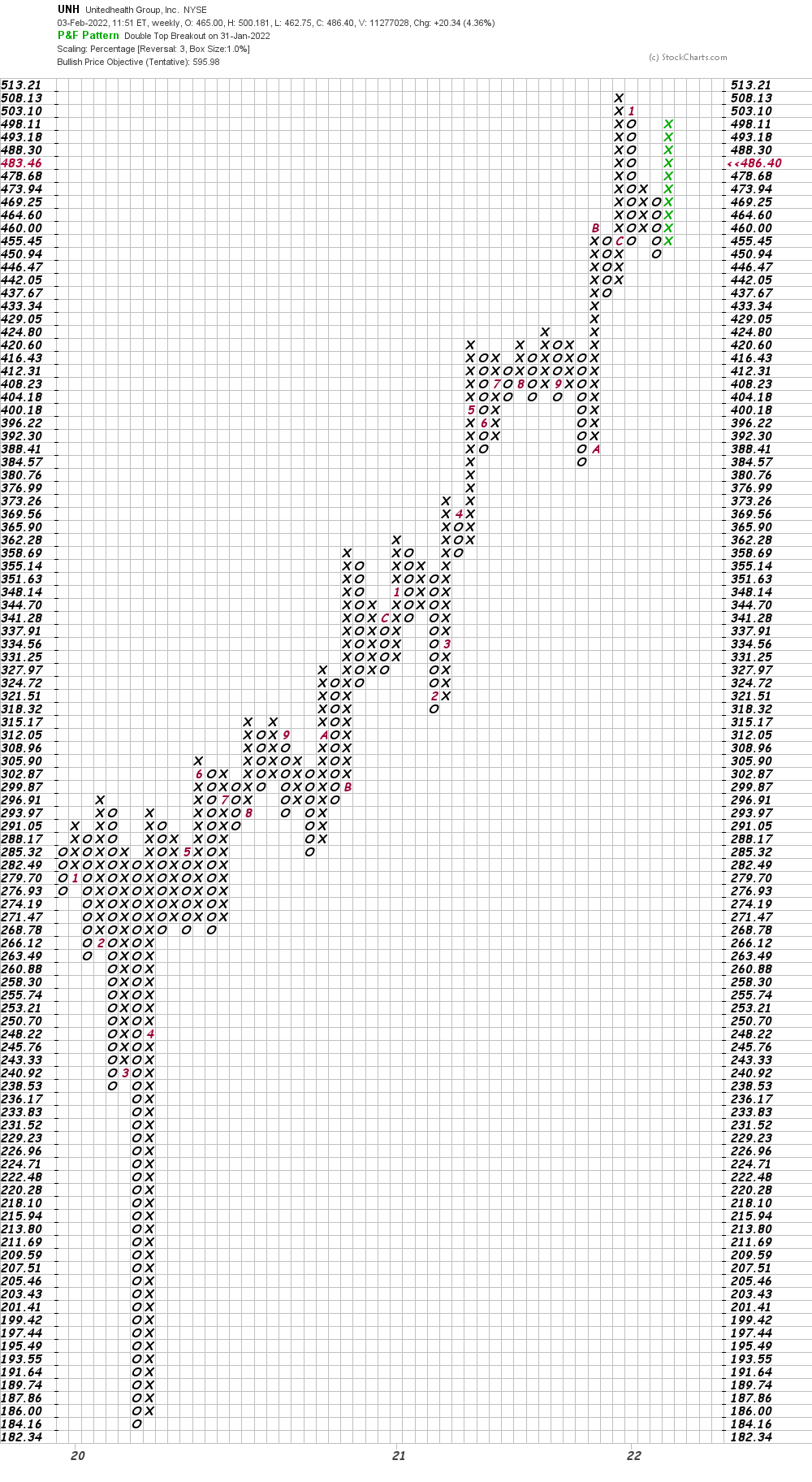

Below, the UNH weekly Point & Figure chart shows the same price target. Weakness below $446 is not a good sign.

Bottom line strategy:I will assume that traders booked profits in UNH at 500 or higher. Reduce the stop on any longs that are still open to $460 from $425.

Get an email alert whenever I write an Article for Real Money. Click the “+Follow” button next to my article’s title.

Please contact us if you have any questions Here.

Email sent

Thank you, your email to It was successfully sent.

Oops!

We’re sorry. We are having trouble sending your email .

Please contact customer supportPlease let us know.

Log in or sign up to email our authors

Email Real Money’s Wall Street Pros to get more analysis and insight

Already a subscriber Login