[ad_1]

The transition to net-zero carbon emissions for economies isn’t one that is going to happen in a bubble, but it will instead be a rapidly accelerating event that will send shocks throughout systems on all levels. According to a recent report, the acceleration can be attributed to the recent COP26 summit, secondary effects of decarbonization and positive feedback loops that result from the climate change transition. paperState Street Global Advisors.

Investors who rely on slow shifts to address climate changes could be in for a surprise and a large loss within their portfolios, says Carlo M. Funk (EMEA head of ESG Investment Strategy at State Street Global Advisors). The transition of economies to low-emissions is a long-term process that will impact regulation and economies at many levels.

Increasing commitments to emission reduction

Although the COP26 global climate summit concluded in November, it did not provide any unique, world-changing solutions. However, more countries are committing to more aggressive cuts and net-zero targets. A global carbon market was created at the summit. It would include two types of allowances: one for public and private industries and one that is only for countries to trade with one another in the global effort towards net-zero. It’s a step towards greater Paris Agreement enforcement and commitment, and a move that accelerates the transition timeline.

Changes in Trade Balances and the Benefits of Being at The Top

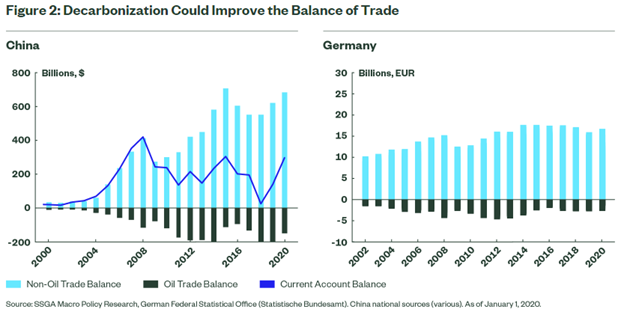

Another reason why the transition could accelerate is because of the secondary benefits that countries, and companies, can derive from reducing carbon emissions. It would be a great advantage for countries to lead the transition to renewable energy, especially as developed countries are net importers of energy in countries that rely heavily on fossil fuels. A new global economy that is not dependent on fossil fuels could see trade balances shift.

Image source: SSGA

“For example, geopolitical superpowers (the US, China, and Europe) are incentivized to stay on top of the race to become a climate leader because the transformation to a low-carbon economy will come with enormous opportunities (similar to other disruptive shifts, like digitalization),” writes Funk.

Feedback loops will intensify the transition

The positive feedback loops that could be created by countries moving away from fossil fuels are another reason for a faster transition. One such feedback loop is the volume-cost loop. In this loop, fossil fuel volumes decrease as they are used more, driving up the price and further decreasing the demand.

Another feedback loop that is important is the expectations feedback loop. As renewable energy demand increases, fossil fuel industries become less credible due to the shifting perceptions of policymakers and investors.

A second important feedback loop to consider, is the financial. Increased renewable energy production results in more investors coming in which in turn reduces the cost of capital. This allows green energy companies to grow and expand while also putting pressure on fossil fuel companies.

“In addition, the broader society feedback loop, the politics feedback loop, and the geopolitics feedback loop will further accelerate this transformation. As society becomes more concerned with the climate crisis and comes to better understand the financial benefits of renewable technology, people will likely change their behavior,” Funk notes.

Visit the for more information and strategy ESG Channel.

These views and opinions are solely the author’s and do not necessarily reflect the views of Nasdaq, Inc.