Michael Vi/iStock Editorial via Getty Images

I have been following this company for a while now and have made some timely calls about it before. In September 2020, I was arguing that the market was not seeing the potential impact of the Radius bank acquisition.The stock was trading at $4.50 when it was first listed. The stock rose to nearly $20 per share by March 2021. I profiled the company once more in 3 diffBetween March and May 2021, there were errant articlesThe stock traded at $15 per share when it was first listed. LendingClub (NYSE:LCIn November 2021, ) shares reached a peak of almost $50 per share. We are back, and the market is hammering away at both good and poor companies. LendingClub shares are still an incredible opportunity at the $13 level that they are currently trading at. In 2020 and early 2021, my articles stated that the market didn’t understand LendingClub’s earning potential. With their 2021 results, the company has proven that they have the earning power to surpass all expectations.

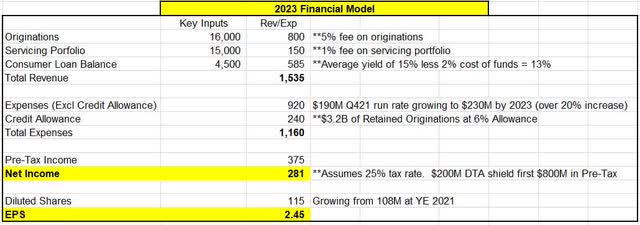

The market is still not sure of the company’s future earnings power. Bearish investors and similar views will argue that LendingClub should be valued at book value or at low PE multiples. Even if those bearish views are correct, these arguments miss the key point: LendingClub must dramatically increase EPS in the next few years. 700% increase in EPS would be the Guidance for 2022From the company. As you can see, my guidance for 2023 is to increase EPS by over 200% to $2.50 per shares (a little more than analyst consensus estimates). LendingClub is a favorite among analysts, with an average price target at $2.50 per share. $37Per share, almost 200% upside

LendingClub recommends that banks not grow EPS at rates even slightly higher than these. Banks have loans that span the gamut from real estate to commercial assets and many other asset classes with very long durations. Banks cannot quickly react to the Fed’s inflation environment and can’t pivot and change their positions. LendingClub only has one core product, a personal loans, which has an average lifespan of 1.5 years. This company can quickly adapt to any environment that the Fed throws at it.

We don’t know what the next few weeks will bring in terms of market performance. I am happy to invest in LendingClub at multiples, just over 1x forward forward, and a forwardEPS 10x.

LendingClub, one of the pioneers of this new type lending product, was able to make personal loans worth $10B back in 2010. This market had exploded by 2021. Nearly $120BLendingClub held almost 10% of the market share. The U.S. has the highest revolving credit card debt. Nearly $900B. LendingClub, personal loans, and other lending institutions have a lot of potential to grow in the coming years.

LendingClub Benefits Inflation

LendingClub generates two streams of revenue. LendingClub originates loans, which it then sells to banks or other investors who take on the credit risk. The company that originates the loan collects a one time origination fee of 5% and then a recurring servicing charge from each loan that is sold (1% annually).

The second revenue stream, which is expected to grow rapidly, is the net interest margin “NIM” earned from loans LendingClub keeps on its balance sheet. LendingClub should be earning 9% on these loans when you consider the yield on loans to consumers and the losses LendingClub reserves upfront for future bad debt. LendingClub had an average personal loan portfolio yield of 15.7% at 12/31/21 and an average cost-of-funds (i.e., deposits) of less than.4%. LendingClub also reserves about 6% at the time it initiates a loan for future losses. This means that you will have a 9% pretax income stream from loans that are issued and retained by LendingClub.

Both revenue streams will benefit from inflation. Inflation is high because of a variety of factors, including the supply chain chaos and all the money that the Government has pumped into it. The Fed will raise rates. This is shocking, I know. Credit card rates will rise. Lending Club will increase rates on new loans. This will still make these loans an attractive option to floating rate credit card debt. Lending Club will need to pay more on deposits as this is the company’s main source for funding loans. However, the company stated that they expect to raise rates enough so that their total income stream is neutral at best and likely accretive to the NIM rate overall.

LendingClub benefits from inflation when consumers are willing to spend. Consumers started spending more as 2021 progressed. However, as COVID faded into the background, they now spend like there is no tomorrow (while fueling the inflation fire). Revolving credit The number of people who have gotten involved in the movement has explodedIn February 2022, it was over $40B. This was compared to $15B estimates. It was also the fastest growth rate in over 20 years. Why? Because the government handouts of free lunches and money are drying up. Because the economy has exploded and people are eager to spend. Because COVID has been relegated to the back-view mirror. People want to travel. LendingClub’s stock was beaten by the earnings of Q4 2021 earlier this year. While the company beat their guidance some people assumed that the guidance was too light for 2022. I’m not sure how or why this conclusion was reached. LendingClub advised that originations would increase to $13B by 2022 (up 30%) and that revenue growth would be 35% or more. According to LendingClub, they plan to reinvest the higher profits they are earning in order to spend about $50M more in 2022 on marketing for new loans, deposit growth marketing, and building technology platforms. LendingClub expects to increase earnings by 700% in 2021, even with these incremental investments.

Today’sMassive inflation is partly due a booming economy and strong labor market. Strong labor markets lead to more qualified potential clients who are confident in their stable and rising incomes. They are therefore more willing to take out loans for any reason.

LendingClub now has more than 4M members. We have been told by the company that more than half of its members return to LendingClub every five years and take out another loan. We were told by the company that more than 80% of their members are interested in LendingClub (auto loans and banking, checking, insurance, etc.). The company boasts a Net Promoter Score comparable to Amazon and Apple. Customers like LendingClub. LendingClub customers love it. In a few years, LendingClub will have 6M to 10M members. LendingClub could generate $15B in new loans each year if just 1M of its existing customers return each year to take out a $15K loan. This model has tremendous power, and the market is completely missing it.

Outlook on Earnings

The market seems to be operating under the assumption that every company is at peak earnings in terms of earnings growth, at best, and at worst, that many companies will see earnings declines. Why? One of the main culprits?

We want to invest in companies that will grow earnings in an inflationary environment.

LendingClub’s FY 2022 earnings estimates are very likely to be met, I am certain. Let’s just assume they have no incremental demand, and only meet the $13B in origination guidance. It is hard to believe there is much risk in us all missing the origination guidelines given the explosion of revolving credit. Let’s say that the company holds 20% of the loans they originate and collects the 5% origination fee on only 80% ($10.4B). This gets us. $520MIn revenue. The year ended with a servicing portfolio of more than $12B. As it continues to grow, let’s assume that it will average $13B per year in 2022. This gives us another. $130MIn revenue. NIM is now a revenue stream that grows by approximately $20M per quarterly. Based on the Q4 2021 exit rates of $83M, NIM should increase from $100M to $160M by 2022. This gives us approximately $520MNIM revenue. This represents $1.17B of revenue and is at the high end of our guidance range. I exclude any gains from loans sales, which LendingClub had a lot of last year. This would increase revenue.

The earnings side of the equation shows that the company has already incorporated a lot of extra spending for growth initiatives, which they spoke about during the Q4 2021 earnings calls. I believe organic demand for personal loans will rise significantly this year, and LendingClub may be able to spend less revenue to generate it than their guidance suggests.

It gets even more exciting when you think about 2023. We have a market that expects slowing earnings growth, or even peak earnings. Based on the company’s guidance ($140M Net Income / 108M Diluted Shares), Lending Club should earn $1.30 per share by 2021.

Below is my model showing earnings increasing to nearly $2.50 per share for FY 2023. This would represent a 90% increase in earnings between 2022 and 2023. There won’t be many value-oriented companies that grow at 30+ % in revenue and earn 90% more by 2023. Lending Club is exactly the type of company investors need to be looking for.

LendingClub 2023 Estimates (Author Estimates)

Defining the risks

Let’s start by saying that LendingClub’s risk of underperformance was slightly lower when it traded at $50 in November than it was today at $13 five months later. We start with a stock that is very vulnerable or uncertain. There are always more risks.

- Fed Risk – Who can guess what the Fed is up to now? Is it possible that they are jawboning harder than they can actually raise rates? If it means crashing the housing market and tanking the economy, are they willing to raise rates to all levels? I believe Inflation will rise to 2% but not by much. If China continues to lock down or the war in Ukraine escalates, then I think we have reached peak Inflation.

- LendingClub isn’t the only company offering personal loans. Banks do it. Other public companies such as Upstart and SoFi (SOFI), do this, and then there are private businesses. It’s a very competitive space. However, no company is able to innovate the other in a large way. It all comes down to trusting consumers and which investors are willing to partner with them. LendingClub can help with both of those questions. There is a possibility that more companies will adopt the Upstart model and try to buy businesses at a rapid pace. Upstart spent $100M on marketing in Q4 2021 in order to originate $4B loans. LendingClub spent $50M in marketing to originate just under $3B in loans. Upstart’s business is buying business. They are making a profit, so they deserve credit. They are trading at 35x analyst expectations for 2022, so the company needs to be on top of their game.

- Credit Performance – Bearish investors will argue LendingClub will collapse in a recession. It is likely that the loans will default and it will be light out. Most investors don’t realize that companies must now book losses for loans as they are issued. LendingClub is using historical loss rates from pre-COVID, which has a decade plus of data. The loans they are issuing are performing substantially better than the loss rates assumptions at this point. Why? As a reader of this article, you might ask yourself why. You have a 700 FICO score. You make $100K a year. A $500 personal loan will be paid off in 1.5 year. Is it possible to ruin the credit score that you have worked so hard to build by paying $500 per month? Do you think it is better than your credit card balances or would you treat it differently? The answer seems to be yes. Credit concerns for products with such a short duration, issued by companies like LendingClub, which has billions of iterations to identify risk, are a lot less risky than the market believes.

Final Takeaway

I encourage everyone to spend thirty minutes listening to the most recent. Presentation by KBW InvestorLendingClub’s CEO was also included in this group.. You can see someone and hear someone who is very positive about the business. Positive things that I learned and I hope you will too.

- LendingClub’s loan sales have seen a surge in investor demand. They have twice the demand for the loans they originate and sell. They have a waitinglist for new investors to join the platform.

- Why is demand so strong These investors are receiving the highest returns of any financial product. LendingClub targets Prime Buyers (700 Fico+ and $100K Income Plus). Investors can earn high yields on short-term loans, which significantly reduces their risk compared to longer-term loan products.

- LendingClub’s involvement in the game is a huge plus for investors. All risk is passed onto investors by Upstart and other originators. LendingClub is a bank that holds loans. This means that investors choose LendingClub as their preferred lender because the interests of both parties are 100% aligned. Platforms that only originate loans and do not retain any risk are not as effective.

- LendingClub has huge untapped opportunities that they will scale to overtime. Auto refinance loans ($300BTAM), rewards checking, and the possibility to offer customers so much else. The CEO stated that within the next two years, customers will be able, when applying for personal loans, to request 2 additional pieces information. Also, they may be able, as an example, to tell them how they can save on their auto loan. The customer could also be able to deposit the loan proceeds into an LendingClub checking account, and earn rewards for that balance as they pay down their loan. There are many options. The flywheel effect is endless.

- LendingClub has a huge data advantage. They have been in the game for 15+ years. They have a total of $80 in loans originated. They have more data than any peer in this space. LendingClub can see what investors are bidding for loans in real time, which was the example that was given on the call. This allows them to have real-time feedback on the pricing mechanism for how they set borrower rates. LendingClub can maximize both their returns and those of investors (by the APR that they charge borrowers).

I doubted at one point that the current CEO was capable of running a business that is truly revolutionary. Those doubts have vanished. LendingClub is an investment company that invests long-term. I believe they will be the industry leader for many years to follow.

LendingClub is also extremely well capitalized. LendingClub has capital ratios that exceed regulatory requirements. These ratios will improve as the company generates significant income over time. Also, with a $200M deferred income balance, the company’s next $800M in pre-tax income will be able to benefit from not having to pay $0 cash taxes. The argument that LendingClub is a bank will soon be challenged. Investors want to own LendingClub because it is a bank. If LendingClub has excess capital, it will likely see stock buybacks and dividends. They will be using that capital to grow the company. Investors should expect to reap the benefits of bank capital friendly shareholder initiatives in a world that is flatlining lending or slowing growth.

I feel quite good about this call, and the timing. LendingClub will report earnings this week. The company will be discussing how the exploding revolving loan debt is affecting their outlook and how their loans are performing. They may also discuss future growth initiatives that will broaden the membership base and set the flywheel in motion.