Investors may feel shaken by the U.S. stock market turmoil, but liquidation phases that may be finally underway will likely need to heat up before it burns itself out. A Wall Street chart watcher warned Friday.

The remarkable thing about Thursday’s market swing Wednesday and Thursday was the whipsawing of market internals indicators. These measures measure the number of advancing stocks relative to declining stocks. This is despite the fact that they tend to be more fickle than prices.

The Dow Jones Industrial Average

DJIA,

After a gain of more than 900 point on Wednesday, the Nasdaq Composite plunged by over 1,000 points or 3.1% on Thursday.

COMP,

The indexes saw their worst day since 2020, with a drop of 5% The S&P 500

SPX,

fell 3.6% Thursday. Stocks were down on Thursday but still above session lows Friday.

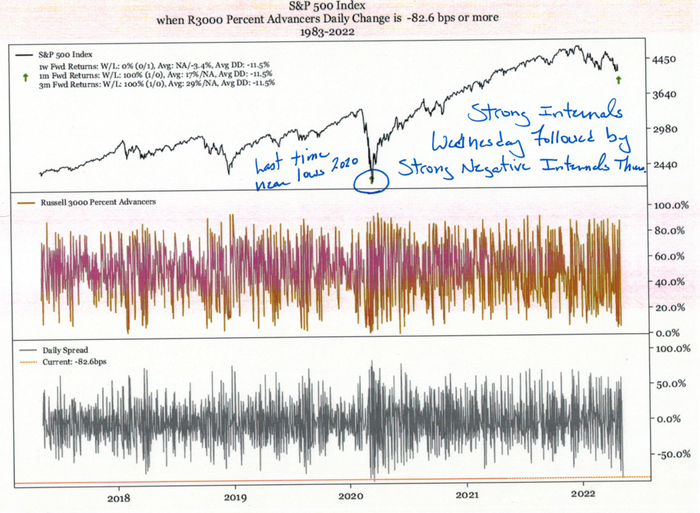

This week saw strong internals. Equities surged higher following Wednesday’s Fed meeting. The Thursday selloff was accompanied with one of the worst sets of internals. Only 5% of Russell3000 was affected by the Thursday selloff.

RUA,

He noted that stocks were rising amid 8% more volume. (See chart below).

DeGraaf pointed out that back-to-back swings within the internals this week were rare, with the most recent one happening close to the March 2020 COVID lows in stocks. Investors have never seen an internal swing so severe as that of Thursdays prior the financial crisis in 2008-09 (see chart).

Renaissance Macro Research

The analyst cautioned that the market may still have some way to go before it exhausts itself, before the COVID low hype gets bulls too excited. The S&P 500s dropped below Wednesday’s low, which turned the call for a stock market bounce into toast.

Were being put into a liquidation atmosphere, and while those often burn out, they get even hotter before they do.

Market watchers who think stocks have not yet bottomed have also pointed out the inconsistency of the Cboe Volatility Index’s rise.

VIX,

VIX, which is an options-based measure that measures the expected volatility of S&P 500 stocks over the next 30 day. Market bottoms often occur when the VIX, a proxy of trader jitters spikes, but this week’s rise in the index has been relatively modest.

Friday’s VIX high was 35, above its long term average below 20. It has not taken out the last weeks highs above 36 nor the March high above 37.

Investors believe a deeper selloff could occur in the coming months, as the Fed is expected to raise interest rates again by 50 basis points at its June meeting. Robert Schein, chief investor officer at Blanke Schein Wealth management, Palm Desert, Calif., said that this is despite the fact that the company has approximately $500 million in assets.

We would see an even higher VIX if investors truly believed that the bottom was near,” he stated in emailed comments.