[ad_1]

As scientists warn of the disastrous effects of climate changes, investors are shifting their focus to environmental risk and how it might affect their portfolios. The rising temperatures and increasing frequency and severity of severe storms floods heatwaves and droughts are eroding many countries’ economic gains.

The unmatched existential threat of climate crisis is a concern for governments worldwide and financial service sector players. Both acknowledge that financial resilience will be at risk if drastic measures don’t take place to reduce the impacts of climate change. Africa is still the most vulnerable continent to climate change. Africa is home of five out 10 countries that are most vulnerable to the climate crisis. This makes Africa a compelling candidate to adopt global best practices to increase its adaptive capabilities.

It is encouraging that the majority of African countries, including Kenya, have ratified and submitted their Nationally Determined Contributions (NDCs) focusing on adaptation measures. Their commitment today is setting them on the right track to increase climate action by reducing Green House Gases (GHG) emissions, and building their resilience. The Central Bank of Kenya introduced to the banking sector Guidance for Climate-Related Risk Management. This was a progressive move. These guidance are intended to guide banks and encourage them to consider climate-related risks when making decisions, especially in terms of their strategy, governance, risk management, disclosure, and disclosure. These progressive policies are crucial to help the country transition to a low carbon economy.

The Kenya Bankers Association has been a leading advocate over the years for banks to be able to recognize and manage the impacts of climate risk through their Sustainable Finance Initiative. KBA’s SFI Guiding Principles were launched in 2015. They have enabled many banks in Kenya, including the Kenya Bankers Association, to be creative in their allocations of resources in order to foster green growth and to mitigate risks associated to their lending practices. This progress can be corroborated by the findings from the 2020 State of Sustainable Finance in Kenya’s Banking Industry report, which highlighted that 85.7 percent of banks’ credit policy ensures responsible and sustainable lending that promotes the country’s sustainable economic development. The same survey revealed that 81% of banks polled said their management had developed procedures to ensure compliance to local environmental laws such as the Climate Change Act and labour regulations. Due to the systemic risk of a late transition to low-carbon economies, banks are keen to comply.

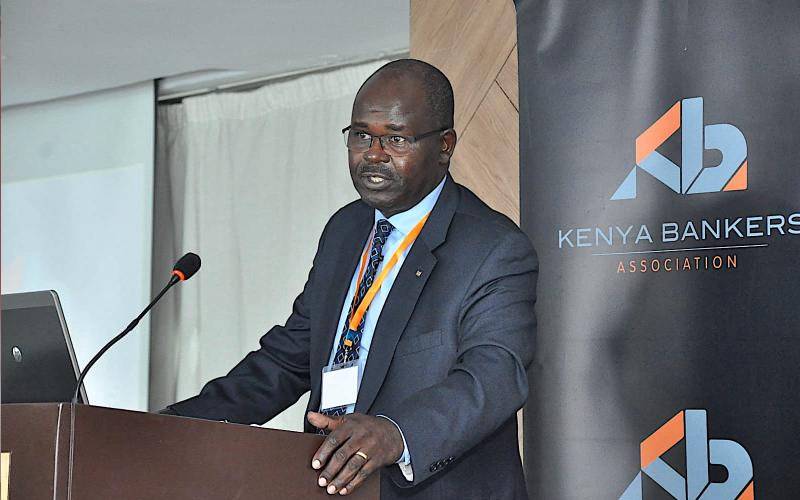

Kenya Bankers Association CEO, Writer