Carvana investors were not surprised that the used car retailer, known for its vending machines delivery towers, announced its first quarter results. This was despite the fact that the stock had fallen 70% over the past eight months. Earnings resultsWednesday afternoon (April 20).

Yet, a combination of internal production delays and macroeconomic factors created what the Arizona-based company called a difficult, unique, and degrading quarter for the purchase, sale, financing, and delivery of secondhand cars.

It seemed like the industry environment was in decline throughout, which is probably the easiest way to describe it. Carvana Chairman and Chief Executive Officer Ernie GarciaOn the company’s earnings conference, analysts and investors heard that the company was experiencing rising interest rates and inflation. Winter storms are causing record high car prices.

Although the year-on-year comparisons of retailers were generally positive, the sequential retreat from Q4’s peak is a better indicator of the impact it and the wider auto industry are currently facing.

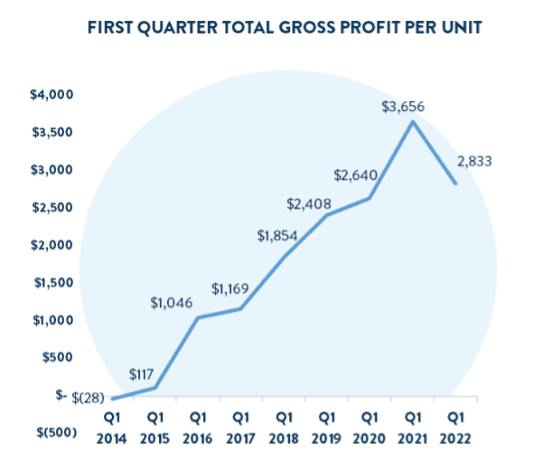

These trend reversals include a remarkable 7% Q/Q drop of units sold during the first three months in 2022 as well as a previously unnoticed decline in gross profit per unit (GPU) by 22% to $2833 from more than $3,600 at last year’s end.

The retailer, which is rapidly expanding, also reported unexpected bottlenecks at its inspection-reconditioning centers as well as unusually high delivery delays and cancellations.

Difficult environments sharpen us. They expose our weaknesses and force us to think differently. They can also open up new possibilities. Garcia said this environment is similar to the one he described to his shareholders, but he also chose not yet to issue guidance.

A Solution with Dilution

Garcia stated that the company’s expectation of hitting $4,000 GPU was being pushed back a few months, but that its planned acquisition ADESA U.S. was to be completed next month. This deal will add 56 locations, 6.5 million square footage and more than 4,000 acres to Carvanas already extensive portfolio.

CFO Mark Jenkins stated that adding the ADESA U.S. presence will greatly improve our logistics network over the long-term. He also noted that the company planned to add 2,000,000 units of annual reconditioning capacity in the new locations. This move would eventually see Carvana recondition inventory within 50 miles of 58% and within 200 miles 94% of the U.S. populations.

The company stated that it was looking to raise $2B via crowdfunding to facilitate the Carvana deal and provide working capital.Two stock offerings, or roughly 12% of its current market price.

Jenkins stated that Carvana would have its strongest total liquidity ever and the highest production capacity, despite the obvious dilution to existing shareholders who have already taken 60% off their previous year.

——————————

NEW PYMNTS DATA: THE FUTURE OF BUSINESS PAYABLES INNOVATION STUDY EARLY 2022

About: Over half of SMBs believe an all-in one payment platform can save time and improve cash flow visibility. However, 56% think it could be difficult for the solution to integrate with existing AP or AR systems. The Future Of Business Payables Innovation Survey, a collaboration between Plastiq, PYMNTS, and Plastiq, surveyed 500 SMBs that had revenues between $500,000-100 million to see if all-in one solutions could meet their needs and help them plan for the future.