While some believe volatility is better than debt to be a way to view risk as an investor, Warren Buffett famously stated that volatility is not synonymous with risk. It is only natural to look at a company’s balance sheets when you consider how risky it is. Debt is often involved in a business’s collapse. We are pleased to note that China Everbright Environment Group Limited(HKG.257) has debt on their balance sheet. But it is more important to ask: How much risk is that debt creating for you?

What risk does debt pose?

In general, debt becomes a problem when a company is unable to pay it off. If a company cannot pay its creditors, it can become bankrupt. Although it is not common, we see indebted businesses permanently diluting shareholders as lenders force them raise capital at a distressed rate. Especially for capital-intensive businesses, debt can be a valuable tool in a business. It is important to evaluate how much debt a business has by looking at both its cash and its debt together.

Check out our latest analysis of China Everbright Environment Group

What is China Everbright Environment Group’s Net Debt Situation?

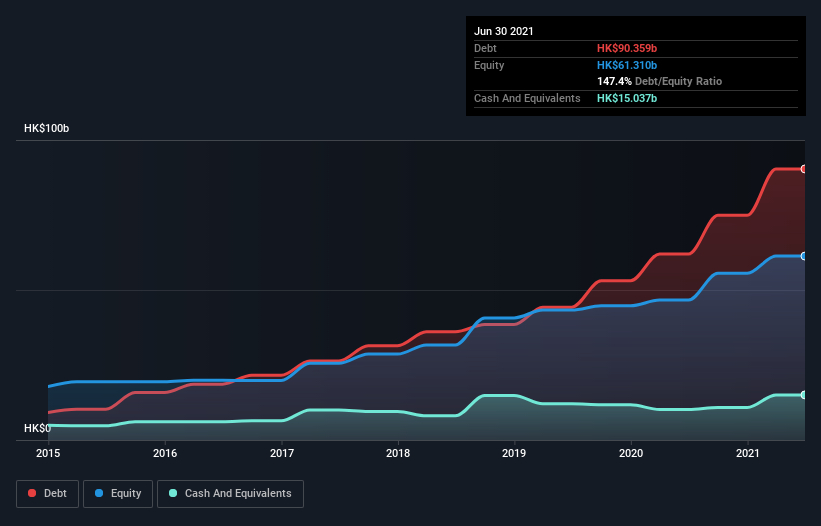

Click on the image below to see a larger version. At June 2021, China Everbright Environment Group had HK$90.4b in debt, an increase of HK$62.0b in a single year. It does however have HK$15.0b of cash to offset this, resulting into a net debt of HK$75.3b.

How Healthy is China Everbright Environment Group’s Balance Sheet

If we zoom in on the most recent balance sheet data, it can be seen that China Everbright Environment Group had liabilities totalling HK$35.3b due within 12 month and liabilities totalling HK$87.9b beyond that. It had cash of HK$15.0b as well as HK$29.5b in receivables that were due within a year. Its liabilities are HK$78.7b higher than its cash and short term receivables.

The HK$36.4b company is weighed down by this deficit. It’s almost as if a child was struggling to lift a huge backpack full of books, sports gear, and a trumpet. We would monitor its balance sheet with a great deal of concern. China Everbright Environment Group would likely need major re-capitalization to meet creditors’ demands.

We calculate a company’s debt burden relative to its earnings power by taking its net debt and dividing it by its earnings (EBITDA). Then we calculate how easy its earnings (EBIT) can cover its interest expense (interest coverage). We consider debt relative to earnings with and without amortization and depreciation expenses.

China Everbright Environment Group’s net debt to EBITDA ratio is 5.1. It is fair to say that it has a lot of debt. The good news is that it has a comfortable interest cover of 5.6 times. This suggests it can responsibly service its obligations. It is worth noting that China Everbright Environment Group has seen its EBIT grow like bamboo after rain, increasing 30% over the past twelve months. This will make it easier for the company to manage its debt. The balance sheet is a good place to start when analyzing debt levels. The future profitability of the company will ultimately determine if China Everbright Environment Group is able to strengthen its balance sheets over time. If you are focused on the future, you can see this. FreeReport showing analyst profit forecasts.

The last thing is that while the tax-man may love accounting profits, lenders only take hard cash. We always verify how much of that EBIT can be converted into cash flow. China Everbright Environment Group spent a lot over the last three-years. Although investors may expect a reversal of the situation in the future, it clearly indicates that debt is more risky.

Our View

To be honest, both China Everbright Environment Group’s conversion of EBIT into free cash flow and its track records of keeping on top of its total debt make us uncomfortable about its debt levels. We are encouraged by its EBIT growth rate, which is a positive sign. We believe that China Everbright Environment Group’s balance sheet poses a significant risk to the company. We are cautious about the stock and recommend that shareholders keep an eye on its liquidity. When analysing debt, the balance sheet should be your main focus. But, the balance sheet does not contain all investment risk. Far from it. Here’s an example: 1 warning sign to China Everbright Environment GroupThese are the things you need to be aware of.

If you feel that you want a fast-growing company with solid financials, then take a look at our list of net cash growth stocks.

Give feedback on this article Are you concerned about its content? Get in touchGet in touch with us. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St has a general nature. We provide commentary based only on historical data, analyst forecasts, and are not intended as financial advice.This does not constitute a recommendation for you to buy or sell any stock. It also does not consider your financial goals or financial situation. We strive to provide you with long-term, focused analysis based on fundamental data. Please note that our analysis may not include the latest price-sensitive company announcements, or qualitative material. Simply Wall St holds no position in any stocks.