Life Insurance

Sun Life Financial Inc.

SLF

Lincoln National Corporation

LNC

Voya Financial Inc.

VOYA

Primerica Inc

PRI

American Equity Investment Life Holding

AEL

About the Industry

Zacks Life Insurance is a group of companies that offer life insurance and retirement benefits to individuals or groups. Annuities, whole- and term life insurances, accidental death insurance, Medicare supplements, long-term health policies, and whole- and term insurance are just a few of the products. The increasing demand for protection products is a benefit to sales. Companies offering wealth and asset management services are also part of this industry. As baby boomers age, the demand for retirement benefits has increased. According to IBISWorld’s report, the U.S. Life Insurance & Annuities Market worth $909 billion is expected to grow by 2.5% in 2022. New virus variants are a concern despite increased vaccinations and an optimistic outlook for economic growth from the Fed. Technology has been adopted at an accelerated rate in the industry.

Three Trends That Will Shape the Future of the Life Insurance Industry

A low rate environmentBecause of their rate-sensitive investments, life insurers are more susceptible to interest rate risks in low-interest rates environments. Low interest rates can negatively impact life insurance companies’ earnings, capital, reserves, liquidity and competitiveness. Life insurers’ income from investments can become insufficient to meet contractually guaranteed obligations. To combat this, they are diversifying their funds into other investments, such as private equity, hedge funds, real estate, and others. Life insurers are also at risk from the increasing incidence of COVID-19. However, the Fed has indicated several rate increases this year. Life insurers, who are the direct beneficiaries of an improving rate environment, stand to gain.

Product DesignIndustry players are looking for new ways to keep their sales and profitability in the current low interest rate environment. Insurance companies are not selling life insurance with a long term duration. Life insurers continue to offer investment products that combine guaranteed retirement income, life, and healthcare to meet the needs of customers who prefer policies with living benefits over those with death benefits. The life insurance industry continues to benefit from increased awareness after the pandemic. A compelling product portfolio will help life insurers increase their sales. According to Deloitte Insights in 2022, the life insurance premium should increase by 4%

Technology adoption has increasedThe COVID-led disruption has seen a rapid adoption of technology in the life insurance industry. Previously, it had been largely operated manually. Companies are now using electronic applications, electronic signatures, and electronic policy delivery. This technology transition will allow it to withstand the coronavirus-induced difficulties. Online policies were offered by carriers that appeal to tech-savvy customers. The use of real-time data makes premium calculation simpler and reduces risk. Automation is expected to increase premium growth and efficiency. Additionally, life insurance companies will be able to reduce operational costs and expand their margins by incorporating artificial intelligence, robotic process automatism, cognitive intelligence, and Blockchain in their operations.

Zacks Industry Ranking Indicates Bleak Prospects

The groups Zacks Industry RankThe Zacks Rank of all member stocks is essentially the average. This indicates that there are positive prospects for the near-term.

The Zacks Life Insurance Industry, part of the wider Zacks Finance Sector currently has a Zacks Industry Rank #233 which places it in bottom 8% among the 255 Zacks Industries. Our research shows that the top 50 percent of Zacks-ranked industries perform better than the bottom half by a factor of more then 2 to 1.

The bottom half of Zacks-ranked industries ranks in the bottom 50% is due to a poor outlook for earnings for all constituent companies. Since November 2021, the industry’s 2022 earnings estimate has fallen 3.9%.

Before we present a few stocks of life insurance that you might consider adding to your portfolio, let’s look at the sector’s recent stock-market performance as well as its valuation picture.

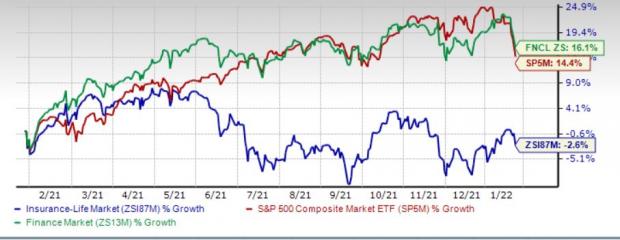

Industry Lags Sector & S&P 500

In the last year, the Life Insurance sector has performed below its sector and the Zacks S&P 500 Composite composite. This industry’s stocks have collectively lost 2.6% compared to the Finance sector increase of 16.1%, and the Zacks S&P500 composites rise by 14.4% over the same time frame.

Performance of the One-Year Price

Current Value for the Life Insurance Industry

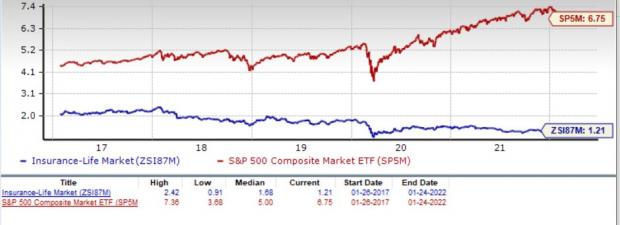

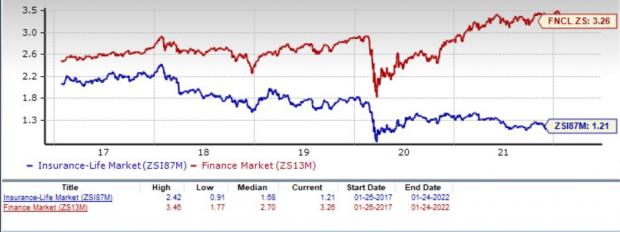

The industry is currently trading at 1.22X on the basis of trailing 12-month Price-to-Book (P/B), which can be used to value insurance stocks. It is currently trading at 1.22X, compared to the S&P 500s 6.73X, and the sectors 3.26X.

The industry traded at a median of 1.75X over the past five year. It has traded as high or low as 2.42X, 0.91X, and as high as 1.75X over the past five years.

Price-to-Book (P/B) Ratio (TTM)

Price-to-Book (P/B) Ratio (TTM)

5 Life Insurers to Keep in Your Portfolio For Better Returns

Five stocks in this space currently have a Zacks rank #3 (Hold). You can see The complete list of today’s Zacks #1 rank (Strong Buy), stocks can be found here.

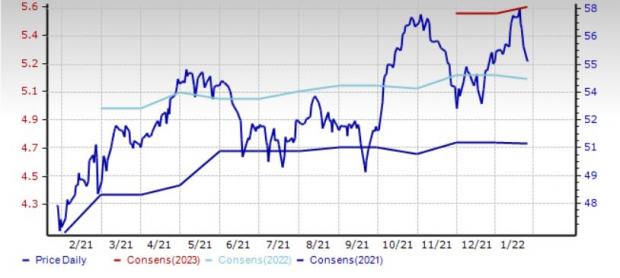

Primerica: With a strong business model, this second-largest North America issuer of term life insurance coverage is well placed to serve the rising demand for financial security from the middle market. The solid demand for protection products will continue to drive policy persistency and sales growth. Primericas U.S. mortgage distribution company is also growing in popularity. PRI is still focused on expanding distribution.

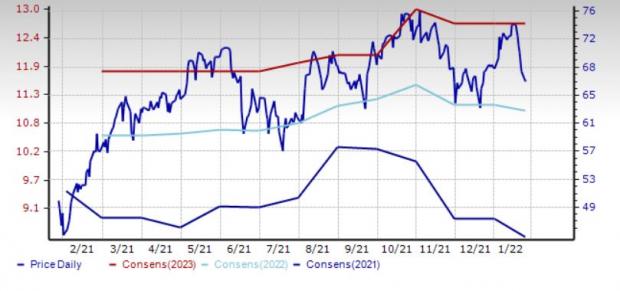

The Zacks Consensus estimate for Primericas 2022 earnings is 13.3% higher year-over–year. Primerica had an average earnings surprise (3.26%) in the last four quarters.

Price and Consensus – PRI

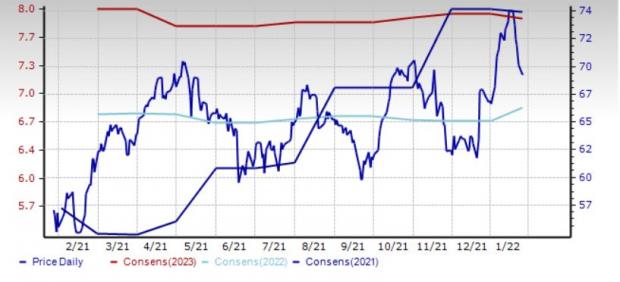

Lincoln National: The strong performance of the Life Insurance section is expected to propel this diversified investment management and life insurance company to greater heights. Lincoln National has been making changes within its sales mix in order to emphasize sales without long term guarantees to improve profitability.

The Zacks Consensus Estimate of Lincoln Nationals 2022 earnings shows a 28.9% increase year-over-year. The industry average of 17% is lower than the 33.3% expected long-term earnings growth rate. Lincoln’s average earnings surprise was 2.11% over the preceding four quarters.

LNC Price and Consensus

Sun Life Financial: Canada’s third largest insurer is poised to benefit from an attractive Asia business, a growing global business in asset management and a favorable business combination. SLF is also expanding its global base, and in Asia’s fastest-growing and largest markets. Sun Life projects a medium-term ROE of 16% due to the shift towards fee-based capital-light business models.

The Zacks Consensus Estimate of 2022 earnings shows a year-overyear increase in earnings of 8.9%. The expected long-term (3 to 5 year) earnings growth rate is 9%. Sun Life’s average earnings surprise was 7.74% over the past four quarters.

Consensus and price of SLF

Voya FinancialThis investment, retirement and employee benefits company in America is poised to grow due to its focus upon high-growth, high return, capital-light business models, solid market presence, cost savings, and strong market presence. VOYA anticipates an adjusted EPS growth rate of 12-17% between 2024 and 2024.

Voya Financial had an average earnings surprise rate of 9.86% for the four preceding quarters. The Zacks Consensus Estimate 2022 earnings has risen 2.4% over the past 30 Days.

Price and Consensus VOYA

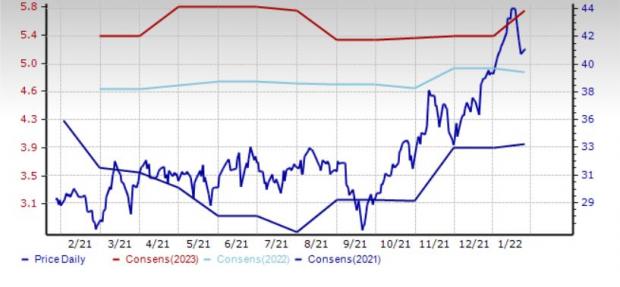

American Equity Investment Life HoldingThis market leader in fixed index and fixed rate products sales expects to increase fixed index product sales to $6 billion by 2022. This fixed index annuity producer is still a leader in the independent agent channel and continues to expand into middle-market credit, real estate, infrastructure loans, and agricultural loans. American Equity Investment believes that its mix of fees revenues would support a higher return business profile and aim above 15% in return-on-equity on an average over a long term.

The Zacks Consensus estimate for American Equity Investments 2021 earnings suggests a 48.3% year-overyear increase. In the four preceding quarters, AEL delivered an average earnings surprise (31.49%).

AEL Price and Consensus

America’s Infrastructure Stock Boom Will Take Hold

The massive effort to rebuild the crumbling infrastructure of the United States will soon be underway. It is bipartisan, urgent and inevitable. Trillions of dollars will be spent. Fortunes will be made.

The question is: Will you get in on the best stocks early, when they have the greatest growth potential?

Zacks has created a Special Report to assist you in this endeavor, and it is available for free today. Find 5 companies that are looking to make the most of construction and repair of roads, bridges and buildings. Plus cargo hauling and energy conversion on an almost unbelievable scale.

Download FREE: How To Profit From Trillions On Infrastructure Spending

Click here to download this free report

Sun Life Financial Inc. (SLF: Free Stock Analysis Report

Lincoln National Corporation (LNC), Free Stock Analysis Report

American Equity Investment Life Holding Company: Free Stock Analysis Report

Primerica, Inc. PRI: Free Stock Analysis report

Voya Financial, Inc. (VOYA),: Free Stock Analysis Report

Click here to see this article on Zacks.com

The views and opinions expressed in this article are those of the author and not necessarily those of Nasdaq, Inc.