Author’s Note : This is about the native Canadian FNV ticker. All dollar amounts are in Canadian dollars.

chonticha wat/iStock via Getty Images

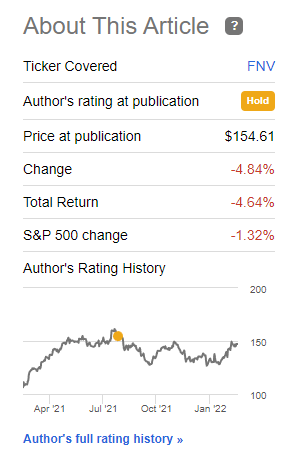

Franco-Nevada Corporation (FNV), is a business that I wrote about a few months ago. It is “my choice” in terms of gold. However, I considered it to be extremely overvalued and opted for the “HOLD” stance.

This has been proven to be the right decision since the publication of that article. FNV has clearly underperformed.

Franco-Nevada Corporation Article (FNV IR)

Revisiting Franco-Nevada Corporation

Franco-Nevada, as I stated in my first piece, is a play on the ownership of royalty streams and gold mining. It also includes other types of precious metals. Its double-listings, dividend yield and correlation to gold prices make it one the most popular gold-type investments.

This article contains basic information about Franco-Nevada.

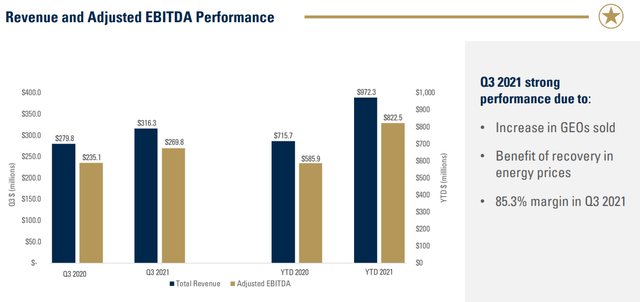

The most recent numbers we have are the 3Q21’s. This means that the company hasn’t yet reported FY results. Let’s still look at the numbers and forecasts for the company.

The company’s 3Q21 numbers are positive YoY.

Franco-Nevada Presentation (Franco-Nevada IR)

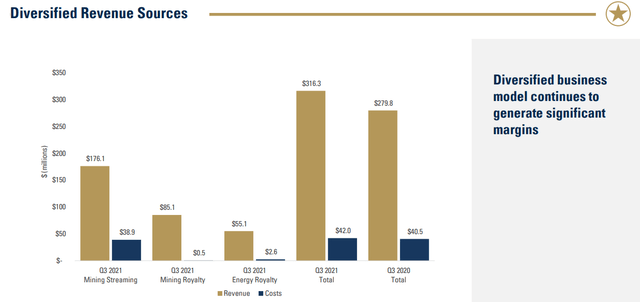

Additionally, the company’s split of income is still attractive, with a heavy focus in Mining Streaming incomes.

Franco-Nevada Income (Franco-Nevada IR)

It is evident that the company’s business generates a lot of cost trends if you look at them. Very highThis margin is not as high as gold costs, and the cost structures are not increasing. This means that when gold cost $1470, it cost $276. Now, at $1789, it costs $269. The company’s cash flows, which are forecastable and very reliable, are consistent regardless of spot price for gold.

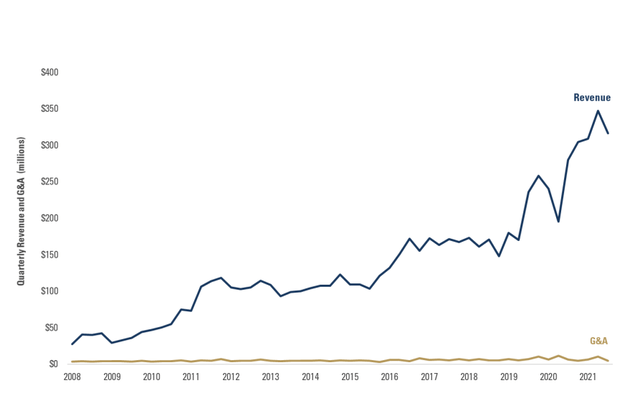

FNV is a cash-efficient, low-cost operation that continues to excel in terms of SG&A and comp expenses. G&A is a small percentage of revenues, which is quite impressive considering the overall revenue.

The company has developed or operates a model that allows them to pay almost the same G&A expenses for nearly $400M in revenue as they did when it was $50. That is quite remarkable.

FNV G&A costs (FNV IR).

It is impressive because it shows company scalability.The company continues its appeal as an asset diversification company as well as income diversification company. Although the company is known for being a gold-focused company, 91% or more of its revenues come from South and North America. The company offers asset diversification and attractive operator diversification. The company’s largest operator contributes less than 17% of its annual revenues. Current guidance calls for an increase of overall revenues from both mining and energy.

FNV is a well capitalized business. Although it doesn’t have a credit score, I don’t believe it matters.

Why?

Because Franco-Nevada is debt-free.It has a $1.1B facility but it isn’t drawn. It also has a $567.8M cash balance, which means it has capital available of more than $1.6B and has 0% long-term capital debt.

This means that the company is in a great position to capitalize on the current market situation.

The quite literal Only problemFranco-Nevada really is the premium. We’ll get into this more later, but I want you to remember how important it is to have a margin for safety in any investment that you make. FNV is a good example of this volatility.

I believe that the best way to protect any investment is to buy it cheaply and of high quality. This gives them the confidence to navigate a high beta. Since the COVID-19 collapse, Franco-Nevada’s overall beta has been very high.

However.

Recent results have been excellent. I expect 2021 results will be outstanding and an increase in adjusted EPS of 25-32% YoY. This company will continue to grow in a world that places safety first.

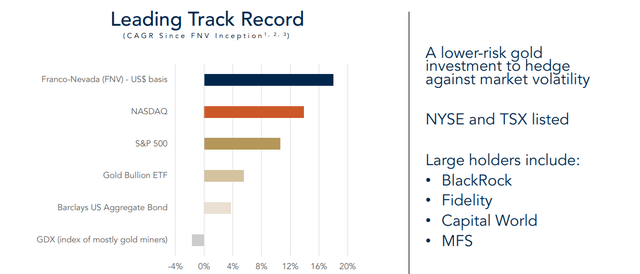

Franco-Nevada Track Record (Franco-Nevada IR)

Franco-Nevada – The valuation

Let’s get to the heart of the matter. The company’s valuation is still at an unworkable level. The geopolitical situation in Europe, and frankly the rest, is causing gold to be of strong interest. However, it is not clear how long or large this premium will continue to be.

I don’t see this ending well for someone who invests today – much the same way I didn’t see that ending well about one year ago.

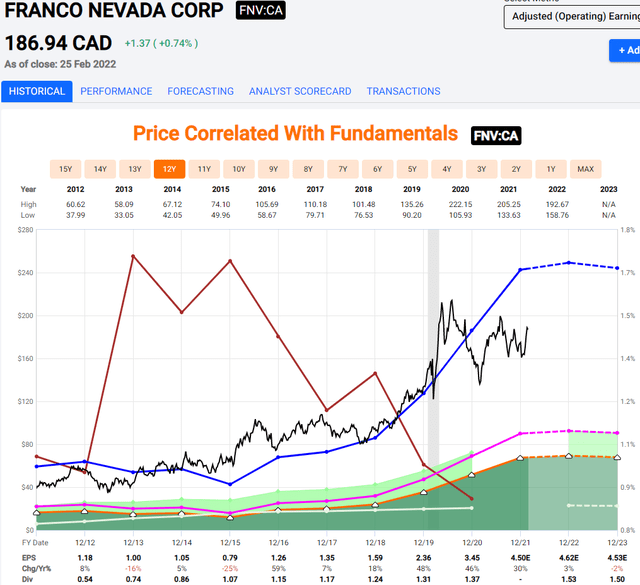

Franco-Nevada Corporation (F.A.S.T graphs)

The company is witnessing increased income and EPS trends, which is undoubtedly a positive sign. The company’s bullish view is that the historical Premium of well over 52-55X will be applied. It’s theoretically possible but I don’t see any relevant catalysts or potential for such development.

The company is trading at a level that is well above the $161 target of 11 analysts. This is despite the fact that the analyst following it doesn’t see the catalyst for such an event. S&P Global estimates that $191 is the highest valuation possible, but it doesn’t give us the historical P/E premium which would be closer than $250/share.

Even today’s price is indicative of a Price/NAV per-share premium 2.5X.This is something that I find difficult to understand or take seriously. FNV is something I gravitate towards the lower end. It doesn’t need to be below $110 to me to buy. But, I would prefer to see a sub$130 target before I engage in “BUY”.

The company is therefore significantly overvalued at $160. I would not consider buying it.

FNV can be compared to a few publicly traded comps. These include Wheaton Precious Metals, Royal Gold (RGLD), Osisko Gold Royalties(OR), and other similar businesses. FNV trades at a significant 10X+ premium over these.

Based on NAV, P/E and public comps I believe it fair that FNV trades for a significant premium that makes them almost uninvestable.

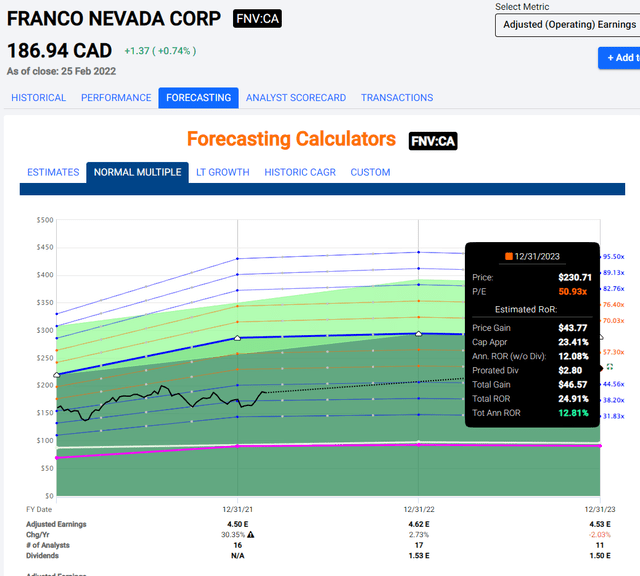

Even if the company manages 50X+ P/E, your annual returns would be just 12.8% until 2023. This may sound high, but consider what P/E ratios your capital is being invested in. This is not a very appealing situation.

Franco-Nevada Upside (F.A.S.T graphs)

The bullish thesis that so-called “gold bugs” will continue to push here is certain. I will repeat what I have already said about this company. This is how I would buy Gold if I could. A ProvenCompany with solid fundamentals that provide a certain amount of correlation to the spot gold price. I would not buy bullions or coins, or any other form of gold. This is how I would do it.

But, I would like it to be at the minimum I could consider. Borderline fair price. That’s not the case right now.

My PT is $130, at the most, and preferably lower.

Thesis

My summary thesis for Franco-Nevada Corporation reads:

- This company is “my way” of investing in Gold, at least once the price is correct. This is not the case at the moment. I would wait until the company is less expensive before buying.

- Franco-Nevada is free from debt, has plenty of cash, and has excellent fundamentals. This is a great business to invest in, but only at the right price.

- FNV is considered a “HOLD” by this investor. Based on my goals, I would consider $130/share to be attractive for investment. But every investor needs to evaluate their own goals, targets, and strategies. Before making such investment decisions, I would consult with a finance professional.

Remember, I am all about:

1. Buy undervalued companies, even if they are not mind-numbingly huge, at a discount. This allows them to normalize over time, while also allowing them capital gains and dividends.

2. If the company is valued above normalization, I will harvest the gains and invest in other undervalued stocks.

3. If the company does not go into overvaluation but is within a fair price range or falls back to undervaluation I will buy more.

4. I reinvest dividends, savings from work, and other cash inflows according to #1.

This has allowed me to triple the value of my net worth in less that 7 years. I plan to continue doing this even if I don’t expect the same rate of return over the next few years.

If you are looking for significantly higher returns, I may not be the right person for you. If you are looking for 10% yields, then I’m not the right person for you.

If you are looking to grow your wealth conservatively, safely, and earn well-covered dividends all while growing your money, I might be the right person for you.

We are grateful for your time.