Market volatility constraints are the foundation of many trading strategies. These strategies/systems are designed for certain market volatility levels, according to technical specialist. Chris Vermeulen, editor of The Technical Traders.

If markets experience excessive volatility, strategies can lead to excessive losses or risks.

Many system developers seek to develop quantitative features to allow them to adapt their strategies to fluctuating volatility levels. Many system developers adjust entry sizes, stop levels and target levels to deal with increased trading risk due to extreme volatility events. These processes are limited in their ability to accomplish certain things.

Increased Market Volatility Causes Havoc and Extreme Risi for Most Strategies

Excessive volatility could lead to huge risks and possibly destroy the ROI of a trading plan. It can be difficult for traders to adjust their strategies to higher volatility and still manage to reduce the extreme risk associated with extreme volatility. Today we will look at ways traders can adjust to the dramatic increase in volatility expected to continue into 2022.

Current volatility in the US markets is more than five-times that of 20162017. This Weekly S&P500 Volitility Indice (VIX) Chart highlights the increase in Normal Range and Upper Threshold VIX over the last four years. The average VIX range has increased from 8.0 – 12.0 in late 2017, to more 18.0 – 25.0 in 2017. This is a two- to three-fold increase over the VIX ranges that were lower in the past decade.

VIX levels higher than 10.0 or 11.0 were considered high volatility. Those same levels would now be considered very moderate volatility. Large volatility occurs when the VIX rises above 16.0 to 18.0. When the VIX is above 19.0, excessive volatility can occur.

System/strategy traders may have been exposed to high levels of market volatility after Covid. Unless traders were prepared for increased market volatility and were able to adapt their strategies quickly over the past 12+months, the end 2021 could have a devastating effect on system traders’ returns. Some systems have found it difficult to deal with the large market price movements over the past six months of 2021.

The Volatility Rises in Recent Times as Evidenced by the Average True range

This Weekly S&P 500 ETF trust(SPY), chart highlights market volatility that has increased over the past eight and a half years. Notice how the peaks in ATR occur during market corrections/pullbacks. This is because market volatility tends to increase quickly in downtrends/pullbacks, and then settles in moderately uptrends.

These dates were the peak for ATR on the SPY chart.

June 2010: 5.01

December 2011: 6.35

February 2016: 7.14

April 2018, 8.05

December 2018: 10.55

April 2020: 18.80

Could we see ATR rise to 18.80 if the US/global markets rolled over sometime in 2022, possibly due the new Omicron viruses or other global market events? What would that look for global markets? What would your trading strategy/system be able handle such an event? Are you ready to handle a massive volatility spike?

Adapting to Market Volatility Efficiently

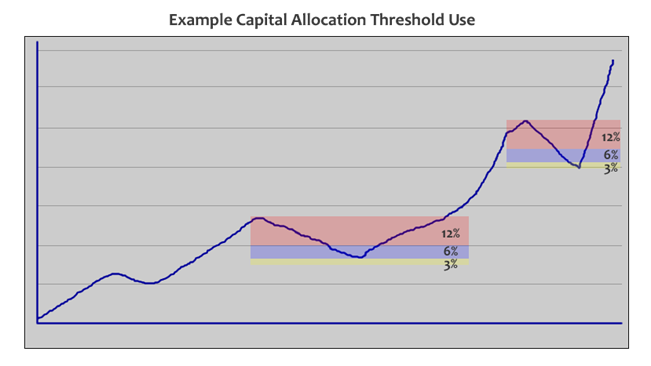

If your strategy cannot adapt to increasing volatility efficiently, there’s one simple rule you can apply to help you keep capital in your system as volatility spikes occur. It’s called the Capital Allocation Threshold.

It is simple to use and deploy while it creates a very efficient “move to cash” process to avoid excessive risks in a naturally progressing process. If volatility spikes adversely affect trading strategies, you will set draw-down thresholds based on the highest equity peaks in your system.

These Capital Management System Rules are Simple

As your system progresses, track the highest peak.

- Whatever the level, set a set of draw-down thresholds to prevent capital from being pulled away from your strategy.

I would suggest a threshold of 12% to 6% and 3% to begin with.

- A 10%, 5% or 2.5% threshold could also be used, but market rotations typically range from 7.5% to 12.5% on average. The more tight you make your thresholds, the more likely they will be reached in extreme volatility events.

You can simulate a backtest of your strategy in order to make decisions based off the Capital Allocation Threshold process.

- So, when your strategy experiences higher returns, you can capitalize on them more efficiently and still execute efficient capital controls related risk.

If your equity curve falls below the first threshold, e.g. 12%, then you should reduce your trading allocation by 50%.

- If you had $100k to trade with, all future trades would be cut to $50k.

If your equity curve falls below the second threshold of 6%, then you can reduce your trading allocation by 50%.

- If you had $50k to trade with, all future trades would be cut to $25k.

If your equity curve is below the third threshold of 3%, then reduce your trading allocation by 50 percent.

- If you trade with $25k, all future trades would be cut to $12.5k.

Stop trading your system if your equity curve falls below the last threshold (the bottom of the 3% threshold).

- Wait for the pullback to end before you allocate capital again to your strategy. The equity curve will recover to within these thresholds.

Re-Allocating Equity as Your Strategy Recovers

As your equity curve begins to recover and move higher, you would begin to deploy higher capital allocation levels as the equity curve moves up into the higher thresholds–eventually moving back to 100% full equity allocation. As your strategy recovers and moves to new heights, you can deploy more capital.

This simple capital preservation strategy will help you quickly understand how it works to protect capital and allow your strategy to withstand volatility and other risk events. At the first stage, we protect 50% of your total trading capital. 75% of the total trading capital is protected at the second level. At the third stage, we will protect 87.5%. Below that, 100% of your remaining capital is being protected so you can learn how to survive these volatile events and continue trading in a near future.

Properly balanced trading strategies in volatile events: The benefits

Let’s say you have a strategy that works well in extreme volatility situations. If that is the case, your strategy will likely adapt to the volatility we are currently experiencing.

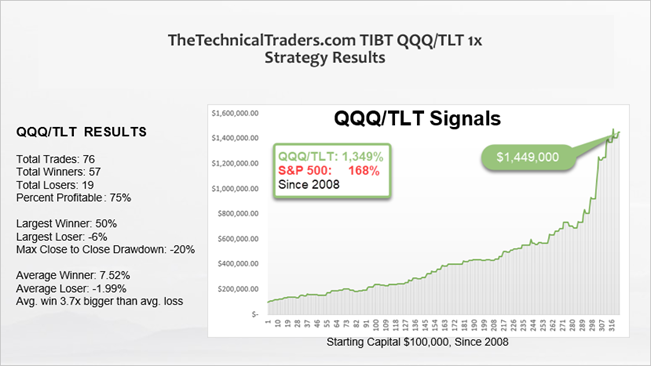

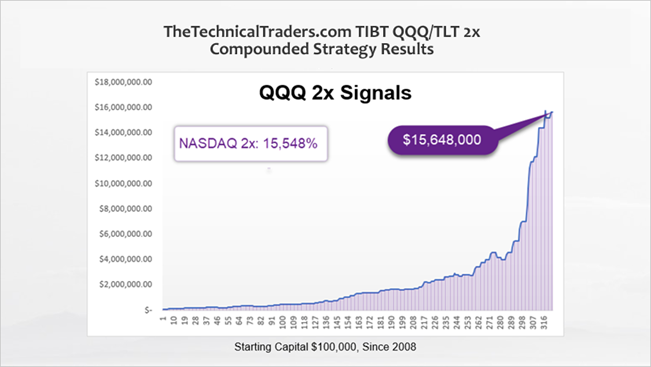

I wanted you to see how volatility can help improve your strategy results, if you have a well-balanced strategy risks and reward. Let’s take a look in two charts. Powershares QQQ trust (QQQ) & iShares 20 Year Bond (TLT) using the same strategy. The first is a QQQ/TLT one-time strategy and the second is two times QQQ/TLT. You can see how market volatility has significantly improved the results for the two-times QQQ/TLT strategies over the past five years.

This is the positive side effect of balancing risk within a strategy in order to allow your system to attempt volatility events.

Pay attention to the speed with which the two equity curves for a one-time strategy and a two-time strategy can use current market volatility to generate gains faster than pulling capital out of the markets. We developed advanced quantitative solutions that balance volatility, risk, and capital allocation to make this strategy possible.

Strategy/system traders may find volatility a great benefit. It continues to be a challenge for strategy/system designers in managing risks. We hope our Capital Allocation Threshold Example helps you to overcome this issue. It will also help you trade volatility more efficiently and protect your capital during major market changes.