undefined undefined/iStock via Getty Images

The Fed’s year-long rate hike program is a reason to move to larger companies. This is not a time for the iShares S&P MidCap ETF (NYSEARCA:IJH).

Because of the increase in data showing that Long-term, active management does not perform wellETFs are now the backbone of most portfolios. These funds allow investors the ability to target broad indexes such as IJH. To broadly track mid-cap stocks

The iShares S&P Core Mid-Cap ETF seeks investment results from an index that consists of mid-capitalization U.S equities.

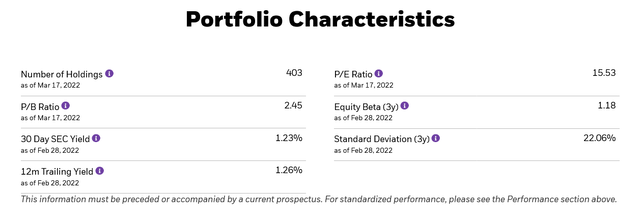

Here are the ETF’s fundamental characteristics:

IJH characteristics (BlackRock).

The beta is high and the yield is low. Both are suitable for mid-cap stocks. They are an asset class that sits between small and large-cap stocks (which are pure growth play) as well as large-caps (which have higher yields but lower volatility).

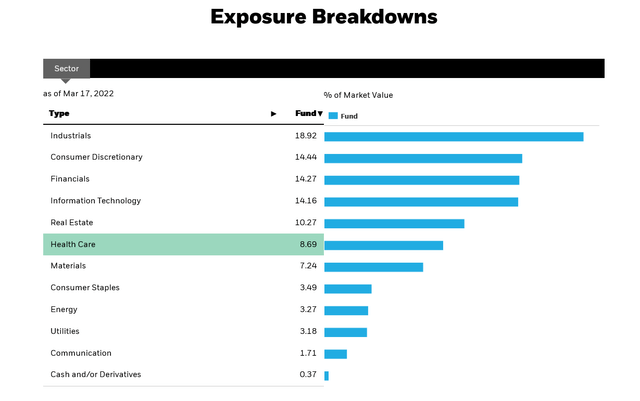

Here’s the breakdown of the sectors in ETF:

IJH sector breakdown (BlackRock).

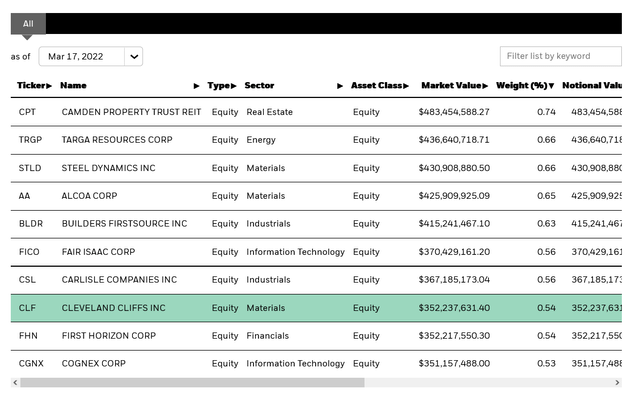

Here are the top ten holdings:

IJH 10 largest holdings, BlackRock

None are greater than 1%.

When analyzing an ETF, my standard method is to first examine the macroeconomic background, then to analyze the fund’s performance relative it to its peers and finally to review the ETF’s charts.

I used the long-leading and leading methods to analyze the US economy in a piece I wrote on the IWC March 11. Most of the analysis is still valid. Yesterday, I presented more recent economic data in my weekly market overview. Refer to that article for more information on retail sales, industrial production, and the rising financial stress.

Today I’ll take a look at the service and manufacturing sectors as described in the Markit Economics monthly releases. Both reports combined described the entire US economy. (The author has granted permission to use the most current ISM report.

Here is the summary of the most recent ISM Manufacturing report

Fiore states, “The U.S. Manufacturing sector remains in an environment that is demand-driven and supply-chain-constrained.” There was still a significant impact from the COVID-19 Omicron variant in February. However there were signs of relief and recovery is expected for March. Early retirements and quits continued to be higher than usual. The panel sentiment was positive and optimistic with 12 positive growth comments per cautious comment. This is an increase from January’s ratio which was 7-to-1.

Although still positive, Markit Economics’ Manufacturing report was A little bit more negative

After the Omicron wave in January brought production to a halt, the US manufacturing sector saw a rebound in February. Despite some signs of improvement, output is still limited by ongoing supply bottlenecks and labor shortages. As we move into spring, the decline in virus cases should help to alleviate labor shortages.

“Demand continues to rise well ahead supply, meaning it’s a sellers’ market for many goods. The survey’s price gauges that measure companies’ costs and selling price are not at the peak seen last year but they are still very high and suggest that there will be continued elevated inflation. The inflation outlook is becoming more concerning due to rising oil prices and the Ukraine crisis, which are likely to cause supply disruptions around the world.

Both reports have very similar analyses: supply is still limited and demand is strong.

Let’s now look at the service sector. Starting with the ISM report

Nieves continues: “According to Services PMI, fourteen industries reported growth. After a two-month contraction in April 2020 and May 2020, the composite index showed growth for the 21st consecutive monthly. Despite some pullbacks in the Services PMI indexes, February saw growth for the service sector. The sector has seen an increase for all but two months of the last 145. Respondents continue being affected by supply chain disruptions. Capacity constraints, inflation and logistical challenges. These conditions have impacted the ability of panelists to meet demand, leading in a cooling of business activity and economic growth.

The Markit Economics Analyses are similar:

The US service sector reported a strong rebound in business activity in February, as virus containment measures were relaxed to their loosest since November. These data, along with evidence from manufacturing surveys, show that the Omicron wave appears only to have had a small and short-lived affect on the economy ……”Supply chains bottlenecks and low labor availability remain significant constraints on output, however they are limiting economic growth in manufacturing. This means that prices continue to rise at unprecedented rates.

The service sector is experiencing strong demand, but also supply problems, just like the manufacturing data.

The economic conclusion is that the US is still in a good place. Demand is strong. Supply is still having issues, which is leading price pressures.

Let’s now examine the IJH performance relative to a peer set of index-tracking eTFs. This is the IWC, IWM and QQQ.

| Week | Month | 3-Months | 6-Months | 1-year | |

| IJH’s Relative Performance | 5th | 3rd | 1st | 1st | 5th |

Data from Finviz.com

The IJH was a top performer over the 3- and 6-month time frames. However, it performed weaker over the long-term and in recent time frames.

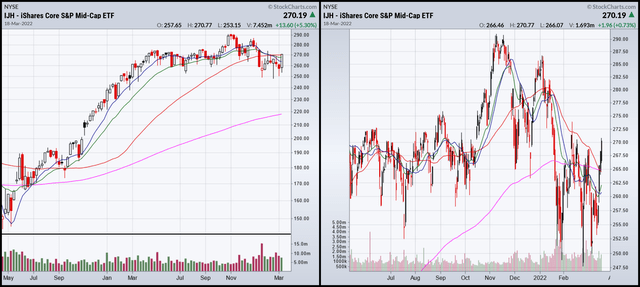

Let’s look at these two charts.

IJH weekly (Stockcharts).

The weekly chart (left), shows how the IJH has traded sideways from last Spring. The daily chart (right), shows prices that have dropped below the 200 day EMA. They have only recently moved above this level.

This chart is not favorable. Recently, prices have consolidated below the 200 day EMA. The shorter EMAs now fall below the 200 day EMA, which is also trending lower.

Let’s add another wrinkle to this analysis. The Fed just started a year-long program for increasing interest rates. This is a bad environment for an index that is more concerned with capital growth.

Transfer assets to larger, established companies. This is not the right time for IJH.