Mlenny/iStock via Getty Images

Morgan Stanley analysts Betsy Graseck & Michael Cyprys list the bank they work for, as the Federal Reserve signaled a March increase in interest rates.Retail broker chooses to work in a rising rate environment

They wrote in a Feb. 4 note that they needed to clarify that “Overweight banks and diversified finance are required for the 10-yea yield rises.”

Analysts stated that banks and diversified finance have been the only two sectors to outperform Top 100 equities over the past 10 years in periods of rising nominal and breakeven 10-year yields and rising real 10-year returns.

“This is crucial. “This is important. Our rates strategist expects real yields to rise from the current -58bp to -10bp by Year 22. This is below the pre-Covid midteens levels,” Graseck, Cyprys stated.

They wouldn’t be surprised to hear that this is an understatement of the case against the backdrop of increased capex on-shoring and inflation and a higher nominal GDP of 8.4% and 5.4% in 2022 vs 4.5% pre-Covid (2017-2018).

They provide several ways to approach investing in order to take advantage higher rates and avoid certain risks.

- Rates increase bank and retail brokerEPS. A 50p increase in Fed funds rate will add 5% to 2022EPS. The range is 0-14%. The top three beneficiaries are Wells Fargo (NYSE:WFC), Charles Schwab (NYSE:SCHW), and LPL Financial (NASDAQ:LPLA). A 10bp increase in the 10-year yield will add a median 1%-2022 EPS to the average, with a range between 0-6%. That basket includes Wells Fargo, Bank of America, and Bank of America. (NYSE:BAC)Signature Bank (NASDAQ:SBNY).

- Analyzing how stocks have moved over the past 4 years relative to the change of the 10-year yields, and against changes made in Fed funds futures since September 2021, analysts concluded that the rate betas were highest for SVB financial. (NASDAQ:SIVB), M&T Bank (NYSE:MTB), Schwab (SCHW), Huntington Bancorp (NASDAQ:HBAN), and Bank of America BAC when measuring 10-year yields. Wells Fargo (WFC), and American Express when using Fed funds futures metric.

- Schwab (SCHW) and State Street are good options for investors who want to avoid credit risks. (NYSE:STT)Raymond James Financial (NYSE:RJF).

- Graseck and Cyprys suggest M&T Bank, MTB, and Schwab (SCHW) as ways to avoid equity market risks.

Here’s a graph comparing SCHW and WFC with BAC, MTB and LPLA over the past 10 year.

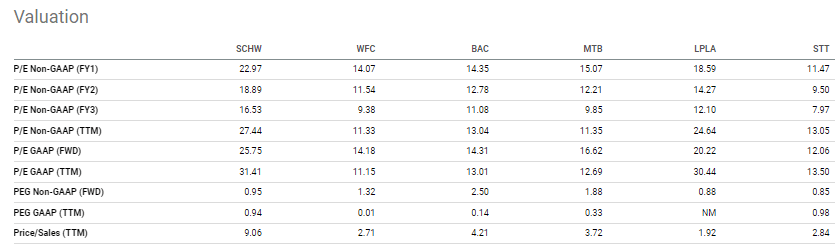

Compare valuations and other metrics for some of the companies mentioned in this article with the peer comparison tab.

Schwab (SCHW), last week discussed its increased spending plans in its Winter Business update.