Stock futures are being affected by volatility due to the intensification of conflict in Ukraine overnight and into Tuesday. There has been heavy bombardment by Russian forces of major cities.

Russian President Vladimir Putin, and his government, remain unaffected by the humanitarian crisis growing in the country and the threat of economic collapse that a mountain of sanctions will grow.

An environment that is more uncertain than usual can make it difficult for investors to navigate. It is important to remain optimistic about the future and the potential returns of their investments, according a Morgan Stanley team led by Mike Wilson, U.S. equity strategist.

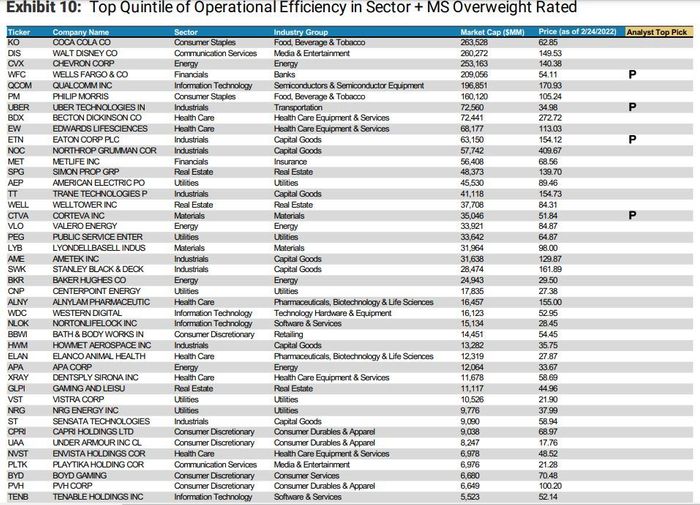

Check out our Call of the DayWilson and his team believe that the best companies are able to achieve operational efficiency.

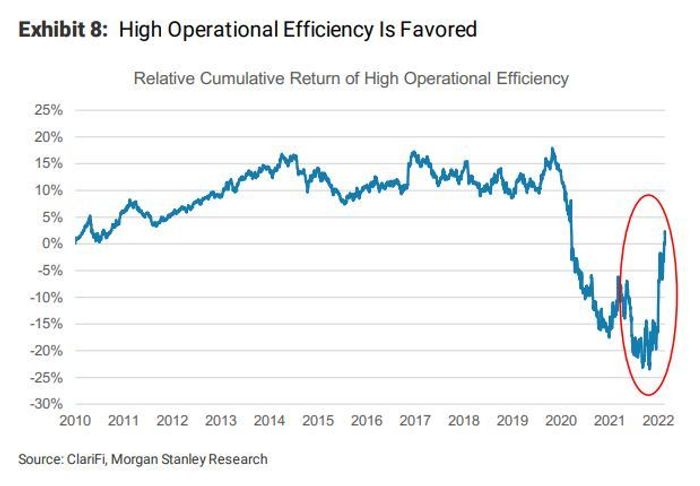

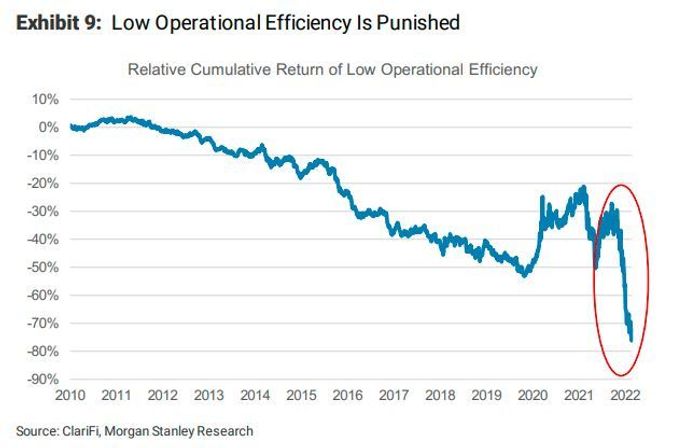

Wilson said that market prices are paying more for companies that are more likely to deliver earnings in a more difficult operating environment. Instead of growth or defensiveness the market wants operational efficiency. This is defined as low capex/sales and employee turnover.

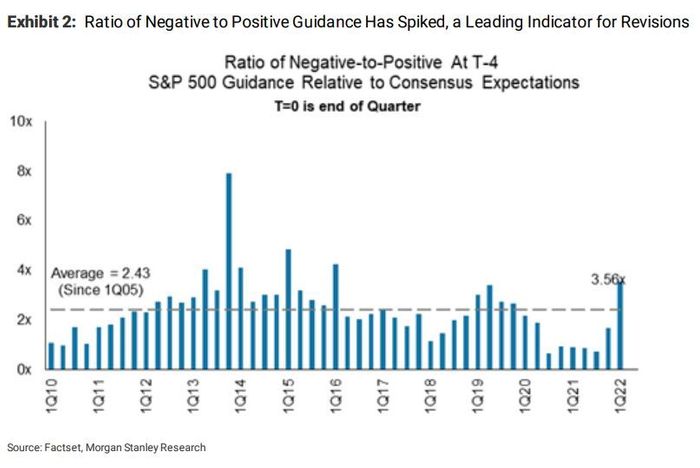

Wilson has a list that includes companies that meet this criteria. But, before we get there, Wilson is concerned about rising earnings risks. He said that the 1Q negative-to-positive ratio has risen to 3.6, which is the highest since 1Q16 when we were in a global manufacturing slump.

This ratio has never been higher than it was in the COVID-19 recession. However, earnings breadth is rapidly falling and is on its way to negative territory.

In an environment where valuations are high and earnings risk is rising it is important to last

As the Fed raises interest rates in March, it is likely that weeks tactical rallying in equities will lose momentum.

Wilson warned that earnings are starting to decline as wages begin to tighten in earnestand.

Wilson reiterated that companies will likely have more difficulty meeting earnings expectations than investors believe. This chart shows that operational efficiency is preferred.

Below is a listing of high achievers who are all part of the top 1,000 U.S. Stocks by market cap, have operational efficiency in top 20% of their respective sectors and are overweight at Morgan Stanley. Coca-Cola

KO,

Walt Disney

DIS,

Chevron

CVX,

Wells Fargo

WFC,

Qualcomm

QCOM,

You are at the top.

The buzz

As a huge Russian convoy closes in on Kyiv capital, bombing intensified in Ukraine’s second largest city Kharkiv. Experts warn that there will be more disturbing images and videos, even though Russian and Ukrainian delegates reached an agreement late Monday to continue negotiations.

Warner Bros. continues to resist this invasion from corporates

T,

Disney

DIS,

Stopping new Russian releases Currently, more than $500 billion worth Russian securities have been frozen.

Read: Ukraine continues to win information war

Target

TGT,

The retailer’s strong results and positive forecasts are driving the company’s growth. Kohls

KSS,

Dominos

DPZ,

AutoZone

AZO,

Salesforce will also provide reports

CRM,

HPE

HPE,

AMC Entertainment

AMC,

First Solar

FSLR,

Following the market close. HP

HPQ,

Following the results, it is also up

Chevron

CVX,

After the oil giant doubled its stock purchaseback plan to as high as $10 billion a Year, the company’s share price is on the rise.

The Institute for Supply Management manufacturing and construction indexes are due later. President Joe Biden’s State of the Union speech will follow, which will likely include coverage of the war, the economy, and COVID-19.

Fed fund futures have priced out the possibility that a 50-basis-point rate increase in March will occur as Fed Chair Jerome Powell’s appearance on Capitol Hill is looming for Wednesday.

The markets

Stock futures

YM00,

ES00,

NQ00,

oil and down

CL00,

As investors gravitate back to bonds, the trend is on the rise

TMUBMUSD10Y,

gold

GC00,

The dollar

DXY,

Bitcoin

BTCUSD,

After Monday’s rally in cryptocurrency, prices for other coins continue to rise.

Read:Cybersecurity stocks gain from fears of a significant rise in cyberwarfare due to Russian invasions of Ukraine

And:Russia may find it difficult to use cryptocurrency to evade Western sanction

The chart

The Russian ruble

USDRUB,

The company is trying to regain ground after the recent massive selloff. Here is a great explanation of what’s happening:

Uncredited

The tickers

These were the top-searched stocks tickers on MarketWatch at 6 a.m. Eastern.

Random reads

Ukrainian sports stars Enlisting to FightAnd the government plans to sell war bonds.

The first Mardi Gras fully dressed in New Orleans since 2020 has begun.

Need to Know is available early in the morning and is updated every hour until the opening bell. However, you can sign up here to have it delivered to your mailbox once you sign up. The emailed version of the Need to Know will be sent at approximately 7:30 a.m. Eastern.

You want more for the next day? Register nowThe Barrons DailyA morning briefing for investors with exclusive commentary by MarketWatch writers and Barrons.