Abstract Aerial Art/DigitalVision via Getty Images

It has been exactly one-year since we took a bullish stance on Triton International Limited (NYSE:TRTN). Our initial thesis was based upon the idea that Triton was an overlooked vehicleTo profit from the supply chain obstacles at the time. Similar to the shipping industry companies that have profited from logistical bottlenecks like Danaos Corp.DAC) and ZIM Integrated Shipping Services Ltd. (ZIMTriton also enjoys heightened leverage in current trading environments, which has led to higher earnings and increased shareholder value.

The stock’s performance since then has been very positive. Over the past year, shares have risen by more than 22%, beating the S&P500 by quite a bit. The company has also been rewarding us with increasing capital returns as well as a 4% yield.

Triton International Stock Performance (Seeking Al)

Triton’s Q1 results were published on Tuesday. They posted another quarter with record net income, a growing book value, and a strengthened Fleet Profile that is expected to continue generating strong cash flows over the coming years.

Additionally, the stock has outperformed, but its financials have improved at a much faster pace. This has meant that Triton remains undervalued despite its year-overyear gains. Triton shares currently hover around 9% above their 52-week peak, making it an attractive investment opportunity for both those who have stayed in the background and those who are looking to add to their portfolios.

Today, We are looking at The Following Topics

- Review Triton’s Q1 results, and the industry’s current state.

- Assess Triton’s capital return profile.

- Set a fair value multiple for the stock (update the price target) and discover the current upside.

Let’s go…

Market Latest Developments, Q1 Results

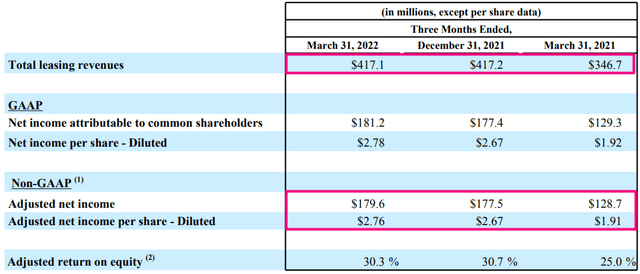

Triton’s Q1 results came in quite strong, beating consensus bottom-line estimates once again. Revenues increased 20.3% to $417.1million, while adjusted net income was $179.6million or $2.76 per share. This represents a 44.5% increase year-over-year, and a 3.4% sequential increase.

Triton International Q1 performance (Q1 Results).

Triton placed $3.6 billion worth container orders last year. This led the company to be called “Triton”. Expand its asset baseBy 30%. Triton’s fleet growth and the way in which finance lease payments were made led to revenue growth that was lower than asset growth.

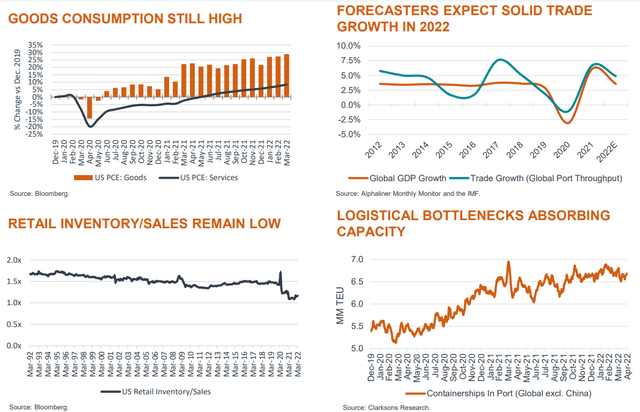

Despite macroeconomic concerns, goods consumption is still at record levels in the United States. Trade growth forecasts remain solid, despite these issues. Additionally, logistical bottlenecks continue to be high and retail inventories relative sales remain at subordinate levels. Triton’s customers continue to be focused on container availability, which has resulted in an exceptional utilization level. Specifically, the company’s fleet utilization stayed constant quarter-over-quarter, at 99.6%, or 50 basis points higher year-over-year.

Triton’s record utilization, record leasing margins and low effective interest rate resulted an annualized ROE at 30.3% in Q1. While the ROE remained fairly steady sequentially, it was still significantly higher than last years’s 25%.

Market Outlook

As I mentioned, we initially jumped on Triton because the company was one the beneficiaries of the supply-chain crisis at the time. Although everyone assumed that supply chains would be more open after the recovery from the pandemic, this has not been true. China’s recent tightening of security measures has resulted in a substantial backlog of container and cargo ships at Shanghai’s port.

Shanghai Ship Jam Causes Supply Chain Trouble (Statista).

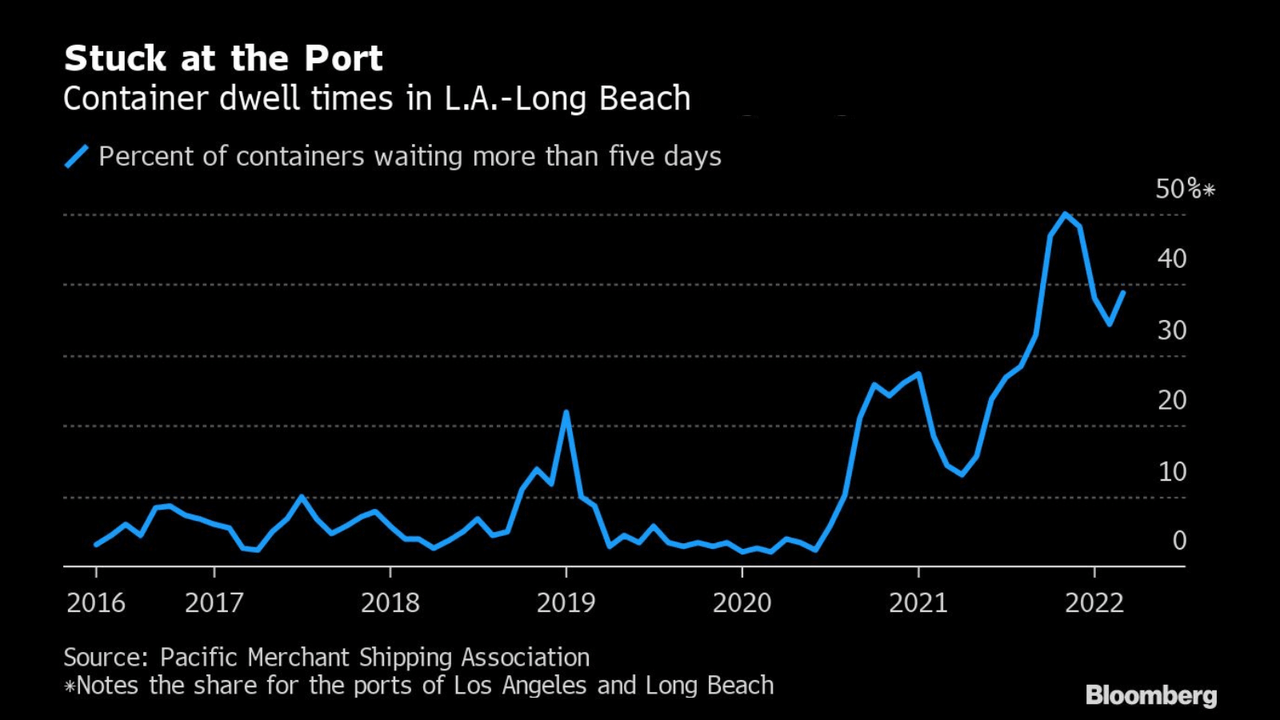

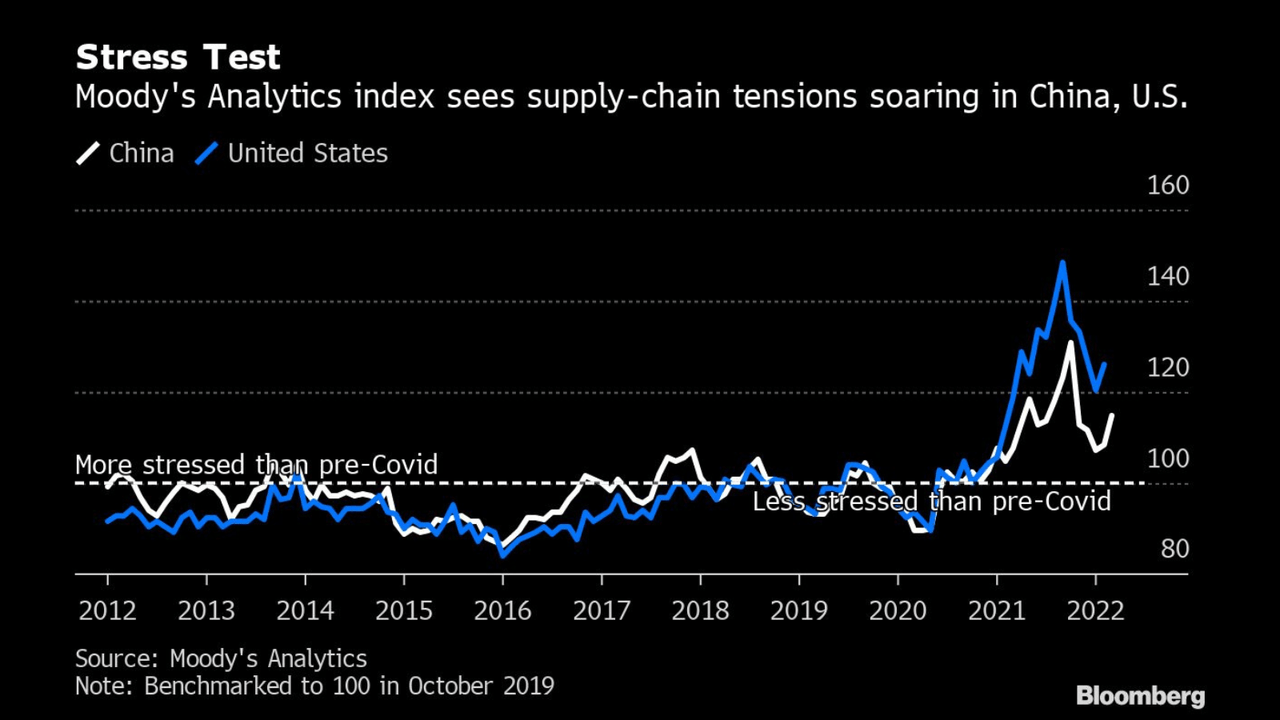

The situation is not exclusive to China. Container dwell times in L.A. continue to be elevated. Supply chain tensions in China and the U.S. are actually on the rise.

Container dwell Times (Bloomberg) Supply Chain Tensions Rising (Bloomberg).

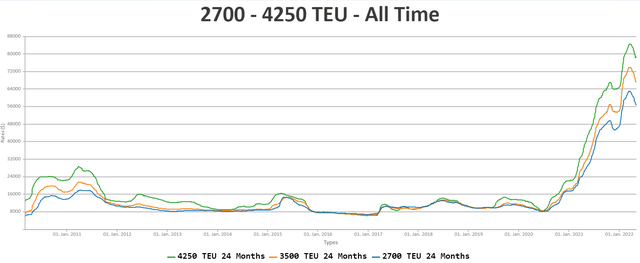

Although containership TCE rates may have slowed down in recent months, they remain at around double the levels of last years and five to six times their historical averages.

2700 – 4250 TEU Containership Rates (Verband Hamburger und Bremer Schiffsmakler)

Container lessors like Triton have continued to enjoy strong operating leverage. The following graphs from Triton clearly show the effects of current market conditions. As we have seen, increased demand for goods and logistical obstacles continue to boost container demand.

Industry Outlook (Triton International Q1 investor Presentation )

The bottom right chart shows that, despite optimism about improving port conditions, there is still a near record number of container ships waiting off the U.S. West Coast to unload their cargoes. Management noted that there is potential for more disorder on the West Coast due to vessel obstructions ping-ponging back and forth between Asia, the United States, and Asia. Triton is actually hearing from customers that these bottlenecks could absorb significant capacity for a while, and in a surprising manner. We expect utilization levels to remain high in the short-to mid-term.

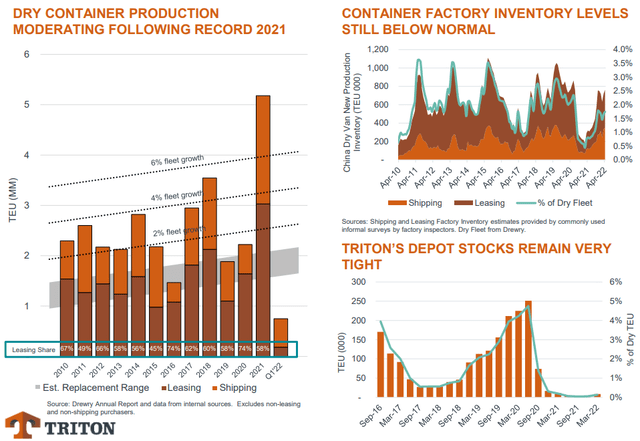

A little further: although container shortages have been reduced by dry container production in the year 2021, overall availability remains tight. The chart on left shows container production. While there has been a lot of building activity in this quarter, it is still below last year’s levels. The right charts show that although the available container factory inventory is increasing as a percentage the global fleet, it’s still below the normal 1.5%. There are also very few depot units. Triton’s utilization rates will remain maximum.

Container Availability Remains Tight – Triton International Q1 Investor Presentation

We don’t need to speculate about whether Triton will continue to be used as high as it is now. The company has taken advantage the current supply chain situation to position itself for future years of benefit.

Recall that the average rent for Triton’s containers acquired last year (the 30% increase in its asset-based growth, as we mentioned earlier), is averaging Duration of 13 Years.

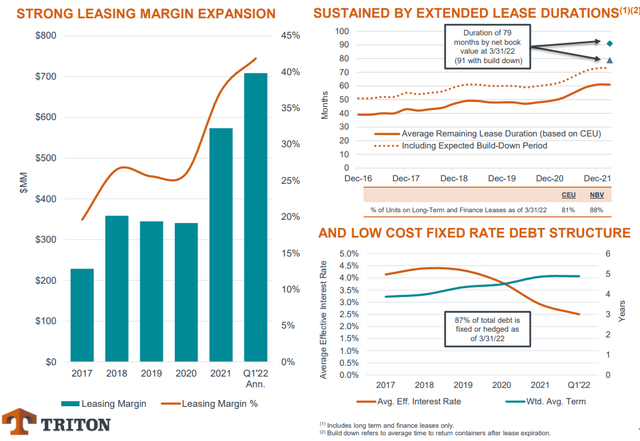

Triton took advantage of the misery of lessees trying to reserve enough containers and locked in long-term leases that were unprecedented for the industry. Triton’s remaining lease term is currently at 79 months (6.6 year). This was compared to 78 months in quarter précédent. This shows that containers are still in high demand. The company was able leases even further into 2019, even though it was just one month.

Sustainable Profitability (Triton International’s Q1 Investor Presentation)

Triton’s record profitability is not being temporarily lifted by the current market environment. It is expected to continue at record levels going forward.

The chart below shows that Triton locked its leases to record rates. This has led to record leasing margins. You can also see why Triton’s record profits must be sustained. The percentage of Triton’s asset portfolio that is made up of long-term leasing has increased from 82.5% at 2020 to 88% now. Due to the refinancing activity over the past two years, the company’s effective interest rate is still very attractive. We conclude that a combination of long-term, attractive leases and short-term, inexpensive financing will result in high leasing margins and profitability for many years to come.

Shareholder Value Creation

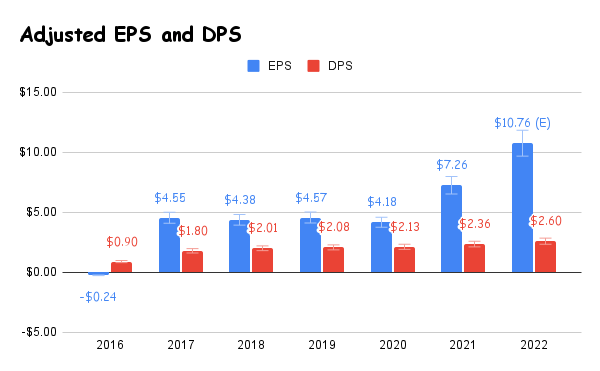

We expect Triton’s net income to continue to be high. This means that we can expect higher capital returns in the medium-term, driven by strong cash flow visibility, and adequate affordability. The company raised its quarterly dividend 14% in October. With a payout ratio close to 25% (Adjusted PE for the year expected to land at close to $10.74), dividends are likely to continue growing in the double digits.

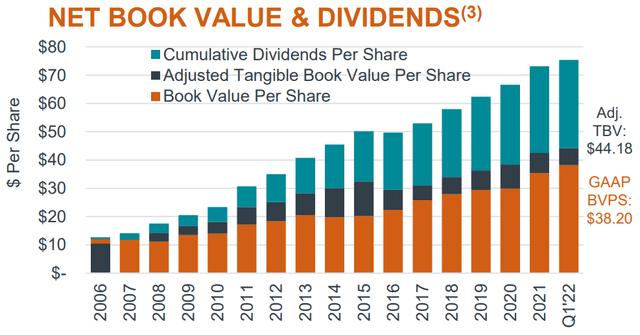

Long Track Record of Value Creation (Triton International Q1 investor Presentation )

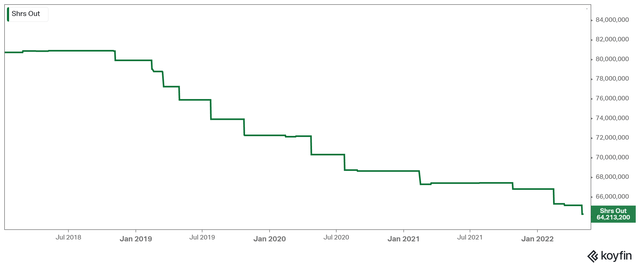

Triton bought back 1.7 million shares (approximately 2.5% of its shares) in Q1 and increased its stock purchase program by $200 million. Triton has repurchased more than 20.5% its common shares outstanding since August 2018, the beginning of its repurchase programme.

Triton’s outstanding shares

Based on Triton’s stock repurchase pace, and the 4% dividend return, the combined shareholder yield is more than double the amount!

The Upside Potential

We believe that Triton will achieve even greater results than the fiscal 2022 adjustedEPS of $10.76. However, this is based on analysts’ estimates. The company is likely to maintain and even exceed its current adjusted earnings per share rate of $2.76, which will lead to a fiscal 2022 adjusted earnings per share of $11.00. Let’s be prudent.

Not only are we displaying a fiscal 2020 DPS of $2.60 (currently run rate), but Triton may announce a DPS rise in Q3-2022 and Q4-2022, so that it will be higher in its full-year results.

Expected adjusted EPS and DPS (Authors, SEC filings).

Triton currently trades at $63.51 and is currently trading at approximately 5.9 times this year’s adjusted net income. However, Triton uses a conservative adjusted EPS estimate. We believe Triton is still significantly undervalued due to all the points in this article and the stock’s substantial capital yield yield.

Even if the conservative, fair multiple of 8.5% adjusted EPS was used, it would still point to a upside of at least 45%. The stock would need to trade north at $90 in that scenario, which is the prudent price target we have established for the stock.

Few companies have the ability to combine a strong capital return profile, medium-term cashflow visibility, and plenty of upside potential in today’s market environment. Triton is a strong buy, according to our view.