tang90246/iStock Editor via Getty Images

The current financial climate is unlike anything we have ever witnessed. Inflation is running at a rapid pace 40-year recordThe global supply chain has been in chaos, and the most destructive war on Europe is still raging. FacingInvestors like you and I are searching for safe havens to protect the value of our hard-earned savings in such a crisis.

Paul Tudor Jones is a billionaire investor who famously called the 1987 stock exchange crash. His advice for investors is to Stay away from the US market. He stated that ”You cannot think of a better environment than where you are right now for financial asset. Clearly, it is not a good idea to own stocks or bonds.

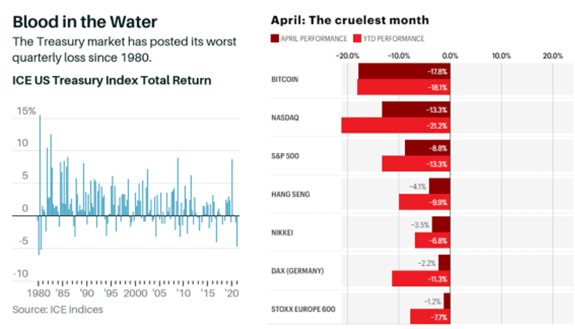

Performance of US Treasury Index and Major Stock Indexes Worldwide (ICE Indices & Fortune)

In fact, the US bond market just experienced its worst quarterly loss in 40 years while the S&P 500 Index suffered its worst April month in over 50 years. Recently, investors have begun to look abroad for safe-havens.

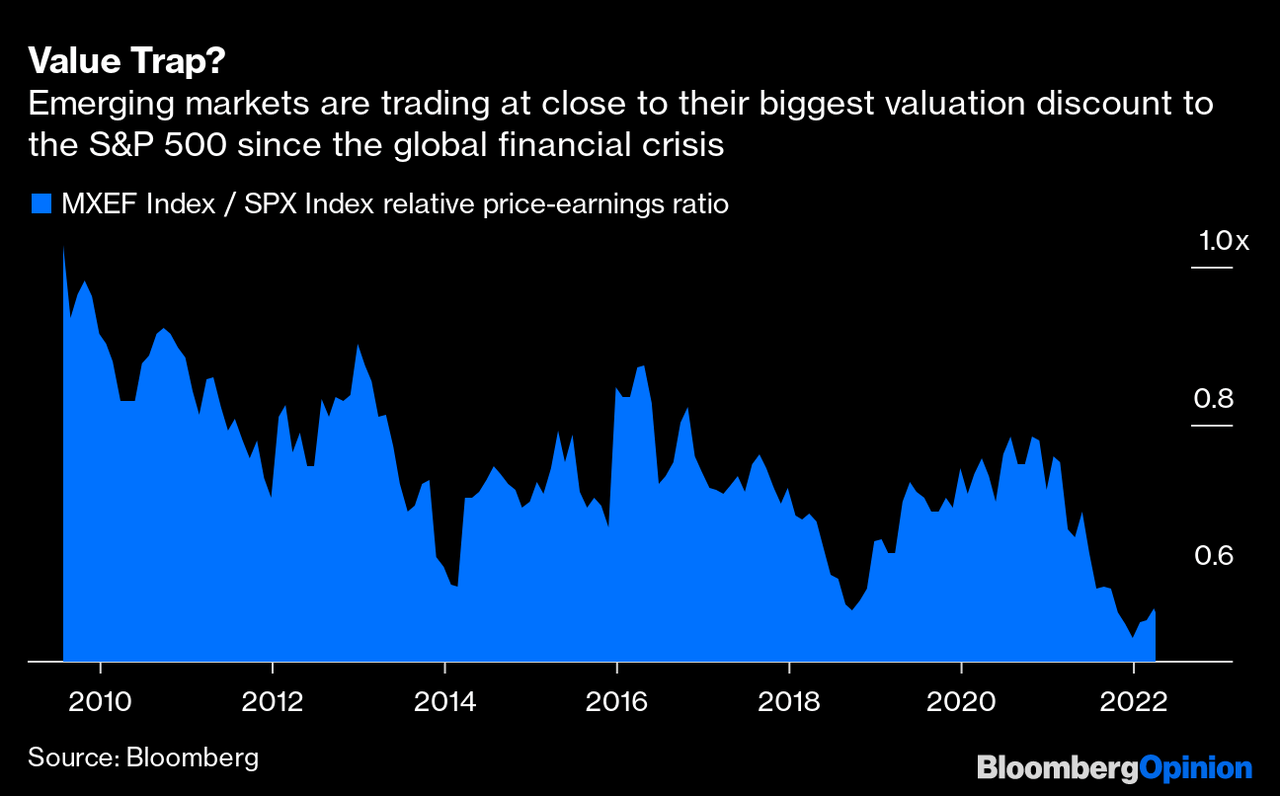

Such an outflow of funds makes economic sense. The US accounts for 62% of the global market cap, but its economy is only 26%. Emerging economies, however, make up only 11% of the global market cap but have a 35% share of the economic pie. This is a huge under-allocation. These funds include some of the largest global funds, such as Goldman Sachs Asset Management or BNP Paribas Asset Management. Switching to emergingMarket equities can take advantage of the lower valuations than their US counterparts. The question is: Which emerging economy would be the best?

Emerging markets are trading at close to their biggest valuation discount to the S&P 500 since the global financial crisis (Bloomberg)

CNBC asked top analysts from investment banks the same question back in April 2022. They answered with Singapore and Indonesia. Singapore’s Straits Time Index increased 9%, while Indonesia’s Jakarta Composite gained 7.7%. In comparison, MSCI Asia-Pacific ex Japan Index dropped 6%, S&P 500 is down 10.4%, and the European Stoxx 600 decreased by 6%.

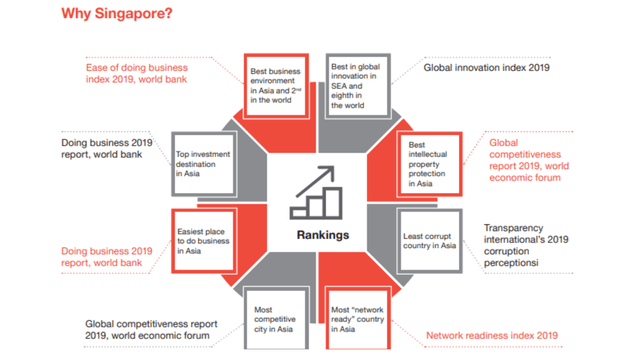

We chose Singapore over Indonesia when we had to choose between the two markets. This is because Singapore is a well-respected international investment hub, the most competitive in Asia, and a top choice for international investors. AAA credit rating from S&P. S&P. Singapore’s economy is set to recover after the country relaxed COVID-19 restrictions. Barclay’s senior economist Expectations for a 7-8% increase in GDPas international travel and mobility. These are the reasons we believe Singapore stocks can be highly invested.

Why Investors Choose Singapore (PricewaterhouseCoopers)

Next, we’ll look at the main constituents of Singapore Straits Times Index. This will allow us to identify profitable industries and then decide which stock to invest. The largest segment is the banks, accounting for 42% of the index’s total weighting. Next, we will look at real estate firms, which account for 23% and manufacturing at 13%. The high-inflation climate we are currently in makes the real estate and manufacturing industries not the best investments. Property developers will soon be faced with higher financing costs and increased materials costs, while manufacturers will suffer from supply chain disruptions as well as record energy prices.

The banking sector is the silver lining in this unprecedented inflation environment. As inflation rises, tighter monetary policies will be implemented, and interest rates will increase. Higher interest rates are a boon for bankers, just as higher milk prices are good news for dairy farmers. Banks are able earn more by increasing interest rates. The spread between the interest that they pay depositors and the interest on loans and investments is higher. Profits from investment banking operations will also tend to rise during turbulent times. Inflation is not a problem for the banking sector.

The constituents of the Singapore Straits Times Index for Investors (SG Investors).

Interested readers may ask: What is the difference between US and Singapore bank stocks? We are glad you asked! One in four economists surveyed at Reuters thinks the United States will suffer a recession this year. Singapore’s economy will be able to benefit from the reopening of its banks and those of its neighbouring Southeast Asian countries. Bank stocks are highly cyclical. They fall significantly in recessions when consumers are unable or unwilling to pay off their mortgages. New loans demand plummets. Investors should avoid investing in US banks that are at risk of recession. As high as 38%. In the meantime, Singapore banks stand to reap the benefits of the regional reopenings and the economic rebound.

Introducing Singapore’s 3 Major Banks

Singapore’s Big 3 Banks (Reuters).

While there are more than 200 banks in Singapore, three major players dominate the city: Developmental Bank of Singapore (OTCPK:DBSDY), Oversea-Chinese Banking Corporation (OTCPK:OVCHY), and United Overseas Bank (OTCPK:UOVEY). DBS, Singapore’s largest bank, reported FY2021 net profit growth of 44.1% (yo-y) while OCBC recorded 35.5% yo-y growth. UOB was at 39.8%. The common factor behind the banks’ impressive results was an increase of net interest income. This was mainly due to loan growth and improved margin. UOB showed the highest loan growth and DBS the greatest profit jump.

|

DBS |

OCBC |

UOB |

|

|

Net Profit Growth (Y-o-Y) |

44.1% |

35.5% |

39.8% |

|

Loan Growth (Yoo-Y). |

9.9% |

8.4% |

10.5% |

|

Margin of Net Interest |

1.45% |

1.54% |

1.56% |

A good piece of news for income-seeking investors, is that dividends are now at their pre-pandemic levels. DBS has a dividend yield 3.5%, OCBC yields 4.55%, and UOB yields 4.00%.

|

DBS |

OCBC |

UOB |

|

|

Dividend Yield |

3.5% |

4.5% |

4.0% |

DBS’s market capital is nearly twice that of its smaller peers when it comes to valuations. However, when we compare forward P/E and the P/B ratios we see that DBS is the most expensive bank among the three. It is currently trading at 11.87x earnings and 1.58x book value.

|

DBS |

OCBC |

UOB |

|

|

Market Capitalization |

S$64.0 Billion |

S$37.6 Billion |

S$37.0 Billion |

|

Forward P/E ratio |

11.87 |

10.40 |

11.45 |

|

Ratio P/B |

1.58 |

1.02 |

1.24 |

Finally, we will discuss the growth potential for the three Singapore banks. DBS is actively involved with mergers and acquisitions, thanks to its strong balance sheet. It bought Indian lender Lakshmi Vilas Bank in India (LVB) last year and merged it into DBS India to expand its reach to India’s large unbanked population. This year DBS announced its intention to acquire Citigroup’s sharesDBS Taiwan’s consumer banking business will be expanded in Taiwan. This will help DBS Taiwan grow by at least 10 more years and make DBS Taiwan the largest foreign bank.

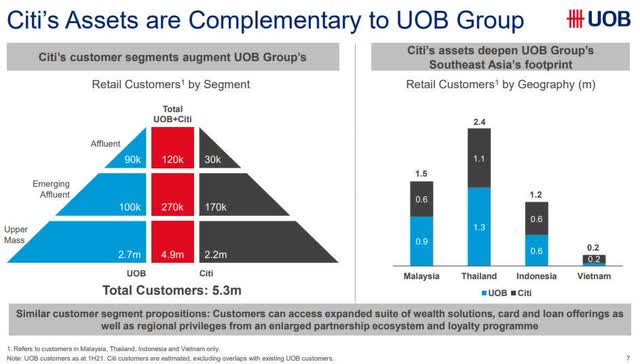

However, UOB has accepted to acquire Citigroup’s assetsThere are four countries that have a consumer banking franchise: Indonesia Malaysia Thailand Thailand Vietnam. This big step forward allows it to rapidly scale its business in 4 key regions at once, thereby establishing its position as a major regional bank.

How Citigroup’s Assets Compliment UOB Group (UOB investor Relations)

OCBC has not yet announced acquisitions, but OCBC’s high capital levels allow it to acquire up to $7 billion in excess fundsFuture acquisitions. OCBC continues to be focused on digital transformation acceleration and supporting ASEAN/Greater China investment flows.

One common trend among the three banks is the optimism about net interest income (NII), rising as the US Fed tightens monetary policies. UOB predicts that NII will expand in the second half of 2022, and continue to 2023-2024 as interest rates rise.

Evaluating the Three Banks

We can see that UOB is a top-performing stock in terms of loan growth and net income margin. It also has the second-highest dividend yield and a moderate value ratio. UOB has a more aggressive growth strategy than its peers. It acquired Citigroup’s consumer bank franchise in four different countries. If the integration goes well, UOB could see significant earnings and revenue growth in the near future.

The Bottom Line

Paul Tudor Jones, a billionaire investor and activist in the US, advised investors to avoid US stocks and bonds. We have also examined stocks on the Singapore Straits Times Index – an emerging market index that has the highest performance this year – as an alternative to the NYSE or Nasdaq. We believe that Singapore’s banks will benefit from the US Federal Reserve’s interest rates hikes. This would increase their net interest income. Another positive factor is the regional trend toward economic reopening, which would increase the number of loans. Three Singapore banks were identified as potential investments by us: OCBC, DBS and UOB. We settled on after comparing their financial performance metrics and growth potential. UOB is our top stock pick in a high-inflation environment.

Before we close, we want to inform US-based investors that they can buy shares of Singapore banks by purchasing American Depository Receipts, the tickers for which are shown below.

|

DBS |

OCBC |

UOB |

|

|

US ADR Ticker |

DBSDY |

OVCHY |

UOVEY |