[ad_1]

Imagine this: You take out an interest-free mortgage to buy your dream home. But the rate you were quoted has expired, and when you go to renew it you find there’s been a major hike in interest rates. This new rate means that you will no longer be able to afford your monthly payment.

How can you avoid this nightmare situation The stress test is the best answer..

In the simplest terms, a stress test helps individuals and institutions mitigate risk and make better decisions by playing out big economic shocks — like a major jump in interest rates or a global pandemic — to ensure they have what it takes to weather the storm.

A stress test is a “what if” exercise, where we contemplate scenarios that would pose the most harm to our financial systems and well-being in order to determine how we can best manage through them. They’re now being increasingly applied to future climate change and the financial risks that come with it.

Transition risks and physical risks

The 2008 financial crisisFinancial institutions especially need to be able to plan better for risk. It’s no coincidence that we have seen a steady rise in the use of this tool since that time.

Banks, policy-makers, and financial regulators use stress tests today to identify weaknesses in the operation of financial institutions and make changes that will protect them (and all those who depend on it) from harm.

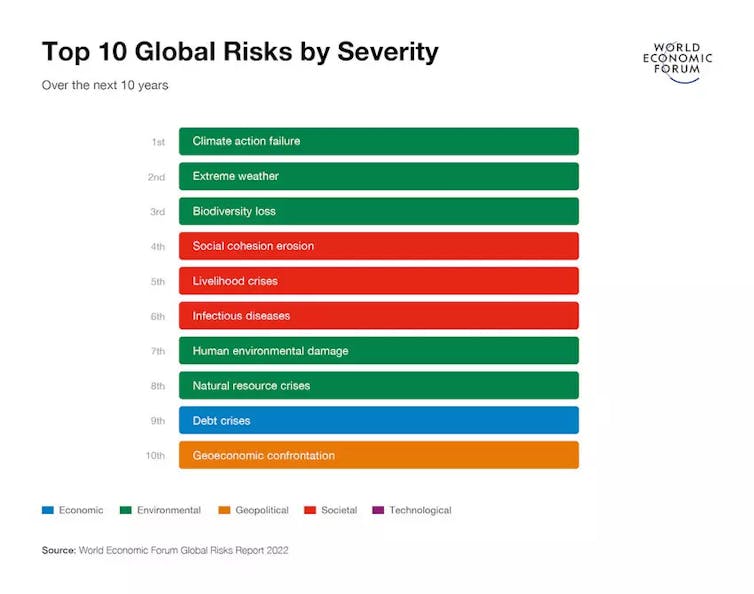

(World Economic Forum Global Risks Report 2022).

So, what’s a climate stress test? It’s the same as a what-if exercise but with different climate scenarios and significant financial consequences.

On the other hand, there are climate risks. For example, extreme weather events such as flooding, droughts, icestorms or heat waves can cause property damage. Supply chains can be disruptedThis can lead to increased insurance costs and shutdown operations. The physical risks are higher in situations where global temperatures rise.

Continue reading:

B.C. floods reveal fragile food supply chains — 4 ways to manage the crisis now and in the future

There are also transition risk. This refers to the tangible impacts of different degrees of climate ambition or action.

In order to further reduce carbon emissions, or accelerate the pace, new or more stringent policies by the government will have different financial consequences for different companies, depending on their climate-readiness as well as on different sectors.

Scenarios aren’t predictions

Climate scenarios consider both transition and physical risk. Like other types of stress tests, these scenarios aren’t predictions. Imagining what would happen if interest rates skyrocket isn’t the same as predicting that they will.

(Shutterstock)

However, the scientific consensus is that Climate change risks are growingClimate stress tests are important tools to assess the sustainability and financial stability of investments, companies, and the overall financial system. This practice is gaining momentum.

The example of this is the The Bank of Canada and the Office of the Superintendent of Financial Institutions recently releasedA major report that examines four climate scenarios over a 30-year period, from 2020 to 2050. These scenarios varied in terms of ambition, timing and pace of global climate change.

-

Baseline scenario: A scenario in which global climate policies are in place at the close of 2019.

-

Below 2 C urgent: A policy action that immediately reduces global warming to less than 2 C.

-

Delayed action below 2 C: A delayed policy decision to limit average global warming below 2 C.

-

Net-zero 2050 (1.5% C): This is a more ambitious policy action scenario to limit global warming to 1.5 C. It includes current net zero commitments from some countries.

Physical risks are the most significant

The analyses produced clear results.

First, delayed action can lead to greater economic shocks as well as financial stability risks. The more we delay in taking action, the more severe and abrupt those actions will become.

Second, while every sector will need to contribute to the transition, the analysis showed that “significant negative financial impacts emerged for some sectors (e.g., fossil fuels) and benefits emerged for others (e.g., electricity).”

Third, macroeconomic risk exists, especially for countries that export carbon intensive commodities like Canada.

Continue reading:

Canada is praised for its climate leadership, despite a damning watchdog report on climate policy failures

The The European Central Bank also conductsA climate stress test that yielded similar results. It determined that climate change represents a systemic risk — especially for portfolios in specific economic sectors and geographical areas. For example, in the mining, agriculture, and oil-dependent regions such as the Gulf States.

It also found that physical risks will be more prevalent in the long-term than transition risks. The effects of changes in carbon pricing and other policies are expected to have a greater impact on the physical risks that climate change will have on real estate in coastal areas or on supply chains than the effects on these properties.

These findings have clear implications both for investors and companies. This is why it is more important than ever to evaluate and prioritize corporate climate resilience, especially in light of the recent economic downturn. Climate data is increasingly being considered by lenders and investors in financial decisions.

It is now easier to understand how climate policy changes could impact the environment. abruptly impact a company’s valuation and financial outlook. This makes climate policy foresight crucial for investors and corporate leaders alike.

As climate stress tests become more common, their findings will have a wide impact on the entire financial industry. Leaders who are savvy will be paying attention to this conversation and taking the necessary steps in order to adapt and thrive.