It was only a matter a time before China bans Bitcoin (BTC), trading and crypto services. A special exemption is required in order to use Bitcoin anywhere in the Peoples Republic. The reason the Chinese governments have given for the crackdown on Bitcoin is to reduce its well-documented impact on climate change. No matter how truthful this explanation is, one thing remains clear: China’s righteous anger towards electricity-guzzling, carbon-spewing cryptocurrency in the service of Earths environment is only the first shot of an impending global showdown. This will include Bitcoin and other crypto projects that depend on proof-of work (PoW), the complex crypto security mechanism we use in mining. This does not look like a battle crypto will win.

This is a difficult realization for many cryptocurrency enthusiasts that hold Bitcoin. There is a solution. It even shares the same name. Coal is dying because of newer, cleaner, cheaper, more efficient, and technologically more advanced technologies. Other options.

Related: Carbon-neutral Bitcoin? A new approach is proposed to help investors offset BTC carbon emission

Although coal isn’t going down easily, it is supported by powerful politicians and monied corporate lobbyists. However, if your financial advisor said he had a great feeling about investing in coal mining, you might consider a new financial advisor. It might be time to accept that mining, from coal and crypto, may soon be a thing of the past.

Short-term consequences of China’s Bitcoin ban

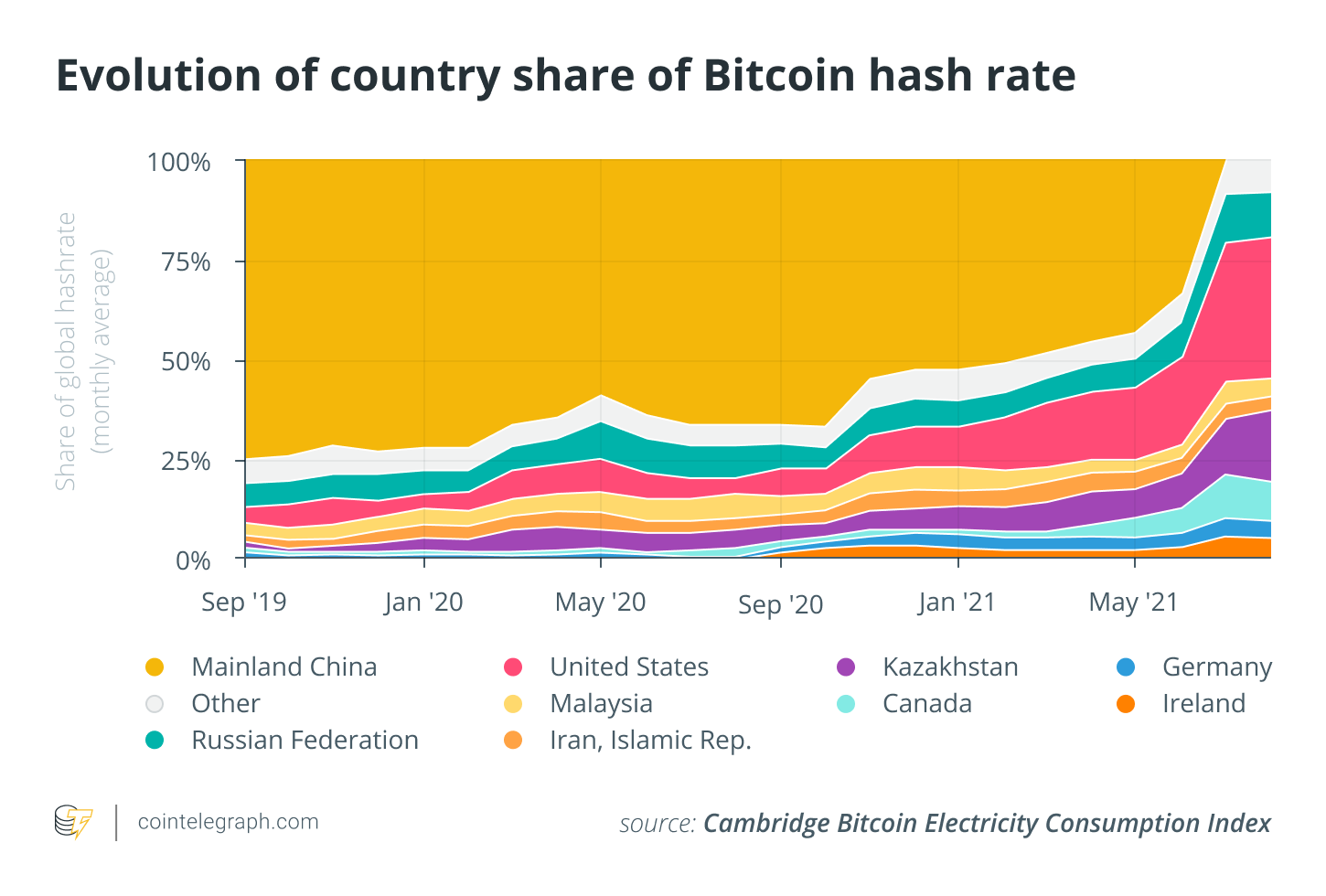

The full impact of Chinas war against Bitcoin has been temporarily mitigated by inertia, hesitation to quit mining, and a combination. The initial shock was overpowering and the United States took advantage of the opportunity to become the new global mining hub. As well as Germany, Ireland, and Iran in Europe, Asia’s Kazakhstan and Malaysia are increasing their mining operations. AccordingRecent stats. It is making for some strange geopolitical relations as the crypto mining industry continues to thrive.

Investors might find some comfort in such a vibrant and diverse Bitcoin mining alliance, but it will not withstand the test of times. The U.S. can’t match China’s low energy prices and will lose its mining champion title. Germany and Ireland are currently in a similar situation. Iran is currently CombatMass protests are caused by severe water shortages. So owning a stake is not only politically unfeasible but also socially unacceptable. Malaysia is similarly vulnerable to extreme weather and rising sea level that would prevent it from. ContinueIt will continue to invest in cryptocurrency mining over the medium and long term. These developments severely limit future prospects for mined cryptocurrency.

Mining is being pushed to the fringe by climate action commitments

It does not help that Bitcoin miners are surrounded by the majority of the world’s nations and the most powerful industrial nations. Enterinto the Paris Climate Agreement. This agreement includes a commitment to limit carbon emissions and prevent the planet from heating further. This promise is not fulfilled by mining Bitcoin. The European Union has its own climate change action plan. European Green Deal. These large-scale multinational deals are driving energy-intensive projects such Bitcoin mining to fringe.

Related: Bitcoin is growing faster than ever, right down to the roots of mining

As the tide shifts in favor of carbon neutrality mining cryptocurrency will be left to a few states that don’t take their climate goals seriously, or simply don’t have long-term plans. It is no coincidence, that many of these countries trying to mine Bitcoin are authoritarian nations under increasing international pressure. If any serious investor is looking to stake their crypto portfolio on the political stability and power of a dictatorship, or an autocracy that runs out of water, or violently suppressing public opinion, there are few options. It is bad for the environment, bad for business, and it has bad optics.

A cryptocurrency that has been pushed to the geographical and political fringes can’t claim to be truly decentralized or democratic. How can we use cryptocurrency that has been mined under tyranny to aid economic liberation, even if the climate problem is ignored? The sun is setting on Bitcoin, and other mined cryptocurrency, from the perspective of finance, climate, and appearances. It is only a matter if time.

The power and pain of inertia and letting go

So what keeps the mining train afloat? First, let’s not underestimate the power and importance of inertia. When Bitcoin was first introduced in 2008, it was revolutionary. It was the first step towards a new digital economy. While proof-of work was a great way to decentralize security and ensure privacy, it also provided us with an inefficient time bomb. This bomb is already in motion.

It will be difficult to let go of mining and its replacement is not obvious. Globally, powerful actors have accumulated enough technological and energy resources and political levers to continue mining cryptocurrency for the near future. Some mining will continue even if there is an institutional crackdown. UndergroundYou can easily slip into organized crime as long as it is profitable.

Related: Before you can just throw away crypto mining, it needs to be re-defined.

However, without legal on and off-ramps for free trade and mass adoption, respective cryptocurrencies will disappear to the shadows and sidelines, with their valuations permanently destroyed. The market for mining projects and law enforcement will eventually render mining obsolete. Investors and crypto enthusiasts must ask: Why wait for this to happen?

Abolition of mining can help to jumpstart the crypto economy in the future

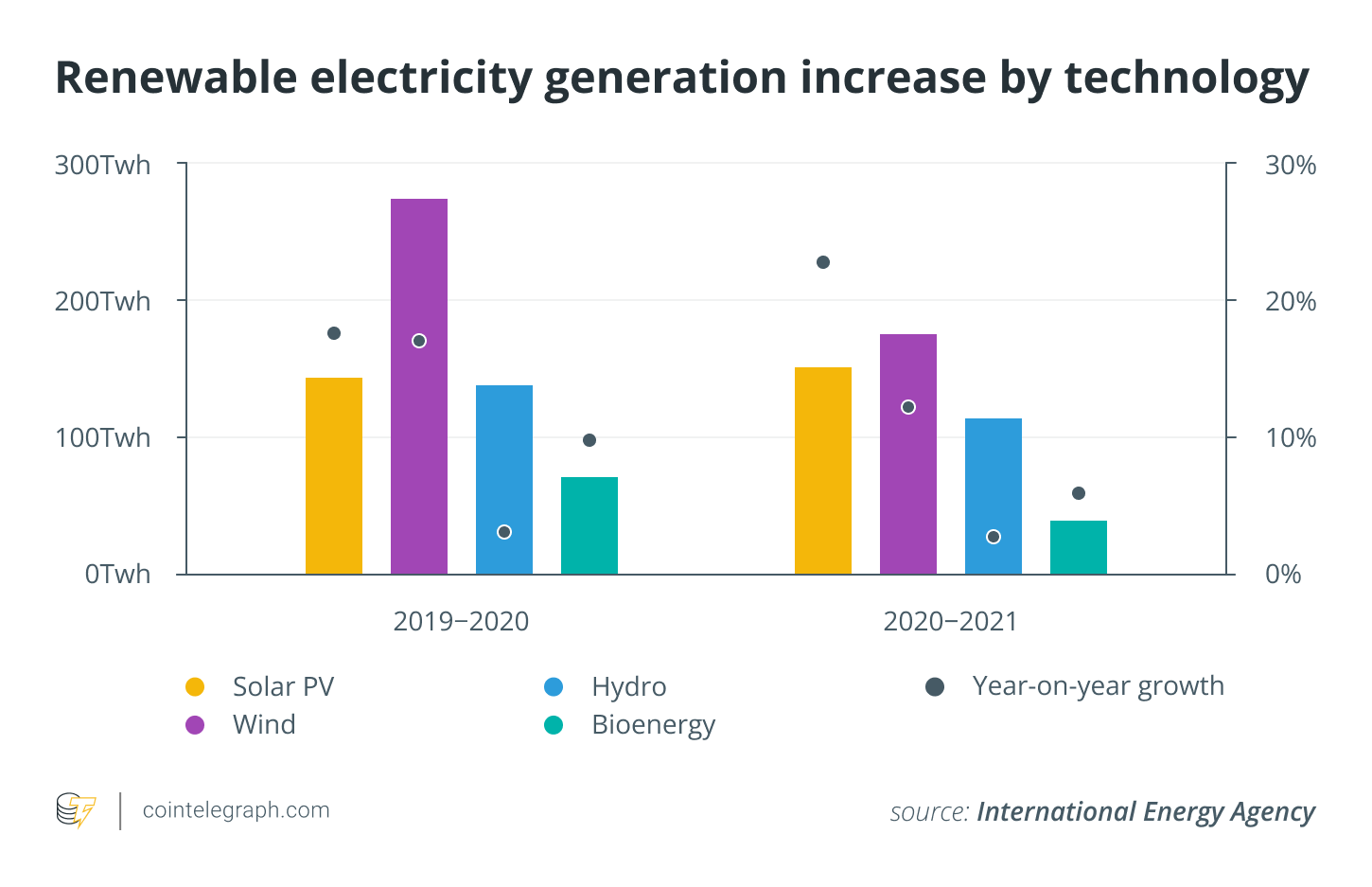

We can achieve a lot more for the digital economy by investing the resources that were set aside for Bitcoin miners into more advanced and sustainable crypto projects. We can continue to pile coal into the old steam locomotive. Or we can switch over to a bullet train, and invest the resources in making it go faster and longer. Some will point to renewables, and how Bitcoin can lower its carbon footprint by using greener energy.

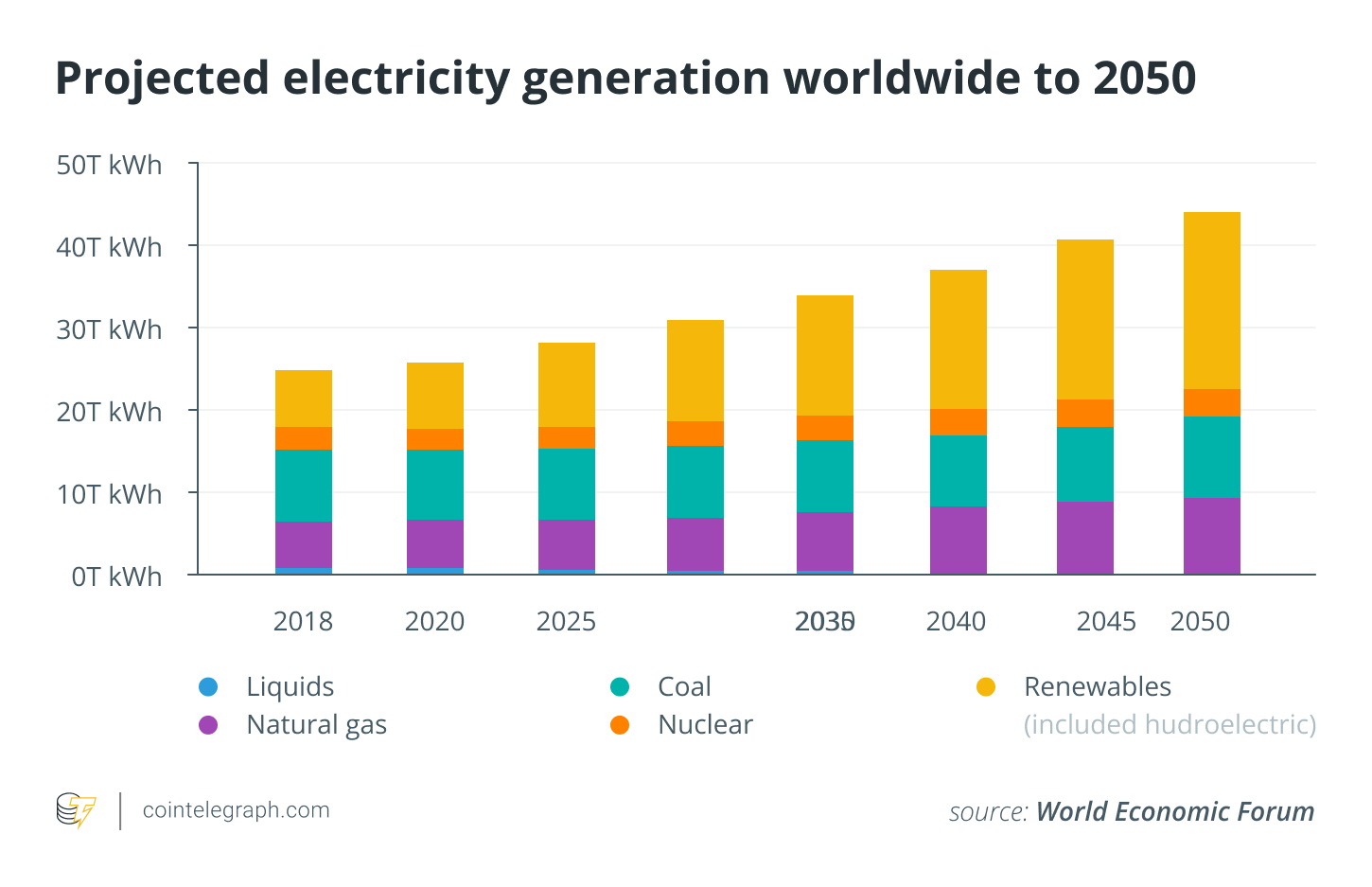

Currently, less that one-third of the global electric power is being generated. SourceFrom renewables. This share could be used to support cryptocurrency mining. But it would only be a fig tree. It would be better to direct renewable energies towards sustainable and practical uses. There are many mathematically rigorous and promising solutions to crypto that could grant PoW-levels security to a network.

We are making ourselves vulnerable by prolonging the inevitable end of mining. Switching to lighter, more durable and scalable solutions will open up the crypto space to a wider audience and help fulfill its promise of true decentralization. This is a fact that everyone in and outside of the crypto space should accept and embrace.

This article does NOT contain any investment advice or recommendations. Every investment and trade involves risk. Readers are advised to do their own research before making any decision.

These opinions, thoughts, and views are solely the author’s and do not necessarily reflect and represent the views and opinions at Cointelegraph.

Dominik SchienerHe is co-founder of Iota Foundation, a non-profit foundation based in Berlin. He oversees the development of partnerships and the realization the project vision. Iota is a distributed blockchain technology for the Internet of Things. It is also a cryptocurrency. He also won the largest blockchain hackathon held in Shanghai. He has been focusing on Iota to enable the machine economy for the past two years.