Eduardo Kopper, after 30 years of operation, had to close down the turbines at his hydroelectric facility Poas I located in Costa Rica’s Central Valley region.

The Costa Rican Institute of Electricity, the country’s public distributor of electricity, rejected Kopper’s offer to sell his energy as the country has surplus renewable power.

Kopper stated, “Essentially, it was impossible to do anything.” It was a very worrying situation. We tried to at least support our workers.”

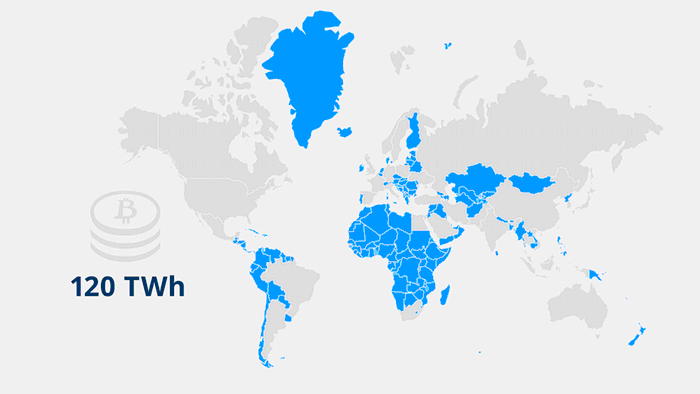

It was then that he discovered about Bitcoin. According to The, the cryptocurrency is a major energy consumer, with a carbon footprint comparable to that of Kuwait. Bitcoin Energy Consumption Index.

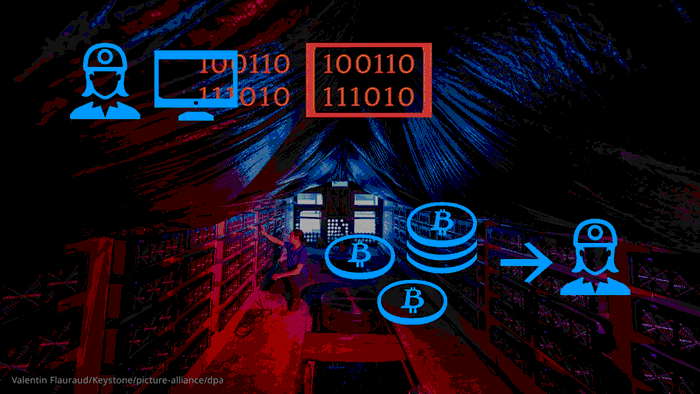

Kopper decided to dedicate his Bitcoin mining plant to him as a way to turn his green energy into currency. After three months of inactivity Poas I was back to being a renewable-powered cryptocurrency mining centre by April 2021.

Kopper isn’t alone. All over the Americas, especially in the United States of America, miners are jumping on the “green Bitcoin” bandwagon.

Neptune Digital Assets and Bitfarms are two large US crypto mining firms that are now marketing their operations to be “green.” Brazil’s lawmakers are currently considering a tax exemption for crypto mining using renewable energy.

Was this a wasteful use of precious energy?

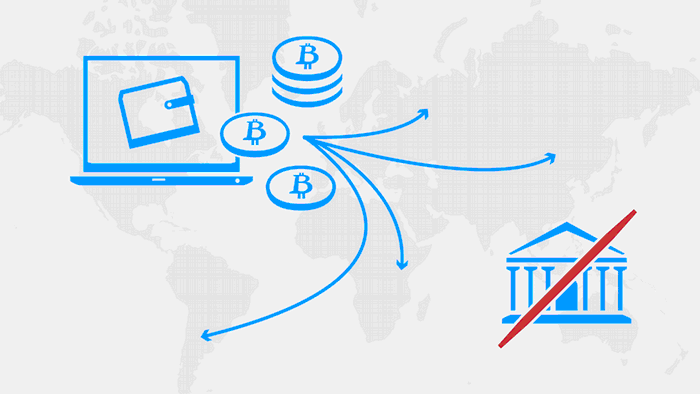

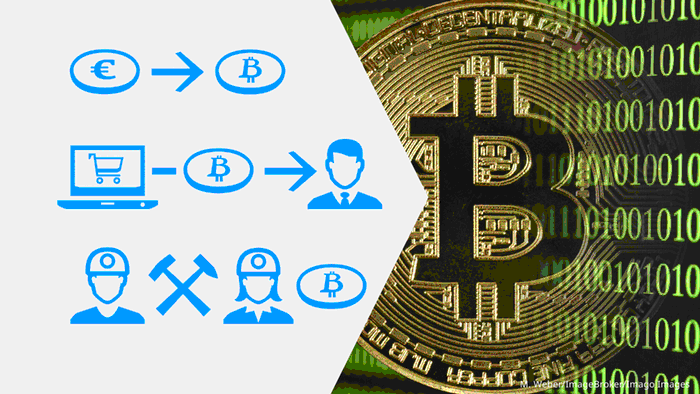

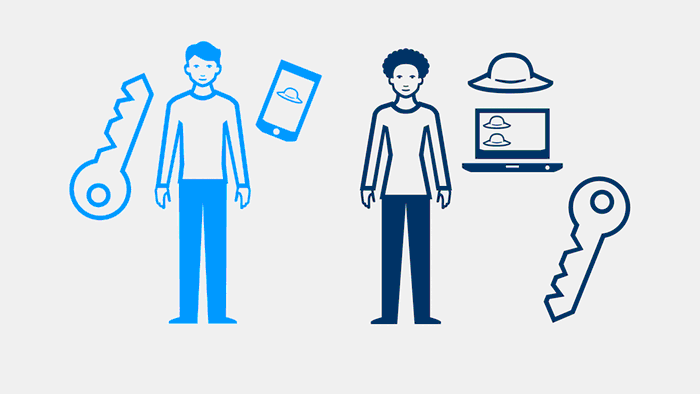

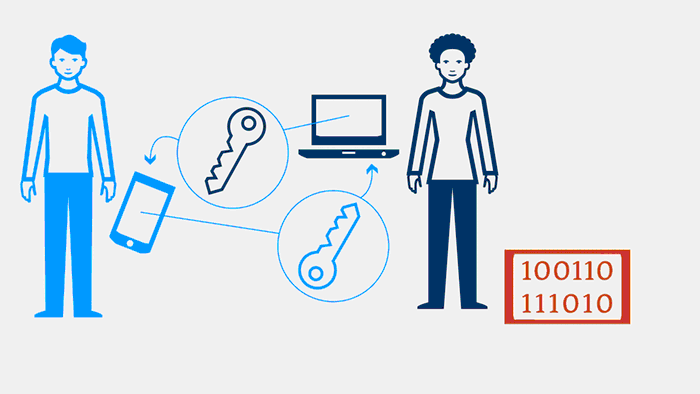

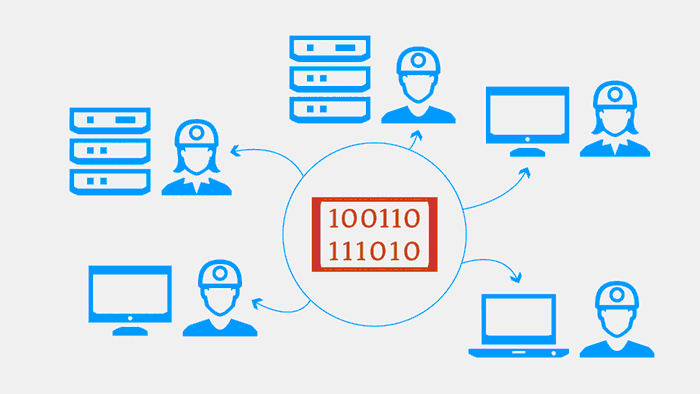

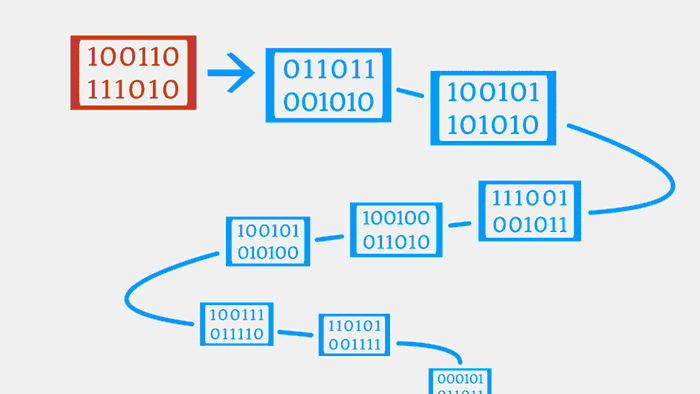

Bitcoin’s huge energy consumption is key to how its blockchain technology works. The “proof of work” feature allows for the creation of new bitcoins by solving complex math puzzles. This ensures that the blockchain network is decentralized. It also requires a lot of processing power because miners are racing to solve these problems first.

More than 200 individuals and businesses launched the campaign to be conscious of the impact on the environment of an energy-hungry currency. Crypto Climate AccordLast year, we committed to net zero operations by 2030, primarily through switching to renewable power sources.

Green mining is not for everyone. Alex de Vries, an economist and Bitcoin expert, said that spending precious renewable power on “random computing” rather than sectors that offer jobs and other economic benefits can be problematic.

Renewables have been a key part of crypto mining since they are often the most affordable source of power. A study done by cryptocurrency analysis firm CoinShares estimatedIn 2019, at most 74% of Bitcoin’s global electricity consumption came from renewables. Much of it was cheap Chinese hydropower.

But in 2021, the Chinese government banned all cryptocurrency-related activities, in part because of their huge energy consumption. Sweden has, however, called upon the European Union to ban cryptocurrency mining. They claim that it diverts power that could be used in other sectors to reduce carbon emissions, which would put climate targets at risk.

Costa Rican exception

Jose Daniel Lara, a Costa Rican energy researcher at UC Berkeley, concedes that in the country, which has an energy surplus, there’s some logic to green cryptocurrency mining. In ideal world, Costa Rica would export its excess power. Unfortunately, this is not possible right now. While Nicaragua, a neighbor with poor energy, may benefit from Costa Rican electricity, it does not have the infrastructure to import it.

A different kind of minewater: The storage basins for Poas I are used to generate electricity that can power more than 600 computers

Kopper was able to revive his 1MW hydropower plants and convert the electricity into something that could be exported without the use of power grids. He stated, “Here is a way of transforming energy into a digital token.”

He constructed a container-shaped storage area for central processing unit, sealed it against Costa Rica’s high heat and moisture, then began to rent some of these CPUs out to mining companies overseas. He now mines bitcoins himself. He has avoided laying off his 25 employees and is planning to reactivate another plant in the coming months.

The Poas I cryptomining center is the only one of its kind in Costa Rica. However, Kopper has received interest from other private energy companies in the country to join the business. Companies claim that crypto mining can solve the problems inherent in renewable power generation.

Crypto-mining as a grid-stabilizing technology

Lancium, a Texas tech company, is building Bitcoin mines powered by renewable energy. It’s not competing with traditional power consumption but is marketing the project to stabilize the grid.

The problem with renewables like Texas’ expanding wind power is that electricity production fluctuates according to the weather. An oversupply could cause grid congestion and even blackouts. That is why fossil-fueled energy stations that can be ramped down or up are often used to balance renewables heavy power systems.

Lancium claims that their model allows Bitcoin operations instead to provide this service by simply increasing or decreasing mining activity based on how much excess power is available. Lara claims that this model could allow projects like Lancium to support the expansion and reduction of fossil fuels.

Poas I’s computers are powered by hydroelectric power, but is this enough to make Bitcoins truly sustainable?

Mining workers migrate to fossil-fueled countries

De Vries stated that the green cryptocurrency wave isn’t having much impact on the world’s massive carbon footprint.

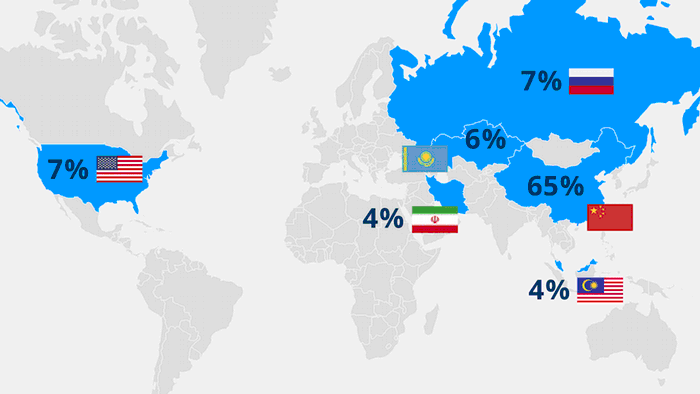

After China banned crypto mining operations, they moved west, mainly to the US and Kazakhstan, which are both rich in fossil fuels. De Vries stated that “the new locations don’t offer the exact same amount of renewables.”

In August 2020 there was 5% global Bitcoin mining in the US. According to data, this number had risen to 35% one year later. From the University of Cambridge. Texas is positioned as a crypto capital. However, despite Lancium’s projects, the majority of Texas’s power comes from coal and natural gas.

A more energy-efficient crypto model

Kopper believes that green mining can reduce Bitcoin’s carbon footprint by encouraging a shift to renewable energy. He stated that they are working to distinguish dirty Bitcoin and clean Bitcoin. “It might take some while for consumers to recognize this but I believe it’s a matterof time.”

De Vries believes that cryptocurrencies should be more energy-efficient. Cardano, Binance and others use a different model called “proof-of-stake,” where miners stake their own coins to engage in transactions rather than solving computations.

De Vries stated that if proof of stake is used, there is no need for a hardware competition. “All you need to connect to the internet is a device. The proof of work is all that is required to increase the energy requirement by a factor 10,000.

Ethereum, the second most popular cryptocurrency in the world is set to switch to proof-of-stake this year. Although the technology is still in its infancy, de Vries said that if it works for Ethereum, it could work for other currencies.

Kopper believes that proof of work is still crucial to his new business model. Kopper has no plans of returning Poas I to its original use.

“As our mining process is optimized, we are achieving better profitability,” he stated. “Today I think we’re not going to go back. We have a new market for our electric power.”

Edited By: Ruby Russell