- After consecutive two-day declines, recent losses in gold are consolidated.

- Omicron woes increase as WHO, Imperial College of London, and the US CDC support market fear.

- Deadlock over US President Biden’s BBB, US-China tussles and Fed’s rate-hike concerns also favor risk-off mood.

Update: Gold (XAU/USD) is bobbing around within a tight Asian range of between $1,789.34 and $1,792.38 in holiday thin market conditions. In the absence any new catalysts, the price action is often subdued this time of the year.

Positons are likely squared with investors taking into account the risks of the spread of the coronavirus variant and the potential impact on the economy. “While risky assets may have reacted negatively in response to COVID news,” said the spokesperson. “We believe that the impact on the US economy will be temporary.”

However, the yellow metal thrives when there is uncertainty and risk. Gold can continue to be bought in steady fashion and remain protected from Fedspeak that is hawkish.

TD Securities analysts stated that ‘Rates continue bleed to lower with omicron worries and their potential economic impact beginning to increase the level market participants’ nerves, all of this can offer support for yellow metal. We expect continued upside flows during the week for the CTA buying program as long as prices remain above $1,777/oz.

End of update

Gold (XAU/USD) licks its wounds near $1,790 during Tuesday’s Asian session, after declining from two consecutive days from the monthly high.

The yellow metal’s latest weakness could be linked to the market’s fresh fears over the South African covid variant, dubbed as Omicron. Adding to the risk-aversion are the chatters surrounding the US Federal Reserve’s (Fed) rate hike, deadlock over US President Joe Biden’s Build Back Better (BBB) plan and the Sino-American tussles.

After rejecting the Omicron fears initially, global leaders are now worried about the COVID-19 variation that forces some of the top economics, such as the UK and Europe to recall strict activity restrictions during holiday season.

The fears of Omicron were recently backed by the World Health Organization (WHO) while saying, “The Omicron variant of the coronavirus is spreading faster than the Delta variant and is causing infections in people already vaccinated or who have recovered from the COVID-19 disease,” per Reuters.

On the same line were the Researchers at Imperial College London and the US Centers for Disease Control and Prevention (CDC). According to Reuters, Omicron virus infections do not seem to be any less severe than Delta. Reuters, however, stated that Omicron is the most common variant of the coronavirus in the US and accounts for nearly three quarters of COVID-19-related cases.

US President Joe Biden’s much-awaited BBB stimulus plan gets a rejection from Senator Joe Manchin, making it hard to cross the House considering the Republicans’ readiness to avoid favoring the plan and Democrats’ wafer-thin majority. However, House Speaker Nancy Pelosi remains optimistic that the aid package will be passed by the House in early 2022.

The US-China tussles have intensified in recent months, adding to the risk-off factor. According to Reuters, Wang Yi, the Chinese foreign minister, stated Monday that “if there is confrontation then (China) will never fear it and will fight until the end.” China’s Wang Yi adds, “There is no harm in competition but it should be ‘positive’”. On the same line were fears of the Fed rate-hike, backed by Fed Board of Governors member Christopher Waller

The US Treasury yields saw a 2.3 basis point (bps) increase to 1.42%, after falling to their monthly lows. The Wall Street benchmarks also suffered losses, but the S&P 500 Future saw mild gains at press time.

Looking forward, a light calendar will restrict gold’s short-term moves but risk catalysts can keep the bears hopeful until the yields keep the latest rebound.

Technical analysis

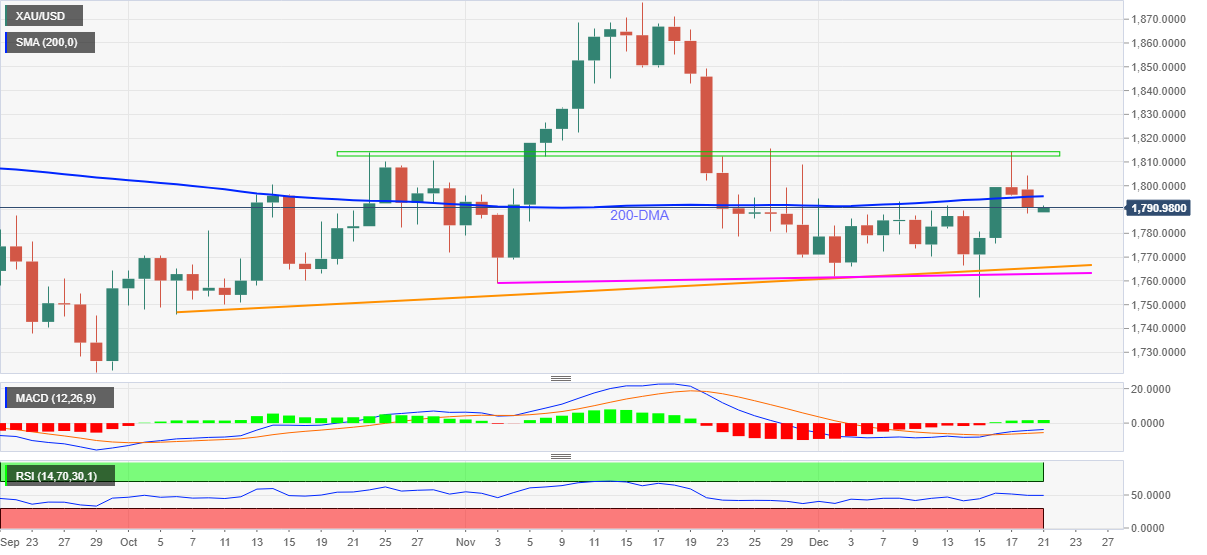

Failures to cross a two-month-old horizontal resistance area precede the metal’s latest break of the 200-DMA, around $1,795, to keep gold sellers hopeful.

An ascending support level, at $1765, will be threatening the bears from October. A break of that support line will have another support from November, at $1760, to challenge them.

In a case where the gold prices decline below $1,760, September’s bottom surrounding $1,721 should become their favorite.

However, a clear upside break from the horizontal hurdle around $1813-15 is possible. The tops will be marked in July and September near $1834, and then several lows during mid November close to $1845.

In a case where gold buyers successfully cross the $1,845 resistance, November’s peak of $1,877 and the $1,900 round figure will be in focus.

Gold: Daily chart

Additional weakness expected to continue in the trend