[ad_1]

The COP26 climate summit in Glasgow will see the return of the almost mystical Green Climate Fund. The fund grew out of a promise made by rich nations in 2009 to provide US$100 billion (£74 billion) per year in “climate finance” to help developing countries to decarbonise their economies. The amount actually raised so far has been very low, but we might be able to get there soon.

It’s notoriously difficult to define climate financing. It’s rarely clear how much is really available, or how much is actually needed. What is the source of this money? And can wealthy nations afford it, especially after the COVID-19 pandemic.

A lack of a universally accepted definition for climate finance has created a wild west scenario. It is difficult to calculate how much is out there and how eco-friendly it is. Governments and fund managers alike can attach “green” labels to investments in new airports or “green” funds with large stakes in fossil fuel companies. Some of this will be blatant. greenwash. But some of it simply reflects real-world complexity: if fossil-fuel majors raise finance to decarbonise their portfolios by building wind and solar farms, should this be considered “green”?

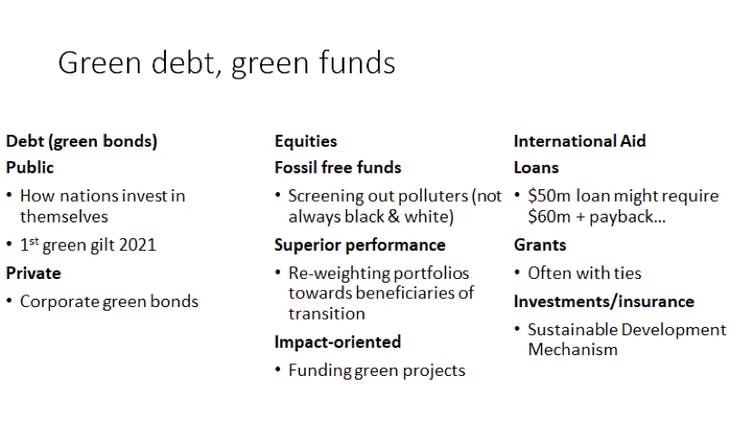

There are three main types of climate finance. The first is debt. This can be issued by governments or privately by companies issuing bonds. The second category includes shares and private capital. This can take many forms, but often includes “green funds” that screen out polluting firms and industries.

The final category, and one that is a key interest at COP26, is the role of international aid in providing finance to help developing countries decarbonise –for example by phasing out coal, developing low-carbon transport, or restoring ecosystems such as mangrovesThis provides protection against flooding and storms.

Climate-oriented international aid can come in a variety of forms, including loans, grants or direct investments. Each type of string has varying degrees of strings attached. These categories are, however, highly controversial in practice. For example, a US$50 million loan to India for a solar farm is an example. It will be repaid with US$10,000,000 interest. Climate finance has been provided in the US for US$50 million. From India’s perspective, it received US$50 million but will ultimately send US$60 million to the US, prompting the question of who is financing whom.

Kamiar Mohaddes et al? Author provided

What is the Green Climate Fund? And why does it matter?

In 2009, at COP15 in Copenhagen, rich countries pledged to provide US$100 million per year by 2020. This led to the formal establishment of the COP15 in 2010. Green Climate FundWith the goal of supporting developing economies to address climate changes. We have not yet achieved the goal at US$100 billion per year, regardless of what measurement or definition of climate financing you use. According to the report, that figure will be reached in 2023. latest estimatesHowever, some at COP26 are. more optimistic: both the EU’s Ursula von LeydenUS climate envoy John KerryThe goal has been set for 2022, according to the officials.

Rwanda Ministry of Environment? CC BY-SA

However, because there’s no clear definition of what counts as climate finance, there are huge discrepancies in estimates of what has been committed so far. The OECD estimate (which represents what the COP26 climate finance delivery plan(which is based on) are at the upper end, while Oxfam estimates just over one-fifthAll that was promised has been realized so far.

How much is really needed?

The estimated amount of finance required to decarbonize the global economy vary between US$50 trillion US$90 trillion. With a thousand trillions in a trillion, the US$100 billion everyone refers to is just a decimal point.

It is almost impossible to estimate how much green financing will be required, as the amount depends on where it goes and when it is spent. Early investments in new technologies can generate income rapid cost reductionsAsset stranding (wasted investment in obsolete, carbon-intensive infrastructure) will be reduced. Further delay slows innovation and worsens the climate crisis.

Climate change is inevitable shrink the economiesIt will be made up of rich, poor, and hot and cold countries. more difficult and more expensiveTo raise the money needed to decarbonise in future. The price of taking action early is far cheaperYou can avoid the high cost of delay.

We just witnessed a coordinated, cross-country response to the pandemic. US$16 trillionGlobal government support is being rolled out at super-fast speed. Climate change will require a coordinated response. The pandemic response has shown that significant financing can be quickly mobilised for decarbonisation.

Mobilizing climate finance can be a win-win situation for both developing and developed economies. The US$100billion is just a distraction when you consider what is really needed to address climate changes.

This story is part of The Conversation’s coverage on COP26, the Glasgow climate conference, by experts from around the world.

The Conversation is here for you to clarify the air and get reliable information amid a flood of climate news stories and stories. More.

Source link