The best investors are able to adapt to the market environment. They are like offensive play-callers who adapt to market changes by focusing on the right sectors and executing appropriate strategies.

The U.S. Labor Department released Wednesday’s updated CPI. It showed that inflation rose 7% in 2012 compared to the previous year, which is the fastest pace since 1982. Although this was expected, the change rate shows how significant the price rise has become.

Image Source: Zacks Investment Research

Which investments are most likely to outperform in this market environment?

Consumer demand remains strong, and the inflationary pressures which grew last year will likely continue in 2022. A few rate hikes of 25bp from the Fed may not be enough to offset rising costs. The U.S. consumer may be in good health and the economy can tolerate slight increases in rates but the damage is already done.

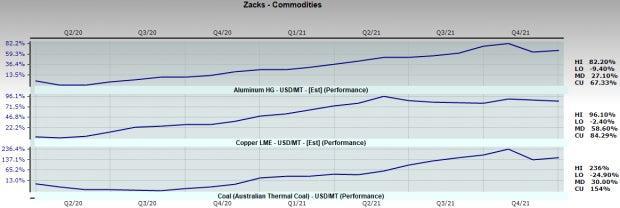

Everywhere you look, people talk about rising prices. Prices have soared across all industries, whether it’s food products, gasoline and oil, or input materials. This is evident in the following list of commodities. Since March 31stAluminum prices rose 67% in 2020, while copper prices rose 84% and coal prices rose 154%.

Image Source: Zacks Investment Research

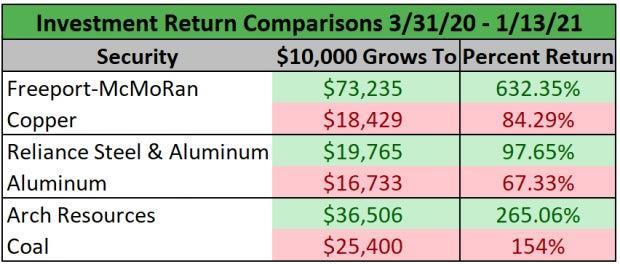

Commodity stocks are a historical hedge against inflation and have outperformed over the past year. They look set to continue this run in the first months of the year. Although commodities investing can be lucrative, it is far more profitable than owning stocks of companies that produce them. This is based on decades of market history. A more recent example can be seen below, highlighted by the three companies.

Image Source: Zacks Investment Research

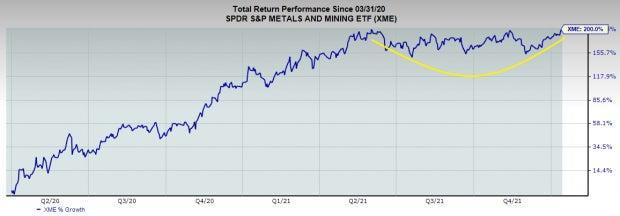

The SDPR S&P Metals and Mining ETF XME have soared more that 200% in the same timeframe and are currently within striking distance of a 52 week high. XME includes all three companies that we will be analysing. These three companies account for 13.63% of total SPDR S&P Metals and Mining ETF assets. XME has been in a consolidation mode for the past few months but the ETF looks poised for continued outperformance in the near-term.

Image Source: Zacks Investment Research

Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan, a major international mining company, is located in North America, South America and Indonesia. FCX is a mining company that primarily searches for copper, gold and molybdenum. Freeport-McMoRan, which was established in 1987, is based in Phoenix, AZ. They have approximately 165 wells worldwide.

FCX will benefit from the progress made in its exploration activities which will boost production capacity. Company margins will also be supported by higher copper prices. FCX will benefit from the international push for electric vehicles. This is good news for copper, as EVs are highly copper-intensive.

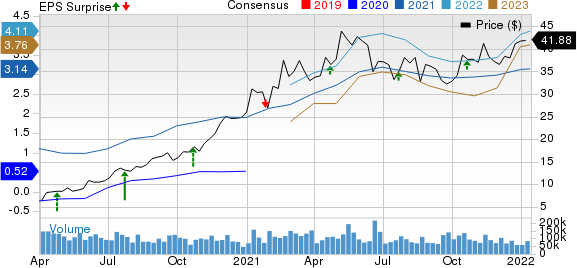

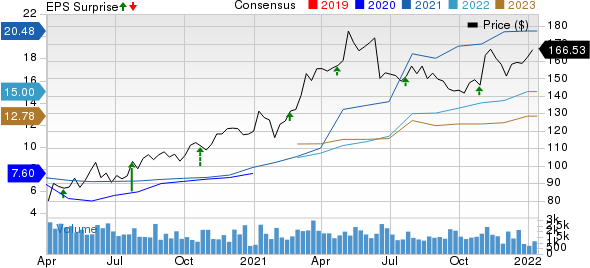

In nine of the ten most recent quarters, FCX has exceeded earnings estimates. The stock trades at a 10.77 forward P/E and has outperformed the market by a large margin since the March 20 market bottom. FCX recently reported EPS $0.89, which is a +14.1% increase over consensus. FCX stock has increased 46.48% in the past year.

FreeportMcMoRan Inc. Price. Consensus. and EPS Surprise

What the Zacks Model Unveils

The Zacks EarningsESP(Expected Surprise Prediction), which seeks companies that have experienced positive earnings estimate revision activity, is designed to help investors find these companies. This data has been very helpful in finding positive earnings surprises and giving investors an edge during earnings season. According to our 10-year backtest, stocks produce positive surprises 70% of the times when combined with a Zacks Rank 3 or higher and a positive Earnings ESP.

FCX could see another earnings beat when it reports on January 26th with a Zacks rank #3 and a +1.74% EarningsESPTh. This will be the last set of 2021 quarterly earnings data. Revenues are expected increase 65.09% to $23.44 Billion for the year. Analysts project EPS of $3.14. This would be 481.48% growth compared to 2020.

Reliance Steel & Aluminum Co.RS)

Reliance Steel & Aluminum, one of the most important metals service centers in the United States, is a company called Reliance Steel & Aluminum. RS supplies aluminum, alloy, brass and copper as well as steel and titanium products to general manufacturing and non-residential construction. It also provides transportation, energy, defense, and energy industries. The company has over 300 metal processing and distribution plants in 40 states as well as 13 other countries. Reliance Steel & Aluminum was established in 1939. It is headquartered in Los Angeles.

RS is a Zacks #1 Strong buy and continues to grow through strategic acquisitions as well as the expansion of its existing operations. Since its IPO in 1994, the company has made 59 acquisitions. The acquisition of Metals USA added approximately 48 service centers throughout the U.S., while Tubular Steel’s purchase boosted the firm’s product portfolio as well as diversification in the end markets. This year, RSs will be driven by higher metals prices.

RS trades at a 11.04 forward P/E, indicating that shares remain relatively undervalued despite recent gains in share price. In each of the eleven quarters since its inception, RS has exceeded earnings estimates. The company last reported a beat of 3.54% on October when it reported EPS of $6.15. RS stock has risen more than 27% over the past year.

Reliance Steel & Aluminum Co. – Price, Consensus, and EPS Surprise

Over the past 60 days, analysts covering RS have increased their 2021 EPS estimates of 2.91%. The Zacks Consensus Estimate stands at $20.48. That’s an increase of 165.63% over 2020. We’ll see if RS can live to the high expectations when it reports its final 21 EPS details February 17.Th.

Arch Resources, Inc.ARCH)

Arch Resources sells metallurgical coal and thermal coal from underground and surface mining. ARCH sells its products in the U.S., Europe, Asia, Central, South America, and Africa to industrial, utility and steel producers. The company controls or owns over 700,000 acres in coal land and has seven active mines. ARCH was founded 1969 in St. Louis MO.

ARCH is extremely undervalued at 2.59 forward P/E and has delivered a trailing quarterly earnings surprise of 10.98%. The company recently reported EPS of $4.92 for October, a surprise of 3.8% over consensus. ARCH stock has increased by 88% over the past year.

Arch Resources Inc. Price Consensus and EPS Surprise

The Zacks Consensus Estimate for 2021 predicts EPS growth of 178.8% to $17.92. Analysts are expecting EPS growth of 109.29% and $37.50 in 2019. Check out the 21 EPS consensus when the firm reports its final quarterly slate, February 8th.Th.

Want the latest Zacks Investment Research recommendations? Download 7 Best Stocks for Next 30 Days Today Click here to download this free report

FreeportMcMoRan Inc. FCX: Free Stock Analysis Report

Reliance Steel & Aluminum Co. – Free Stock Analysis Report

SPDR S&P Metals & Mining ETF (XME): ETF Research Reports

Arch Resources Inc. (ARCH), : Free Stock Analysis Report