Urban Flight Reversal

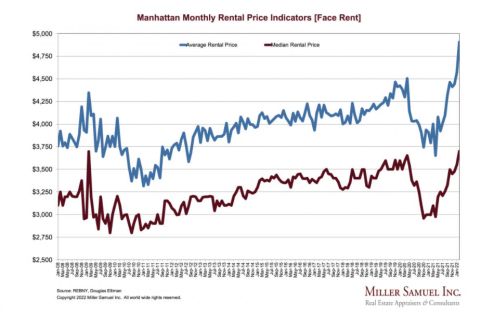

The demand for rental apartments has increased significantly since Q3 2021. This has resulted in a surge of lease signings, with monthly rents returning back to or even exceeding prepandemic levels. This surge has continued to grow despite the difficult winter leasing season and is not expected to slow down as the first quarter 2022 draws to a close. Miller Samuel Market Reports reports that Manhattan’s February 2022 median rent was $3,700. This is an increase of 33% over the previous year and approximately 5% above the pre-pandemic rent levels in February 2020. The flight-to quality trend has led to average rents being even higher.

The rebounded rental market accelerated the investment sales market, as demonstrated by Q4 2021 being the highest Q3 2018 sales. Buyers who were left on the sidelines with dry powder after the pandemic began were now ready to take a risk and get back into the market. As buyers realized that a market correction was imminent, capital began to flow back into New York City. The recovery also enabled sellers to transact at levels that they believed reflected their longer-term property value. This was the perfect storm to create the narrowest buyer-seller price gap in six years. The Manhattan Q4 multifamily and mixed-use markets recorded 46 transactions totalling just over $1.47 Billion in dollar volume. This is a 98% & 190% increase on the trailing 4 quarter average.

Rising Interest Rates: What Does It Mean?

The New York City market for investment sales is at an important turning point after a strong Q1 2022, and as Q2 2022 begins. There are so many positive things to be proud of: Apartment rents continue their upward trend; retail spaces are being leased at healthy rents. Luxury residential condominiums are being snapped up every day. Major corporations such as Apple and Microsoft are calling for a return back to the office. On the other hand, the Fed raised interest rates in 2018 for the first time and expects six more increases by 2022. This would bring the Fed’s near-zero rate to a mere 2%.

Lenders have already begun to account for these rate increases. Rates that were available last quarter are not currently available, and they are unlikely to be available in the next month. Buyers have a race to lock in their rates before any more increases are made.

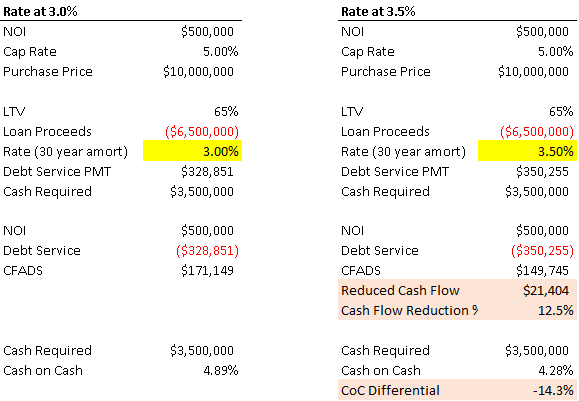

Usually, debt is sized using a variety of tests, including LTV, Debt Yield and DSCR. Exhibit 1 shows an example where LTV is the constraint. The loan proceeds are consistent with the rate increase. However, the actual debt service payment is higher, which leads to a lower cash flow. For the same equity invested, less dollars are distributed which results in a lower cash-on-cash return and leveraged IRR.

Exhibit 1. Cash Return Comparison| Cash Return Comparison

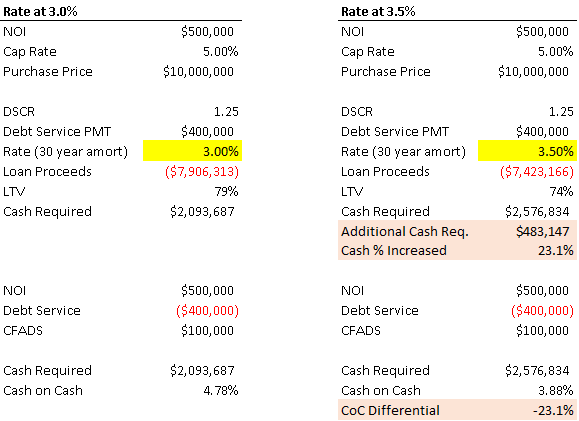

Similar results can be seen if DSCR is an active constraint (Exhibit 2), where the loan proceeds are reduced but the debt service and cash flow following debt service remain constant. The investment will require greater equity for the same cash distribution. This results in a lower cash-on-cash return and leveraged IRR.

Exhibit 2. Exhibit 2.| Cash Return Comparison

To summarize, pricing must be adjusted to maintain equity returns.

History Repeats Itself

The 10-Year Treasury rate has increased 100 basis points in the five months between November 2021 (1.35%), and today (2.35%). This is not the first time we have seen it.

The 10-Year Treasury Rate climbed 122 bps between 1.37% and 2.59% during the five months of July 2016 to December 2016. This rate held steady until March 2017. As a result, sales volume dropped dramatically from 616 in 2016 to 300 in 2017. The decrease in sales velocity was caused by several other factors, including an increase in the interest rate.

What to Watch

Will history repeat itself? Most people agree that rising interest rates can have negative effects on property values. There are however, some other factors that can help to mitigate the negative effects of rising rates.

- Continued Rise in Rents. Many properties could continue to appreciate if rental rates continue to rise, even if interest rates go up.

- Capital Flight to Real Estate. There is a lot more capital available to make deals due to rising inflation. Some assets may be priced stable despite rising rates due to strong demand.

- Low-Cost Equity Providers. New York City has been a safe place for foreign buyers, ultra-high net worth investors and other low-cost equity providers in the past. As the capital stack becomes more complex, buyers and sponsors who have access to less-expensive equity sources will be more successful.

Conclusion

Avison Young is keeping an eye on the buyer/seller gap. One, sellers have higher pricing expectations because of all the positive factors at property level. While buyers are supporting this growth, they are also receiving higher-priced debt quotes which lead to lower valuations. These two factors can cause a widening of the buyer-seller divide, which could result in a reduction on sales velocity.

We anticipate that many owners are currently considering their options. Many owners will be testing the waters this year by looking for refinancing options (say in 2023) to prepare for rising rates. The real question is whether buyers will match the price.

(Visited 1 Times, 12 Visits Today)